How family offices can achieve returns in 2021

Family offices looking for safety, yield, and diversification in a low-yield paradigm may find answers in the digital asset space.

Family offices are younger than you would expect

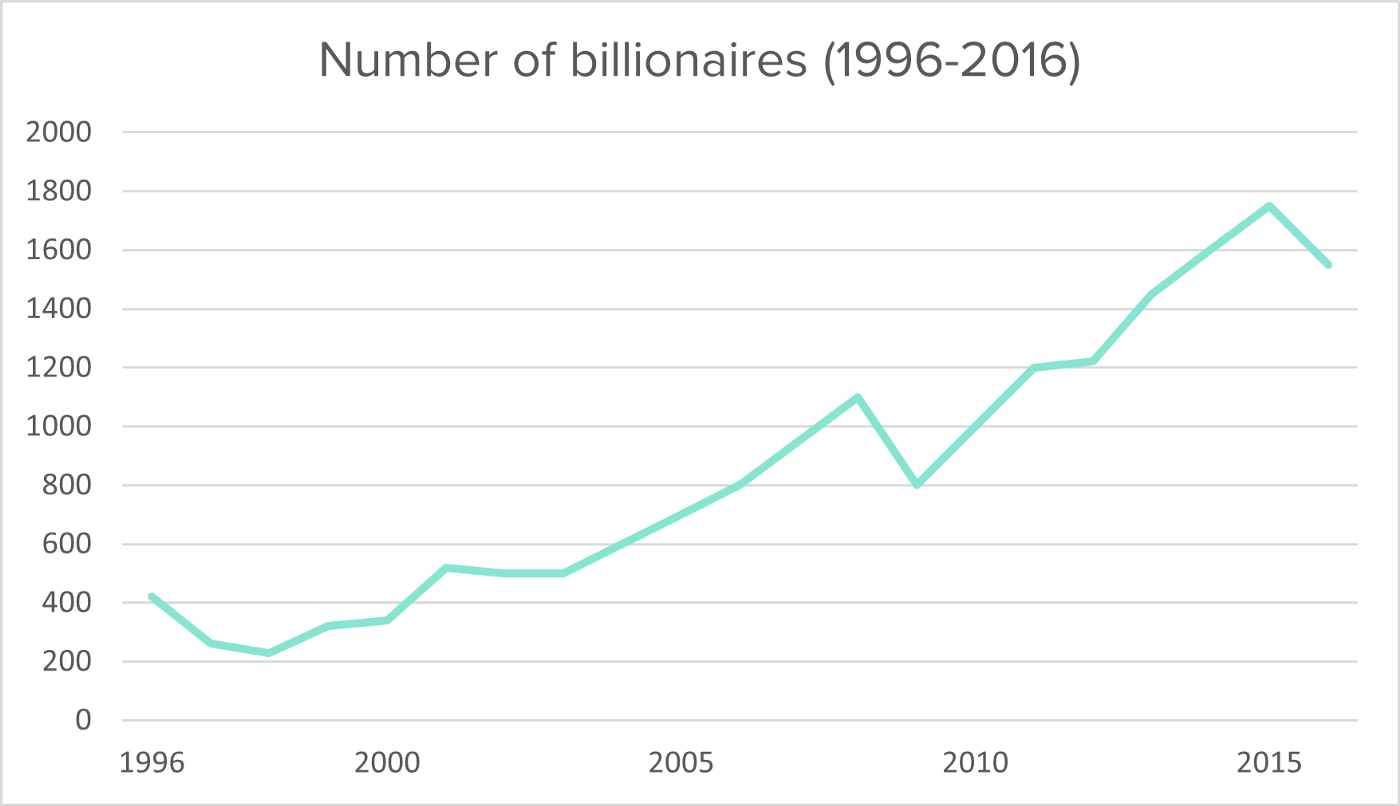

Family offices aim to preserve the generational wealth of one or more families, giving them perhaps the longest time horizon of any class of investor. These firms rarely appear in financial news headlines, but that’s not to say they don’t hold significant wealth, with some analysts estimating their total assets under management at over $6 trillion. Given that family offices exist to preserve wealth across generations, one would assume that most of this $6 trillion originated as old money. However, the UBS 2020 Family Office Report found that more than two-thirds of today’s family offices were founded in the past 20 years. This means the average family office client is not the descendant of a 19th-century oil baron but more likely an entrepreneur looking to protect and grow wealth created during the growth of the internet. The rise of family offices reflects a growing number of high-net-worth individuals, with around 2,600 billionaires holding $8.6 trillion of assets and a further $31.5 trillion held by 256,000 individuals each worth US$30 million or more.

Source: Towards data science

Investment strategies built to outlast their creators

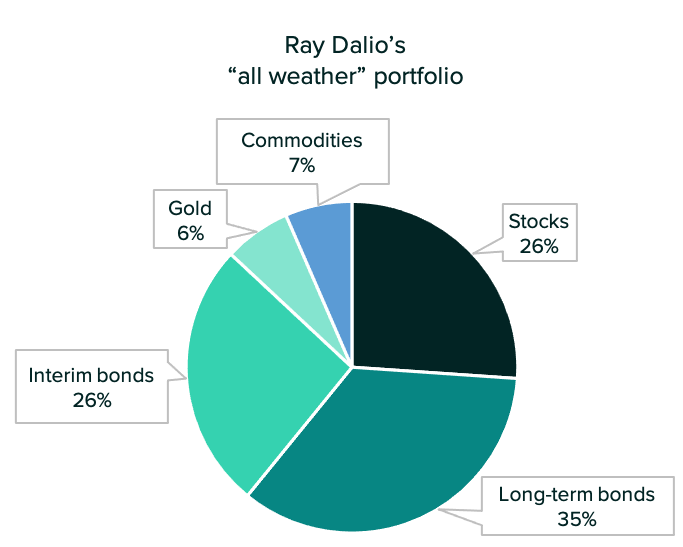

An inter-generational time horizon means the family office investments must succeed across many market environments. Perhaps some of the most straightforward and well-known thinking on this topic comes from Bridgewater’s founder Ray Dalio. He constructed an “all-weather portfolio” in response to his desire to formulate a family trust and create an asset allocation mix that would prove reliable long after he was gone.

Source: Bridgewater, The all-weather story

As shown in the chart, almost two-thirds of the all-weather portfolio’s allocation is to government bonds, which have traditionally served as a risk-off investment that guarantees a yield. As explained by Bridgewater, “going back to the building blocks of a given portfolio, the client’s ‘risk-free position’ was no longer cash, but rather a portfolio that provided a real return. Inflation-linked bonds (bonds that pay out some real return plus actual inflation) would ‘guarantee’ this 5% hurdle, as long as one could find bonds paying 5% real coupons.” The problem in today’s environment is that a 5% yielding bond is hard to find.

A new ‘zero-yield’ paradigm

Bond yields have declined steadily since the 1980s, finally reaching zero in 2020 after authorities introduced policies to combat the economic effects of the COVID-19 lockdowns. These measures have put financial markets into a new paradigm, forcing investors to look elsewhere for the safety and yield previously provided by government bonds.

Source (left): Federal reserve bank of St.Louis. Source (right): World government bonds

The CIO of a Swiss Family Office, when interviewed as part of Blackrock’s Global Family Office Survey, put it this way: “When the US 10 Year Treasury was yielding 3.5–4%, you were clipping a nice coupon. Today, high-quality sovereign bonds are expensive. Something like 60% of sovereign bonds in the developed world are trading at negative yields. Consequently, fixed income is going to give you nothing. It is most likely going to lose you money.”

Bitcoin is scarce, but also uncorrelated

Where else can family offices look to preserve generational wealth in this new paradigm? Some asset managers may scoff at the suggestion, but those who understand Bitcoin’s limited supply and hard-coded inflation rate dub it “digital gold.” (Over 18.5 million of bitcoin’s total 21 million supply has already been mined, with the remaining getting supplied at a slower and slower rate until the creation of the final bitcoin 2140.) It’s taken over a decade for bitcoin to build acceptance, with 2020 proving to be a pivotal year (see previous post), and now even Ray Dalio admits that he would “rather own bitcoin than a bond.”

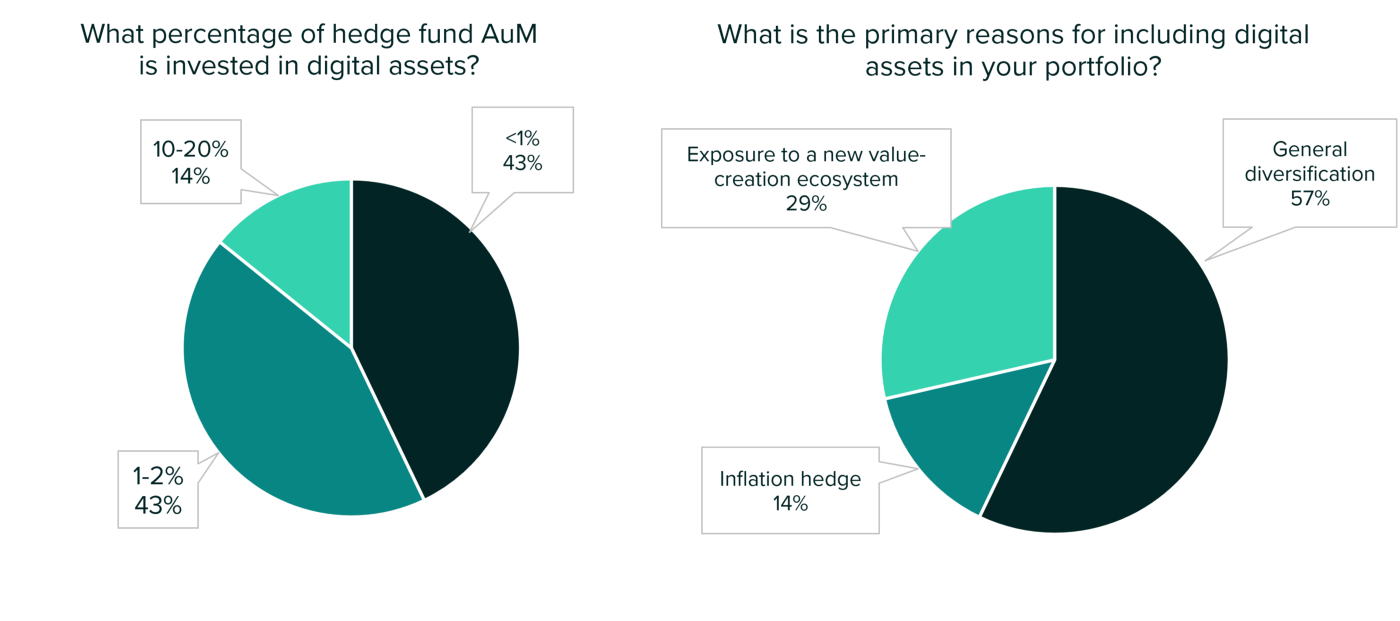

Bitcoin not only has a limited supply but is also not correlated to the rest of the financial system. This characteristic allows it to increase portfolio diversification where it is present, as reflected by a PwC hedge fund survey. Over half of the hedge funds already invested in digital assets reported having done so primarily to increase the overall diversification of their portfolios.

Source: Source: PwC, 2020 Crypto Hedge Fund Report

Institutional investors are beginning to understand that bitcoin has its place in a diversified portfolio and that small allocation can achieve significant increases in the Sharpe ratio. Analysis by the ETP provider Iconic Holdings found that a traditional 80/20 stock-bond portfolio saw its Sharpe ratio increase from 6.6 to approx. 8.2 with 1% crypto, 9.5 with 3% crypto, and 9.8 with 5% crypto allocated.

Source: Iconic Funds

Achieving yield with digital assets

The historical appeal of bonds has been their ability to provide income to their holders. But with bonds now yielding near-zero yield, where can investors look for predictable returns?

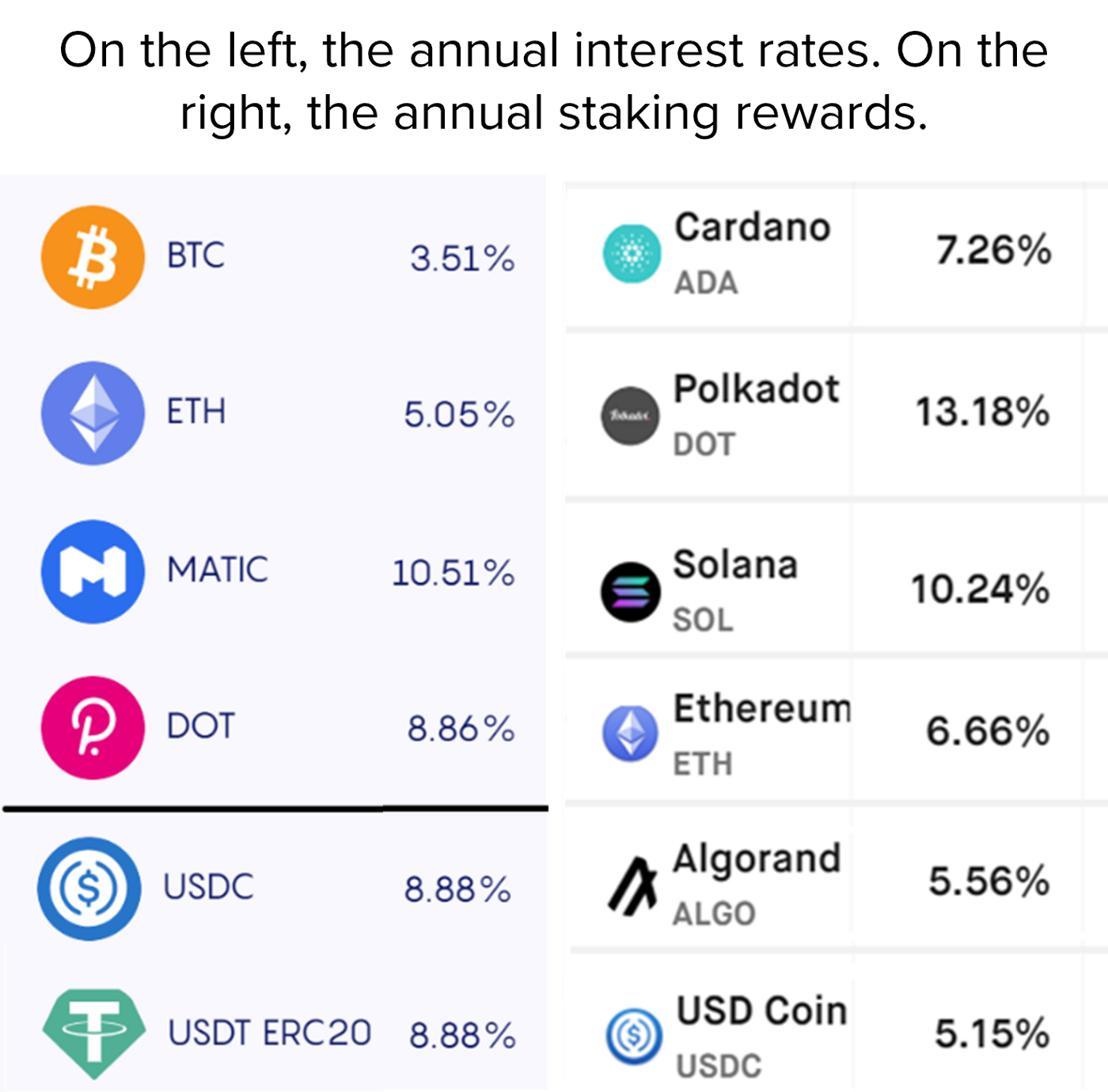

Here again, the digital asset space may present an answer. As described in a previous Finoa blog post, there are countless opportunities to earn low-risk yields in the crypto space, potentially warranting family office investment. Investors can earn over 8% per annum by lending out stablecoins, for example, which are assets with value pegged to fiat currencies like the Dollar or Euro. Lending can be done via smart contract protocols on blockchains like Ethereum, or via institutions that build their over-collateralized loan books. Institutional investors thus have access to an attractive yield opportunity without having to bet on the upward or downward movement of a digital asset. This is, however, only possible via direct ownership of digital assets, and Finoa is looking to bring lending functionality to our platform in the future.

Source (left): Celsius. Source (right): Stakingrewards

A feature of digital assets in even wider use than lending is staking, a process in which assets are used to verify blockchain transactions and earn rewards for doing so. As described in a previous blog post, staking has become a widely utilized method to earn rewards with 42% of hedge funds already invested in cryptocurrencies participating in staking, according to a PwC survey carried out last year, compared to 33% who are lending. Another way of looking at it: according to stakingrewards.com, over 70% of the supply of Cardano and Solana are being staked, and over 50% of the supply of Polkadot, Algorand, Binance Coin, and Avalanche. This indicates an understanding by Proof-of-Stake token holders that earning rewards via staking is part of the fundamental case for holding these tokens in the first place. Staking is already live on the Finoa platform, made possible by partnerships with institutional-grade staking providers.

The most recent and sophisticated method for earning yield in the digital asset universe is by providing liquidity to trading pools on decentralized exchanges. These ‘exchanges’ are programs running on the blockchain which rely on a type of smart contract called an automated market maker to facilitate the trading of tokens. Users can earn a share of trading fees by placing their assets into a liquidity pool with rewards adjusting automatically to ensure that each pool remains liquid enough to support the trading volume. The smart contract functionality of blockchains like Ethereum and on-chain lending and borrowing constitutes the emergence of “decentralized finance” or DeFi. Participation in DeFi is still largely limited to those with significant technical savvy but large swaths of the digital asset industry are working to remove barriers and improve access to these yield-bearing opportunities.

Are digital assets also primed to take over alternative investments?

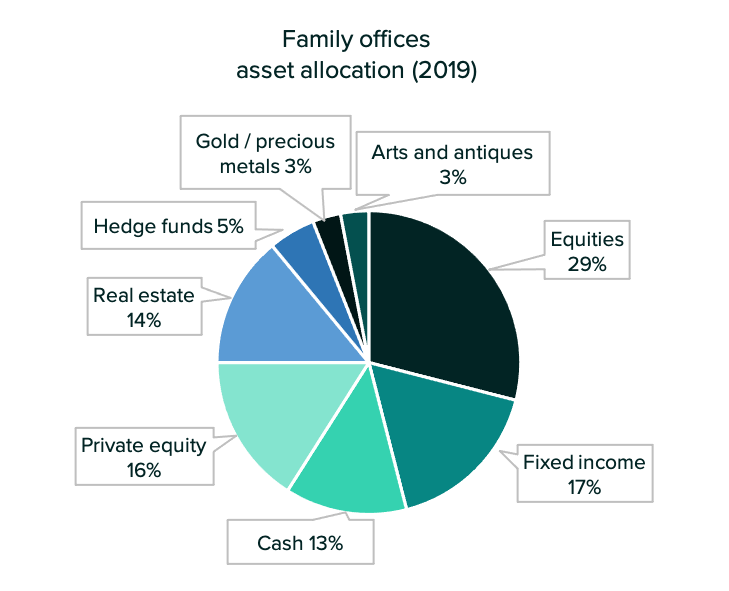

Even family offices that don’t know how to invest in crypto may soon find blockchain entering their existing areas of activity— namely via tokenization of existing assets. As referenced in a Finoa blog post and a more recent research report from Cointelegraph, it is estimated that $24 trillion of assets will become tokenized by 2027, lowering costs and boosting liquidity for previously illiquid assets. A report from UBS showed that family offices invest over 40% of their capital in alternative asset classes, including art, private equity, and real estate. Tokenization will soon facilitate family office investment in alternative asset classes — and now might be the time for family offices to get ahead of the curve and gain familiarity with digital assets. Investors will gain access to tokenized assets with service providers like Finoa and may begin assessments of these services in preparation for the trend of tokenized investing, even if they are not currently pursuing crypto investing strategies.

Source: UBS 2020 family office report

The time is now to gain experience with digital assets

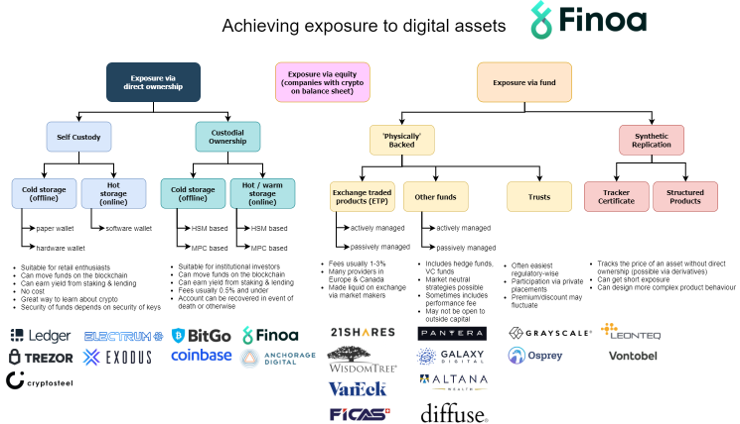

New investors wondering how to invest in crypto are faced with a variety of choices. These include direct ownership via a custodian and ownership of shares in crypto-backed ETPs, trusts, and funds. Investors new to crypto perceive ETPs as the easiest way to get exposure to crypto assets. On the contrary, these are the most expensive and do not currently offer access to yield-earning opportunities like liquidity provisioning or lending. Going down the route of direct ownership opens the door to possibilities still yet to be seen in mainstream exchange-traded products.

Conclusion

In a world where government bonds do not bear significant yield for their investors and cash deposits result in negative interest rates, family offices may be wise to look to the digital asset space for long-term safety and reward. Limited-supply, fundamentally uncorrelated digital assets like bitcoin create a compelling case for wealth preservation and portfolio diversification while staking and lending offer significant opportunities to earn returns. Investors choosing to own digital assets directly will pay lower fees than holders of ETPs and prepare better for the coming trend of alternative asset tokenization.

Whether to gain access to digital assets, participate in staking and lending, or prepare for the coming wave of tokenized assets, opening an account with a digital asset custodian like Finoa is the first step toward hands-on participation in the future of finance. We strive to offer a digital asset banking service meeting the needs of every institutional investor — including industry-leading token support, staking with institutional-grade validators, and trading via a German-regulated OTC trading partner, all within the context of Germany’s strict crypto regulations. Please do not hesitate to contact us if you want to discuss how we can support your digital asset investing strategy.