Bitcoin for Corporates: De-risking cash in a negative real-yield environment

“Every company, every major corporation at this point in time, needs to digitally transform their balance sheet and their treasury policies, and bitcoin is the way to do that. It is not something that comes immediately to mind for every corporation, but when you take the time to do the research, to understand the macroeconomic impacts, the digital impacts, the global impacts, et cetera, you either immediately get it or you gradually get it, and as people gradually get it a lightbulb goes off and they suddenly get it, and then you dive in and it’s a great thrill, it brings great value to your organization, to your employees, to your shareholders, to your stakeholders, and to your customers, and it’s something that everyone should be considering, and then very quickly doing.”

- Phong Le, MicroStrategy CFO

Financial risk management is a key function of both large and small firms

Capital is the lifeblood of business, and every business must efficiently manage its cash flows and treasury reservices to succeed. This is the mission of a company’s finance and treasury departments, whose tasks also include the management of financial risk. Their exact priorities will vary depending on the size of the firm, but a 2014 PwC survey showed that both large and small organizations rank financial risk management as a key role of their treasury department. For example, a company’s business activities may leave it significantly exposed to changing prices of commodities, foreign exchange (forex) rates, or interest rates. In order to effectively mitigate these financial risks, firms often use futures- and foreign exchange markets to reduce unwanted exposures, and enter low-risk, long-term investments in order to guarantee the safety of their spare capital. But with bond yields at an all-time low and inflation metrics rising quickly, treasurers are faced with a unique set of post-pandemic challenges.

Rising inflation is concerning for some treasurers

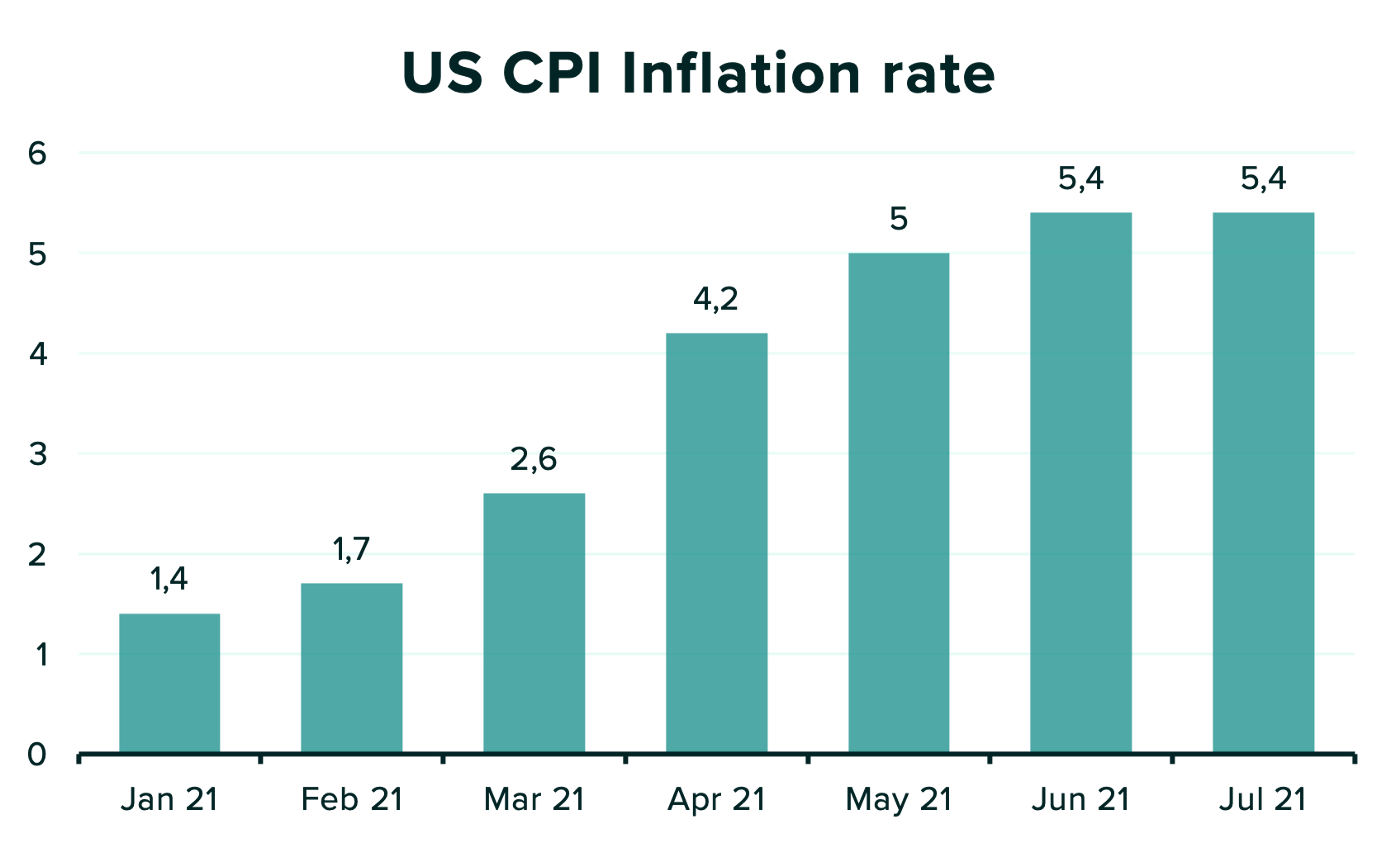

While the use of futures and forex markets to hedge financial risk is routine for many corporate treasury departments, the same cannot be said for the task of combatting the effects of inflation. With the US consumer price index (CPI) rising at more than 5.4% year-on-year, many businesses have already begun to raise prices to combat the effects of rising prices for energy (up 24.5%), gasoline (up 45.1%), and commodities (up 8.7%).

Source: Tradingeconomics.com

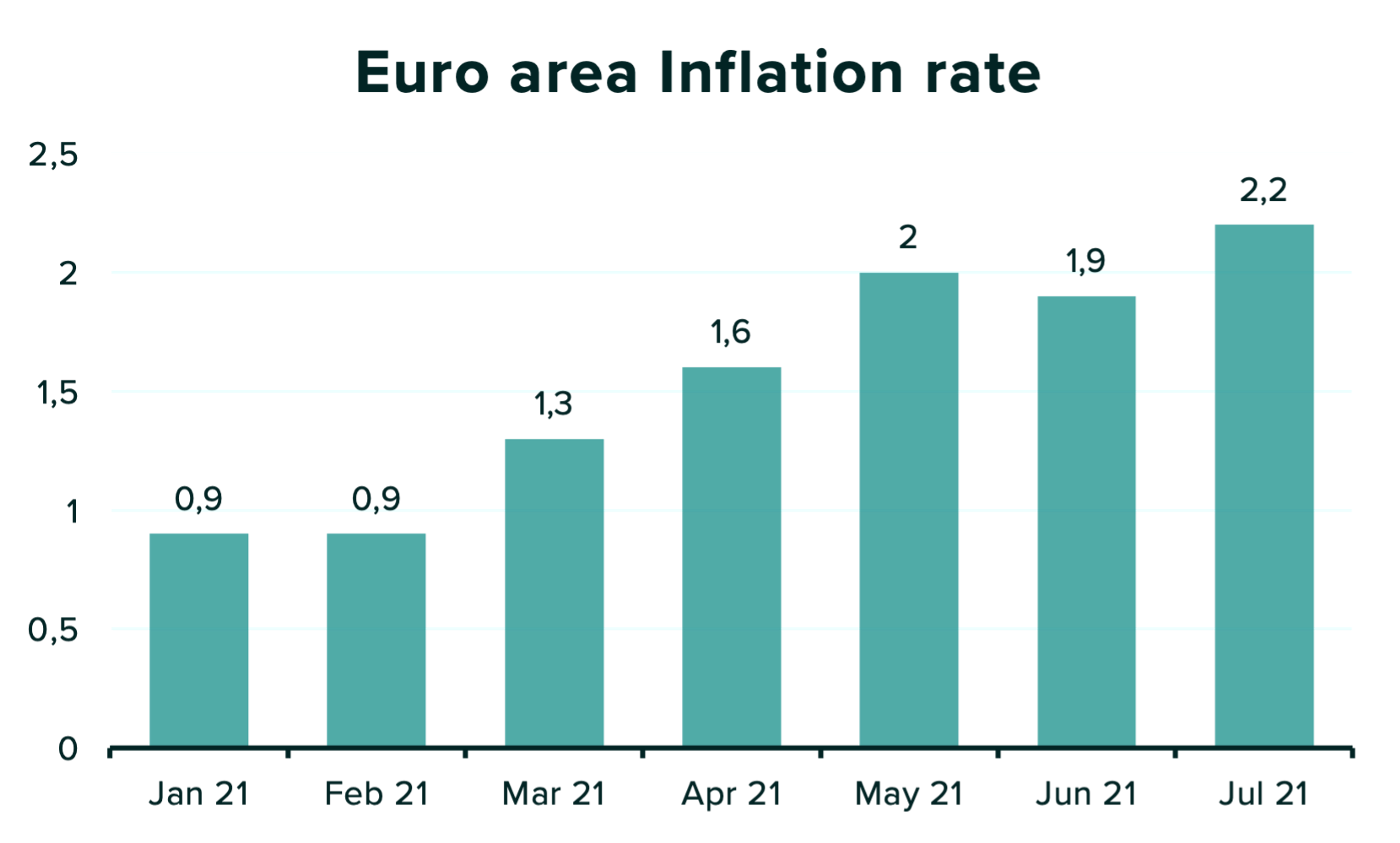

In Europe, inflation numbers remain lower than in the US but are also rising. In Germany, the year-on-year consumer price inflation rate jumped from 2.3% in June to 3.8% in July 2021, its highest level since December 1993. (source) Inflation in the euro area rose past 2% in July.

Source: Tradingeconomics.com

Whether or not a business faces rising input costs, the task of managing a treasury’s reserve assets becomes complicated as inflation rises past the yields offered by bonds, as we will explore in the next section.

Bonds no longer offer a store of value

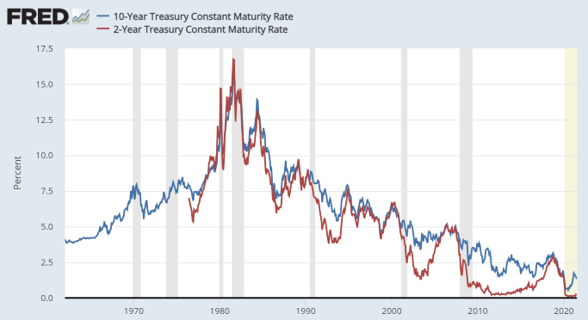

Government bonds used to be the easy solution to preserve capital’s purchasing power over a long period of time. Traditionally, bonds provided a fixed-income return that yielded higher than the rate of inflation. Bond yields have declined steadily since the 1980s, however, with the 2-Year US Treasury finally reaching zero in 2020. With returns from bonds no longer outpacing rising inflation, financial markets have entered a new paradigm, forcing investors to look elsewhere for safety.

Source: Federal reserve bank of St.Louis

The CIO of a Swiss Family Office, when interviewed as part of Blackrock’s 2020 Global Family Office Survey, put it this way: “When the US 10 Year Treasury was yielding 3.5–4%, you were clipping a nice coupon. Today, high-quality sovereign bonds are exceptionally expensive. Something like 60% of sovereign bonds in the developed world are trading at negative yields. Consequently, fixed income is going to give you nothing. In fact, it is most likely going to lose you money.”

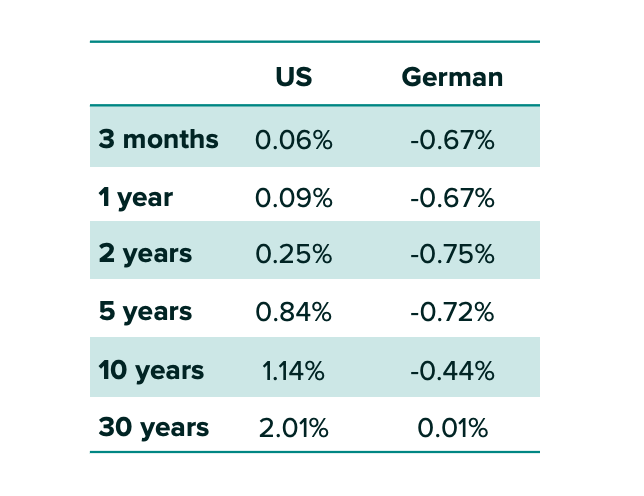

US and German government bond yields. Source: Worldgovernmentbonds.com

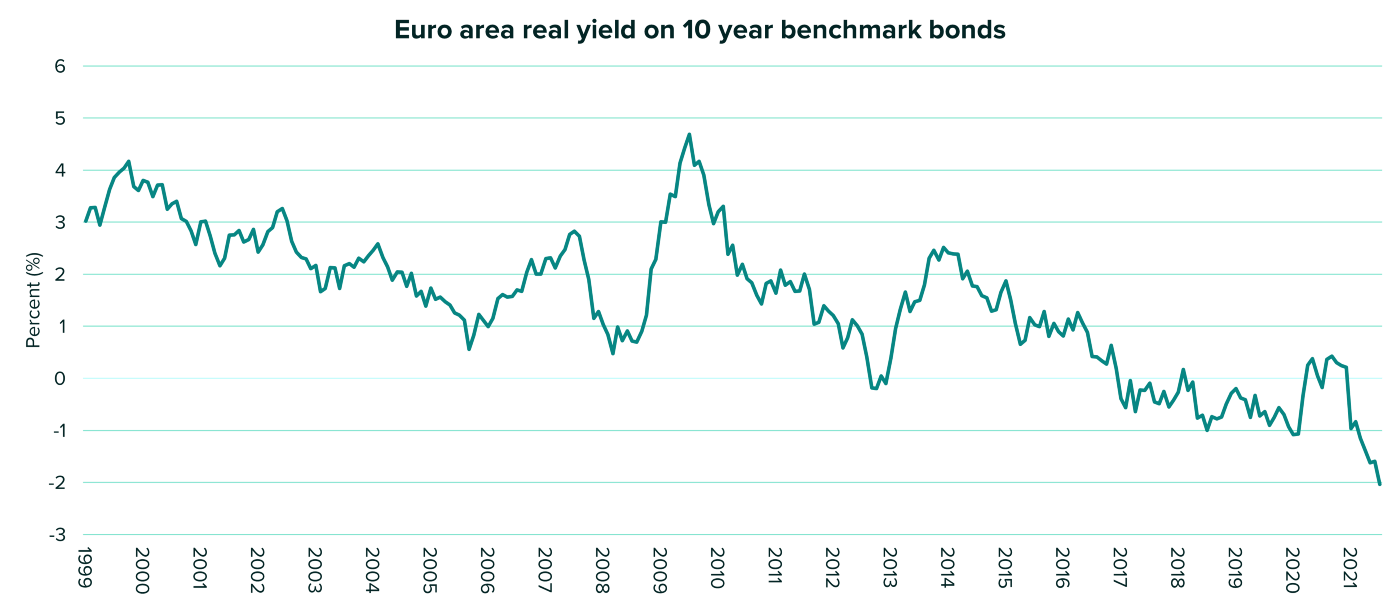

In Europe, inflation remains lower than in the US but bond yields are already negative. Subtracting the euro area harmonized inflation rate from the yield of Euro-area government benchmark bonds shows that the real yield of European government benchmark bonds crossed into negative territory several years ago, and is now crossing below -2%. Clearly, holders of European bonds are losing purchasing power year over year.

Source: Worldgovernmentbonds.com

Higher rates are nowhere in sight

The Federal Reserve has committed to lower interest rates even in the face of rising inflationary pressures, as have the ECB and other central banks. In turn, this monetary policy stance keeps downward pressure on real rates and erodes returns from traditional stores of value like cash or treasuries.

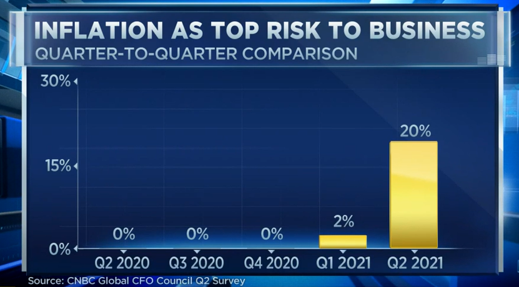

A recent survey by the CNBC Global CFO Council shows a dramatic rise in the number of U.S.-based CFOs now regarding inflation as the largest external risk to their business. (shown in graphic) The concern is that the Federal Reserve could lose control of inflation, as explained by Victor Li, professor of economics at the Villanova School of Business: “The lack of confidence that U.S. CFOs have in the Fed’s ability to control inflation is concerning. The cornerstone of the Fed’s price stability mandate is central bank credibility. Without a credible and transparent monetary policy, it will be impossible to anchor inflation expectations.”

Source: Cnbc.com

Inflation is becoming top-of-mind for CFOs and corporate treasurers, who hinge on the actions of central banks like the US Federal Reserve or the ECB. The next section will explore the actions which can be taken to protect against inflation or hedge against central bank missteps.

De-risking cash and bonds — the search for a store of value

Treasurers looking to protect their companies’ balance sheets against inflation must look beyond cash and bonds.

As explained by Aker ASA Chairman Kjell Inge Røkke,

“Risk is not an obvious concept. What’s commonly considered risky is frequently not. And vice versa. We are used to thinking that cash is risk-free. But it’s not. It’s implicitly taxed by inflation at a small rate every year.”

With bonds no longer yielding real returns, few options remain available to store value over the long term.

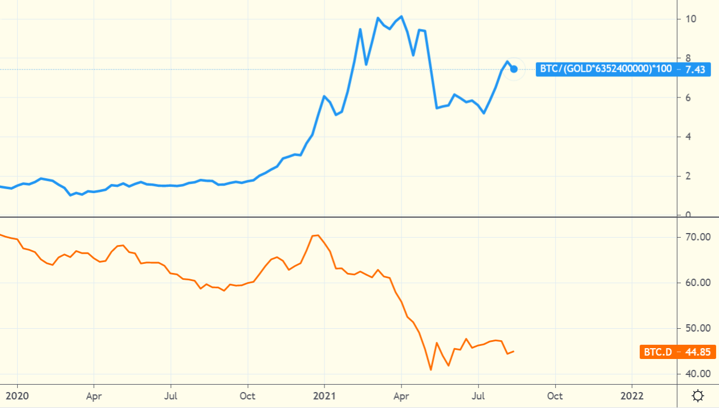

The store of value with the longest history is gold, which has served for thousands of years as a scarce commodity with money-like properties, easily understood as possessing scarcity that should prevent its value from changing dramatically over time. Periods like the current one — where government bonds fail to outperform inflation — typically drive capital into alternative stores of value. This time, though, we’ve seen bitcoin outpace gold, gaining acceptance as a store of value and a hedge against inflation for corporate investors and institutional asset managers. In 2021 Bitcoin’s market grew to 10% of the size of gold’s market, finally putting it on the map as a competitor to the age-old metal.

While bitcoin’s market grew to 10% of gold’s market cap in early 2021 before correcting (top), bitcoin’s share of the crypto market fell dramatically. (bottom)

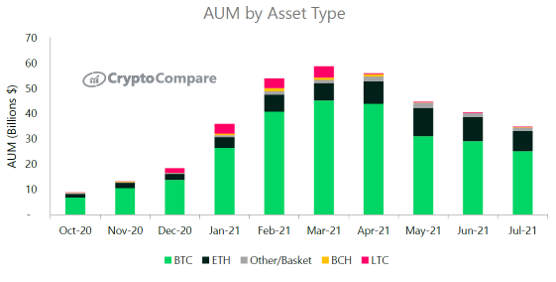

But the digital asset space extends beyond bitcoin — while bitcoin’s market grew in 2021, its share of the overall crypto market decreased from a high of 70% to a low of almost 40%, signaling an increasing interest in other digital assets like stablecoins, or those like Ethereum (ETH) that power decentralized finance applications for lending and trading. This is likely true for institutional investors as well, as ETH’s share of crypto-backed ETPs and trusts is also increasing, as shown by Crypto Compare in the graphic.

Source: Cryptocompare.com

What all digital assets have in common with each other is that they are defined by a protocol, which can be thought of as a set of rules. Bitcoin’s protocol contains not only a method for enabling payments to and from users on the network but also a monetary policy giving it a store of value properties, which we will explore in the next section.

Bitcoin’s scarcity is pre-defined

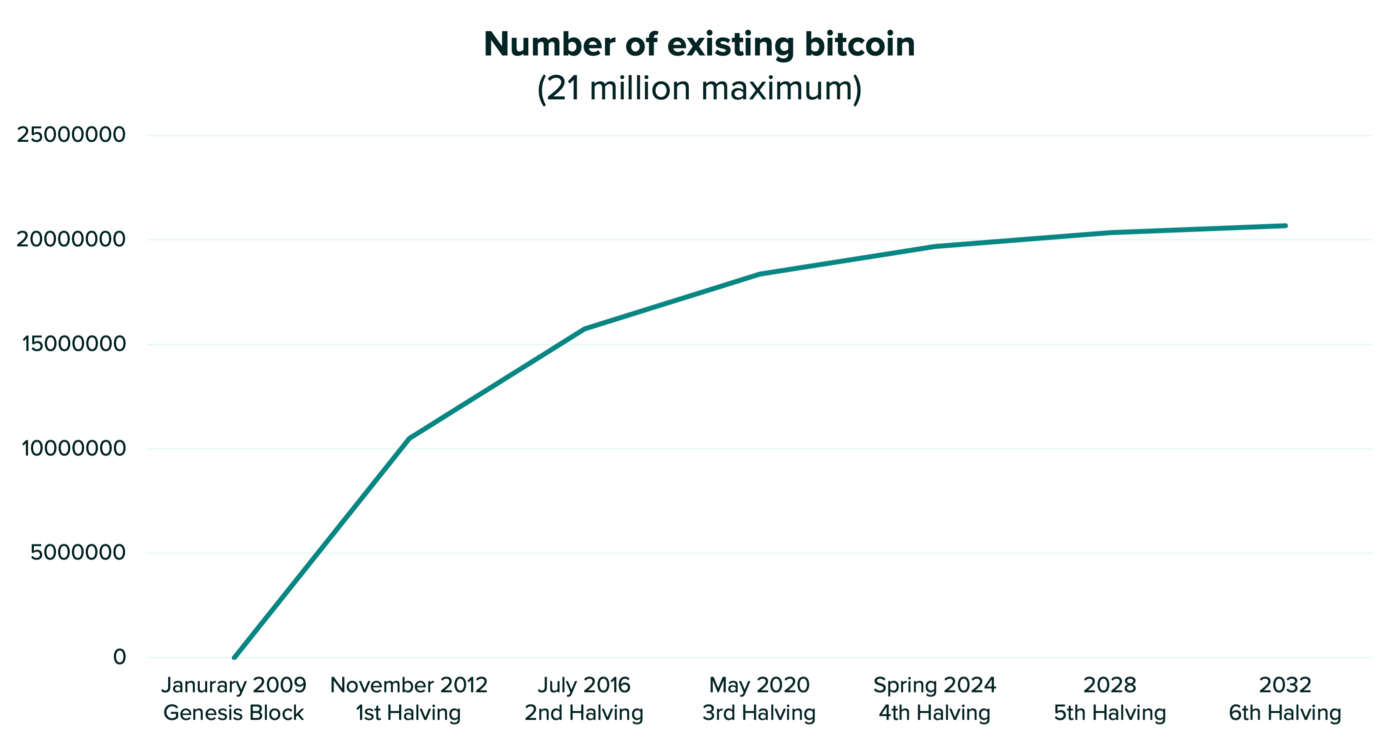

Bitcoin’s limited maximum supply and hard-coded issuance curve have earned it the nickname “digital gold.” Bitcoin’s blockchain protocol ensures that it is impossible to create or destroy at will, adhering to these rules as strictly as gold adheres to the laws of physics. Unlike gold, though, bitcoin is cheap to transact and store, as it is inherently digital.

To be more specific, only 21 million bitcoins will ever exist, and about 18.5 million have already been created. The remaining supply will be generated at a slower and slower rate until the final bitcoin is created in 2140. This gives Bitcoin scarcity, making it a form of “sound money”, as well as a pre-defined inflation rate — two ingredients for an effective store of value. It’s taken over a decade for bitcoin to build acceptance, with 2020 proving to be a pivotal year, and now even Ray Dalio admits that he would “rather own bitcoin than a bond.”

Another way of thinking about bitcoin’s scarcity: If you own 1 bitcoin, you can be certain that there are, at most, 21 million other people who have as much bitcoin as you do. If you have 10,000 bitcoin, there can’t be more than 2,100 other people who own as much bitcoin as you, since you own almost 0.05% of the supply. Bitcoin’s limited supply means that its market is purely driven by demand, as more people and organizations begin to understand its potential as a store of value and acquire a share for themselves. The bitcoin market may grow and shrink, but 1 bitcoin will always represent the same share of ownership of the entire bitcoin supply.

Bitcoin’s place in a portfolio

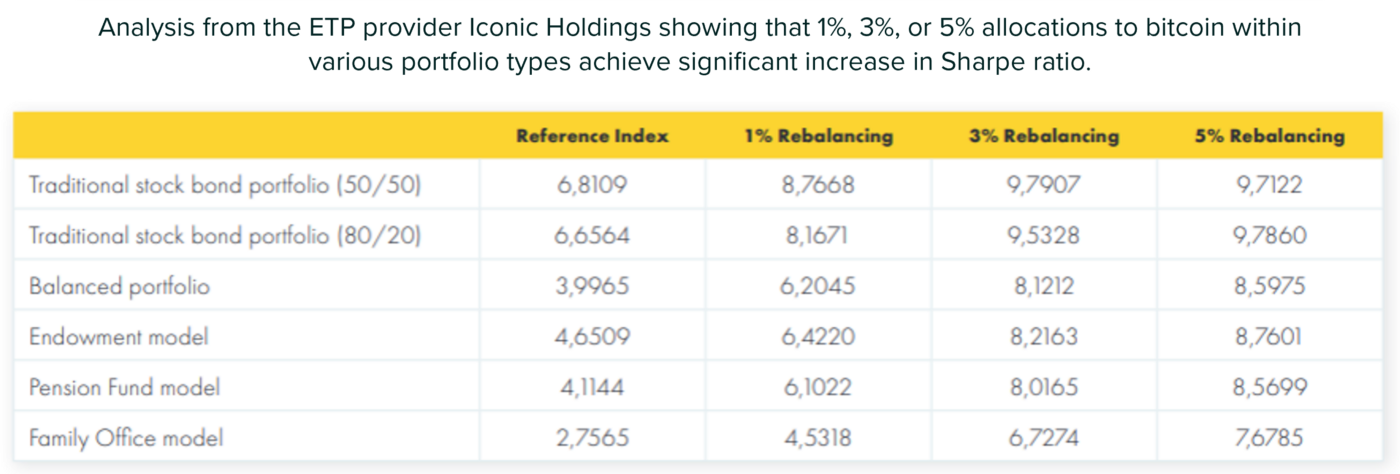

Bitcoin is unlike any other traditional financial asset, and as a result, its market dynamics have played out independently from other markets. This “noncorrelation” means that bitcoin can serve as an effective diversifier in a portfolio, significantly increasing the Sharpe ratio even with a small allocation. Analysis from the ETP provider Iconic Holdings found that a traditional 80/20 stock-bond portfolio saw its Sharpe ratio increase from 6.6 to approx. 8.2 with 1% crypto, 9.5 with 3% crypto, and 9.8 with 5% crypto allocated.

Source: Iconicholding.com

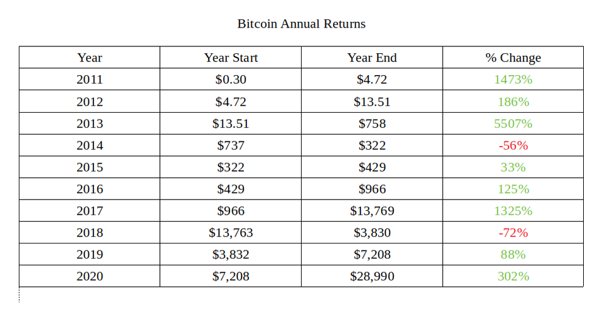

While Bitcoin’s volatility is well-known, in a long enough time frame its market has only moved up. This explains the increase in Sharpe ratios — bitcoin experiences volatility largely independently from other markets and continues to aggressively trend upward over a long time horizon.

The trend is already underway

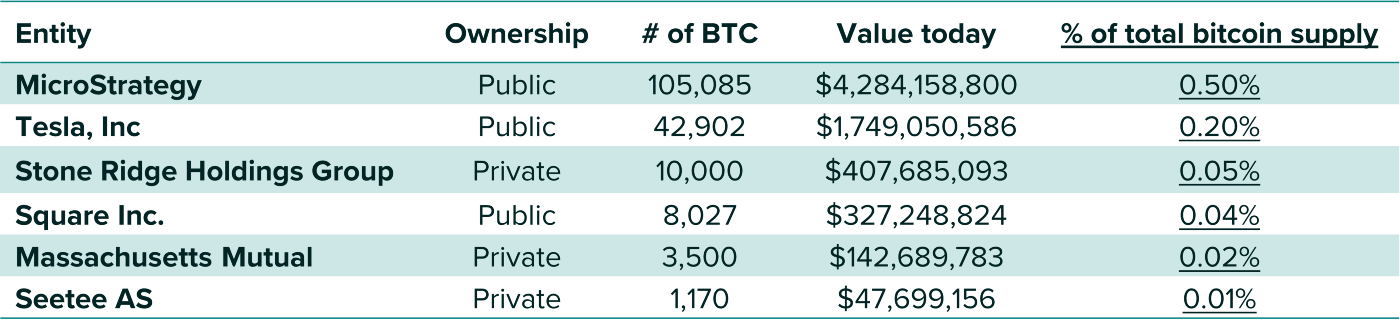

According to buybitcoinworldwide.com, over $8.8b of bitcoin is currently held in the treasury of 34 public companies, with another $7b in the treasury of private companies. Together these represent about 1.86% of bitcoin’s supply. Another $33b, or about 3.9% of the total supply, is held by issuers of ETFs and Trusts. Some of the largest corporate holders of bitcoin are shown in the table.

ETP providers and holding companies are excluded

While corporations have generally not led the institutional investment surge, Genesis Trading reported in their Q1 2021 Report that the ratios are shifting:

“Before Q1 2021, hedge funds and passive funds were some of our largest clients by OTC volume. As corporate clients began buying Bitcoin for their treasuries in Q1, our ratios shifted. When viewing our top 100 largest clients by OTC volume traded, Genesis saw volume from “Corporates” increase from under 1% to over 25% of our total activity.”

Not every institutional investor buys bitcoin for the same reason, but it does seem that the largest firms use it as a store of value and a hedge against the rest of the financial system. For example, Ruffer Investment Company, a conservative UK-based asset manager focused on capital preservation, invested approximately $740 million in bitcoin in December of 2020, explaining that their investment was “primarily a protective move for portfolios” to “act as a hedge” against “some of the risks that we see in a fragile monetary system and distorted financial markets.”

Even more striking is the language used by MicroStrategy’s founder and CEO Michael Saylor, who began an aggressive bitcoin-buying campaign in 2020, eventually putting over $1b of the company’s money into bitcoin. He explained that it took MicroStrategy 30 years to accumulate $475m in retained earnings, all of which they put into bitcoin in 2020.

Their reasoning:

“Cash is a liability, not an asset …we are going to have to do something to remain solvent. Think of it as a $500MM acquisition of a big tech monopoly growing 100% per year.”

Embracing “The Bitcoin Standard” requires a mindset shift

Those that understand and believe in bitcoin focus on the properties programmed into its protocol instead of the changing value assigned to it by humans in the marketplace. Shareholder letters published by corporate investors like Aker, Square, or Stone Ridge don’t explain their decision in terms of the market’s growth rate or the price’s moving average, instead of compelling the reader to take a step back and consider the history of money, the abandonment of the gold standard, and the question of what money is in the first place. A common theme among these letters is the unprecedented expansion of the money supply that took place in the wake of the COVID-19 pandemic.

Stone Ridge, for example, begins their shareholder letter with the statement: “The most obvious, most important realities are the ones that are hardest to see. For Americans alive today, one of [those] is ‘What’s money?’”

Meanwhile Square stated in their bitcoin investment whitepaper:

“We view bitcoin as an instrument of global economic empowerment; it is a way for individuals around the world to participate in a global monetary system and secure their own financial future. This investment is an important step in furthering our mission.”

Bitcoin’s value doesn’t come from being “backed” by gold or shares, instead, its believers value it for the usefulness of its global transactability, the soundness of its hard-coded monetary policy, and its independence from any governing or policy-making body. These core characteristics are fundamentally different from other forms of money or financial assets, and an ever-increasing number of treasury and asset managers are beginning to understand and believe in bitcoin as an asset.

Whether for a retail investor or multi-national corporation, bitcoin offers a store of value with no cost of storage, that is globally transactable and will continue to function regardless of the actions of any human being or government. While still too early for some, corporate treasurers should at least consider whether the risk of holding bitcoin may in fact be lower than the risk of holding cash and bonds in a low-interest rate, high inflation environment.

Education is key

In response to a bitcoin meme posted by Elon Musk, Michael Saylor recommends that Elon convert the Tesla balance sheet to bitcoin. Tesla announced a $1.5b bitcoin purchase two months later.

Those who have already made the shift are often compelled to communicate their reasoning to others, educating externally in the same way they educated decision-makers within their own organizations. MicroStrategy is leading the way with a website called “Bitcoin for Corporations” where they’ve made available their guidelines and policies regarding their Bitcoin Accounting Treatment, Trading Policy, Contractual Considerations for Custodians, Key Considerations, and a roadmap instructing how to help navigate a corporate bitcoin strategy. Their advice is not falling on deaf ears: when they hosted a webinar for companies considering a similar path of action, 1,400 firms signed up. Most notable was the Twitter exchange between Michael Saylor and Elon Musk in December of 2020, which resulted in Tesla purchasing $1.5b in Bitcoin a few months later.

Phong Le, the CFO of MicroStrategy, explains the motivation behind their push to educate other corporates:

“Every company, every major corporation at this point in time, needs to digitally transform their balance sheet and their treasury policies, and bitcoin is the way to do that. It is not something that comes immediately to mind for every corporation, but when you take the time to do the research, to understand the macroeconomic impacts, the digital impacts, the global impacts, et cetera, you either immediately get it or you gradually get it, and as people gradually get it a lightbulb goes off and they suddenly get it, and then you dive in and it’s a great thrill, it brings great value to your organization, to your employees, to your shareholders, to your stakeholders, and to your customers, and it’s something that everyone should be considering, and then very quickly doing.”

Making a plan and taking action

Once corporate treasurers and key decision-makers have learned enough about bitcoin to decide to allocate a portion of their balance sheet, an entirely new set of educational and operational tasks begins. These include due diligence on service providers like custodians and brokers, drafting of a treasury reserve policy, trading policy, and accounting memo, and building of internal controls. Whether via Deloitte’s guides on investing in digital assets, or MicroStrategy’s open-source documents and educational sessions, there already exists a great deal of information and guidance available for corporate investors to move forward in their digital asset strategy.

Finoa offers trusted access to the digital asset ecosystem

At Finoa, our goal is to create a gateway for traditional financial market participants to engage with digital assets. We’ve significantly reduced the technical barrier to entry and simplified the digital asset management experience, empowering many VC funds, crypto funds, high-net-worth individuals, and corporates to enter the digital assets ecosystem for the first time. We instill trust by keeping safety and security our highest priority while developing our product to meet the needs of an increasingly sophisticated client base. We see industry trends clearly reflected in our client base, and we’re excited to serve as the leading European custodian in the rapidly evolving world of cryptocurrencies and digital assets.

Secure, qualified, and compliant custody: Clients can be confident that their digital asset holdings are in good hands. Private keys are encrypted and managed by hardware security modules (HSMs) designed to meet the US FIPS140–2 level 3 standard, the same type as used by the German Federal Office for Information Security (BSI). As an organization, Finoa meets the level of operational security and anti-money-laundering practices associated with German banks and has been issued a preliminary crypto custody license (§64y KWG) from the German BaFin regulatory agency.

Since March of 2020, Germany’s Federal Financial Supervisory Authority (BaFin) and several other entities have classified digital assets as financial instruments, bringing them into the same regulatory regime as other assets governed by the banking act. We collect AML & KYC information on all of our clients and run a fully PSD2 compliant business, and we are continuously monitoring regulatory developments here in Europe that affect our business and our clients.

Accounting & reporting: In order to simplify the calculation of capital gains and losses from the purchase and sale of various tranches of digital assets, Finoa users can create multiple wallet addresses for the same asset type. By segregating tranches of assets, FIFO accounting methods can be avoided, allowing simpler, more tax-efficient decision-making can be carried out. Account data can be exported directly from our interface or accessed via API, enabling corporate investors to fulfill reporting, tax, and audit obligations regardless of the tools they use to do so.

Supporting internal controls: Equally as important as the custodian’s quality of service is the quality of the internal controls set up within the client organization, determining who will manage funds and make decisions. The Finoa account is highly customizable, with many types of user roles and approval policies ensuring that each action reflects the intention of the organization rather than an individual.

Trading: Institutional crypto trading is enabled through our partner Bankhaus Scheich, a German-regulated trading house that makes markets on the Frankfurt Stock Exchange and has a very capable crypto trading desk. The crypto OTC desk is connected to many crypto markets, allowing access to deep liquidity and enabling the execution of large orders in an efficient manner for a range of digital assets. Better execution means less market impact and lower average costs for investors seeking to enter or exit large positions.

Get in touch

Regardless of the strategy or asset type, crypto’s unique barriers to entry make finding the right partner increasingly important. Finoa’s offering is shaped by our experience partnering with and supporting a diversity of asset managers and corporate investors, allowing them to effectively execute their strategies while meeting their strict requirements. We offer fully a compliant custody solution with industry-leading security, in partnership with a German-regulated OTC trading partner. Please don’t hesitate to get in touch if you’d like to discuss how we can support your digital asset investing strategy.