Finoa Custody: launching the world’s first fully digital warm-storage custody solution for digital assets

Institutional investors’ behavior and preferences in Digital Assets have significantly changed over the past years. The overall trend shows an increase in the total number of funds, a professionalization of product offers, and an enhanced ecosystem and infrastructure. Despite these developments, not a month goes by without an exchange being hacked. The result of which is funds being lost, stolen, or compromised, with no guarantee of recovery.

Consequently, safeguarding Digital Assets today remains a daunting task for institutional investors, mainly due to the numerous risk that Digital Assets are subject to:

- Phishing

- Fraud

- Hacks

- Loss of keys

- Transaction errors

- Counterparty risk

Finally, some fund and asset managers have started to slowly move away from self-custody and/or pure cold storage towards more advanced solutions.

Relying on self-custody not only equals “buying internal risk”, but also presents a conflict of interest that could potentially raise regulatory concerns (i.e. by putting investors’ money at risk from not separating “operating” to ‘holding” the assets and distributing risks and responsibilities).

On the other hand, cold storage, despite its perceived high security, remains a sub-optimal solution as it not only kills the Digital in Digital Assets but also transfers the risk from high-security technological infrastructures to a human-managed process. The “offline” nature of cold-storage solutions prevents professional investors from taking advantage of market fluctuations. It keeps them away from participating in advanced Blockchain-protocol functionalities such as staking or harnessing the value of tokenized securities.

Deep-cold storage in Swiss bunkers might sound secure — but are we talking digital here?

A professional, sophisticated, and trusted Custody solution is the crucial missing piece of infrastructure holding back the growth of institutional investors in the space.

Finoa’s vision: servicing “The Era of Tokenization”

We at Finoa believe in a future where assets will be natively digital, tokenized, and represented on the Blockchain. According to the World Economic Forum, $24 trillion worth of Digital Assets is projected to be stored and transacted on the Blockchain by 2027. Our mission is to provide asset services to those institutional investors that share our same vision, starting with a high-security, banking-grade, high-speed custody solution safeguarding Digital Assets.

Finoa’s solution has been tailored to institutional investors’ needs, operating a secure and cost-effective infrastructure to service professional investors directly or as a sub-custodian on behalf of financial institutions.

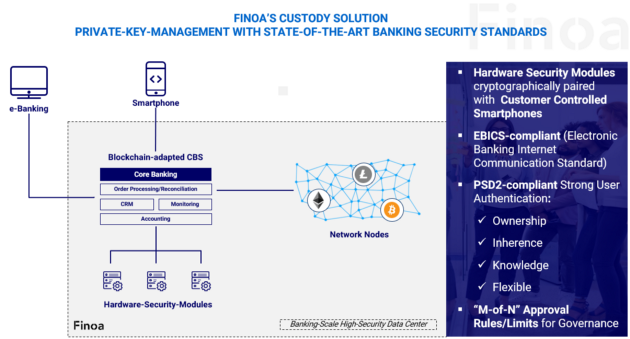

Our warm-custody solution (online storage with deep-cold-storage security characteristics) is based on state-of-the-art banking standards. Our infrastructure not only guarantees maximum security, but also unlocks the potential behind immediate-online-accessibility of Digital Assets — such as supporting in-custody trading, staking, voting, and other advanced Blockchain-protocol functionalities (currently in development).

Compliant with European Union’s PSD2 banking regulation and built on EBICS (Electronic Banking Internet Communication Standard) standard, our custody solution removes common issues with Digital Assets and provides a frictionless experience for asset safeguarding and servicing. Developed on proven banking technology, Finoa guarantees maximum security and compliance by combining a custom-built core banking system, and eBanking interface, and a proprietary Blockchain/private key technology.

Our custody solution is currently unique in the market and institutional investors would find a trusted “go-to-partner” in Finoa with our distinctive features:

- Fully Mobile: Smartphone/Fingerprint-controlled

- Fully Digital: App/Browser Interfaces

- Immediately Accessible: Warm Storage

- Highest Security: Cryptographic Device Pairing

- Fully Compliant: PSD2, EBICS, Audit

- Uniquely Regulated: License and Insurance Partners

Finoa’s technology: first smartphone-controlled, core-banking-integrated infrastructure

Our architecture leverages the highest security banking standards known to the market. Combining established and proven technology from the traditional banking industry with our knowledge in Blockchain and cyber security, Finoa created a solution based on four major building blocks:

- Leveraging the “gold-standard” in hardware security through a partnership with German-based Hardware-Security-Module (HSM) provider Utimaco GmbH, also renowned for supplying hardware to the Bundesnachrichtendienst (Federal Intelligence Service) in Germany;

- Utilizing the most secure available Smartphone Hardware of Google Pixel 3, the worldwide only Smartphone with tamper-resistant hardware security module supporting StrongBox Keymaster;

- Integrating one of the world’s first Blockchain-adapted Core Banking system assets for secure accounting and reconciliation, developed in-house over the course of the last year;

- Cryptographic-Pairing of Smartphones/Fingerprints (latest smartphone generation with mobile, programmable HSMs) with eBanking interface and HSM infrastructure; and

- Establishing redundant infrastructure plus backup mechanism in a banking-scale high-security data center.

The importance of sophisticated and secure applications is paramount in Digital Asset Custody. With Finoa, we can provide safety and security while delivering maximum user-friendliness and a digitally-native experience.