The crypto space is developing and institutional investors are getting involved

This report focuses on the crypto institutional adoption of crypto from the perspective of Finoa as the leading crypto custodian in Europe. It provides a general overview of the news-worthy institutional investments over the past year and a categorization of use cases of such investments as we observe them.

2020: The inflection point for Bitcoin’s institutional adoption

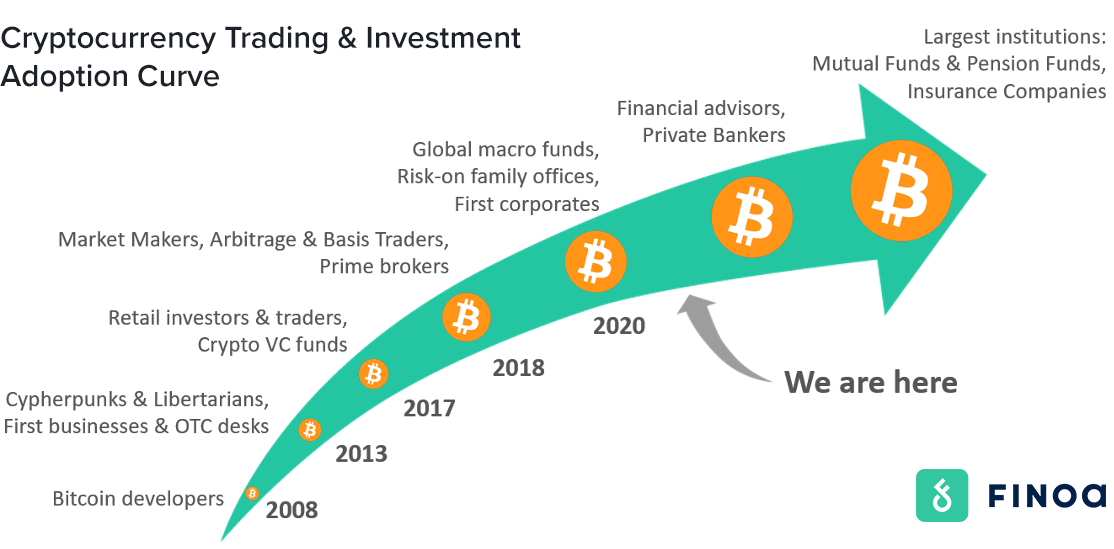

The past 12 months have seen a major shift in the way institutions look at digital assets. The economic effects of the covid-19 lockdowns in the spring of 2020 caused central banks to engage in economic stimulus and lower interest rates to zero, and the narrative surrounding Bitcoin became that of “digital gold” — a good hedge against inflation. This was further strengthened by Bitcoin’s halving in May 2020, whereby the supply of newly “mined” Bitcoin was cut in half, making it less inflationary than gold.

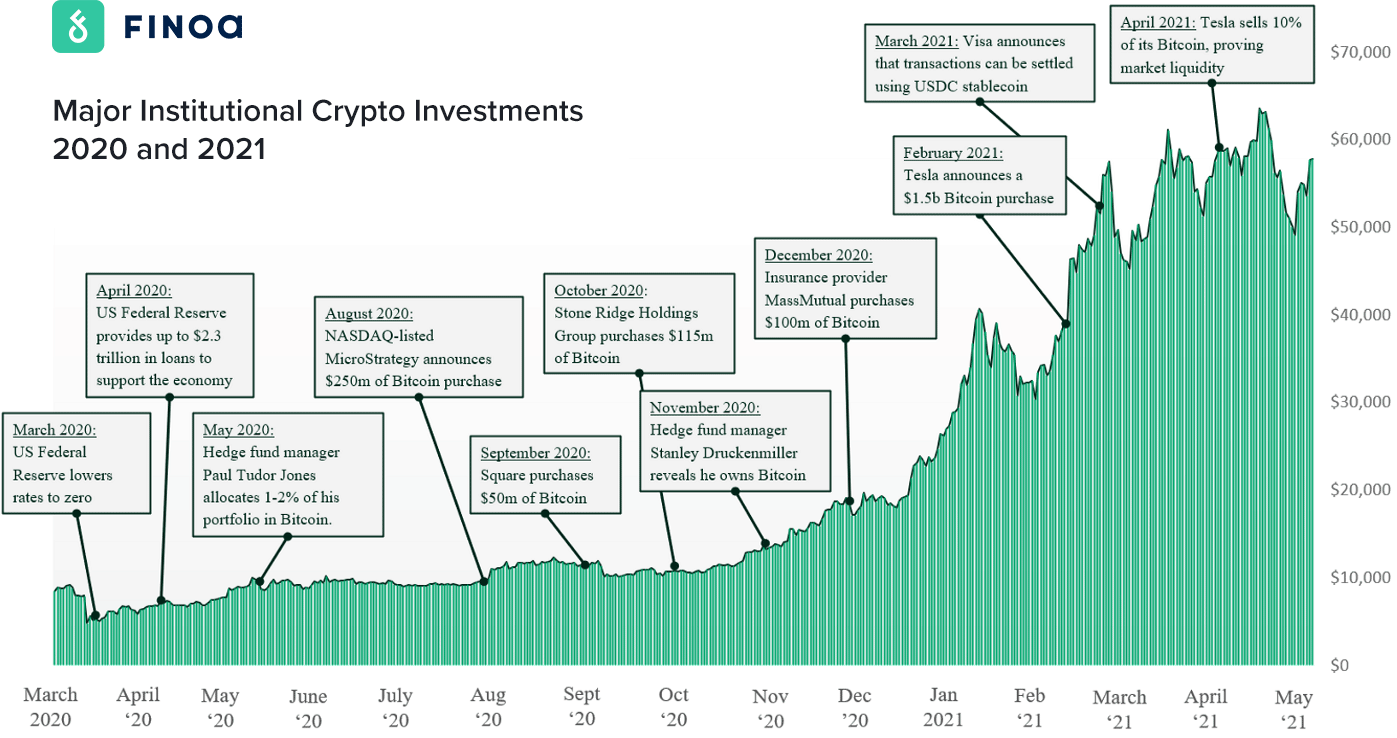

A June 2020 survey from Fidelity Digital Assets found that 36% of US and European institutional investors were already investing in crypto assets — those institutions included high-net-worth individuals, financial advisors, family offices, crypto hedge and venture funds, traditional hedge funds, endowments, and foundations. Especially in the latter half of 2020, a number of large institutional investors announced purchases of Bitcoin, as shown in the timeline graphic below.

Institutional crypto investing accelerated in 2020, with major bitcoin purchases from the likes of MicroStrategy, Tesla, and Square, as well as hedge fund managers like Paul Tudor Jones and Stanley Druckenmiller

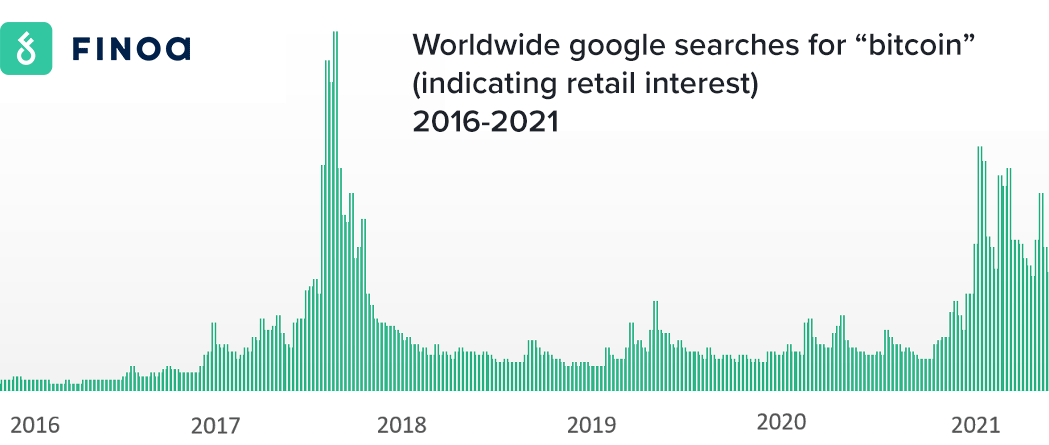

Curiously, while Bitcoin garners ever-increasing attention from institutions, interest from ordinary retail investors never passed its 2017 high, according to Google Trends.

Google searches worldwide for “bitcoin” over the past five years. (As of May 5th, 2021). This indicates that bitcoin’s price rally to 3x the 2017 high has not been driven by the same sort of retail mania as in 2017.

It has never been easier for institutions to get exposure to crypto

Making the first foray into crypto investing can be an intimidating prospect, but the reality is that it is easier than ever to achieve a crypto allocation, for both retail and institutions alike. Firms like MicroStrategy and Tesla chose to achieve their Bitcoin allocation through direct ownership of crypto, purchased and custodied through US prime brokerage services. Those who prefer not to own crypto directly, however, can choose from several crypto-backed ETPs now trading on stock exchanges in Canada and Europe. Although the US SEC has yet to approve a crypto ETF, Grayscale has provided an investment avenue for US institutional investors via a trust structure. The Grayscale trusts take on new investors via private placements, buying cryptocurrencies in the background to achieve the underlying backing for the shares. Alternatively, for institutions comfortable holding derivatives, futures for both BTC and ETH can be traded on the Chicago Mercantile Exchange (CME).

There are also a few options to purchase stock in crypto companies. Coinbase went public on the NASDAQ via a direct listing in April, and its stock provides a way to bet on one of the largest brokerage exchanges in the space. Other notable public crypto companies include the crypto miners Canaan and Riot Blockchain, the ETP provider Coinshares, and the holding company Galaxy Digital.

While this report focuses on institutional investment, it is worth mentioning that opportunities for retail investors to purchase crypto now include Paypal, Venmo, CashApp, Revolut, Trade Republic, Robinhood, eToro, and more. For retail and institutions alike, whether from the US or global, it has never been easier to determine how to invest in crypto.

Breaking down recent institutional inflows into crypto

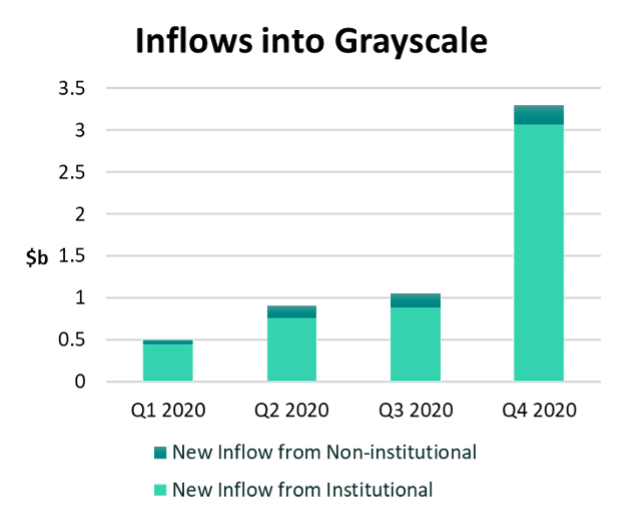

Grayscale led the way in the 2020

The prevailing narrative surrounding institutional inflows has been centered around the Grayscale trusts, which offer new institutional investors access via private placements. These trusts provided an easy answer to institutional investors wondering how to invest in crypto, and Grayscale reported higher inflows for every subsequent quarter of 2020. (The average commitment of institutions also rose dramatically to $6.8 million.) By the end of 2020, Grayscale had raised over $5.7 billion across its family of investment products, more than four times the inflows the received from its inception in 2013 to the end of 2019. Further inflows in Q1 of 2021, combined with the continued rising price of Bitcoin, grew Grayscale’s Bitcoin trust to $36 billion under management, as of May 5th, 2021. With another $8.7b in the Ethereum Trust, Grayscale is one of the fastest-growing asset managers of all time.

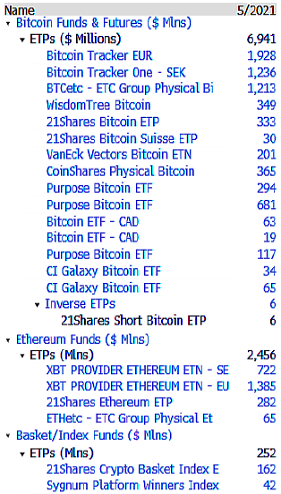

More traditional (non-trust) exchange-traded products (ETP) have also seen significant inflows. ETPs are springing up in Canada and Europe quickly attracting hundreds of millions from investors wishing to get crypto exposure without the challenge of managing custody of their assets. According to Bloomberg, as of May 5th, 2021 there are $6.9b in Bitcoin ETPs and another $2.4b in open interest in CME’s Bitcoin futures. (See graphic for full breakdown)

The largest ETPs for both Bitcoin and Ethereum is the “trackers” from Coinshares, which have traded for many years on the NASDAQ Stockholm exchange and have several billion dollars under management. While these “trackers” are synthetically replicated — using both direct ownership of Bitcoin and also derivatives — they do offer shareholders the ability to redeem their shares for the underlying crypto assets, and the funds have been audited to prove their 1:1 replication of the underlying assets.

Further demand may soon come from Germany, where new legislation passed in April of 2021 allows German Spezialfonds to invest up to 20% of their assets into crypto, creating new avenues for institutional investment in Europe (this legislation has yet to come into effect at the time of this report).

The ongoing wait for a US ETF

The next major step forward in the crypto ETP landscape would be the long-waited approval of a Bitcoin ETF by the United States SEC. The Winklevoss twins filed their first application for such an ETF in 2013, which was rejected by the SEC in 2017. Many Bitcoin ETF applications have been made since then, only to receive similar rejections. (Currently, there are 8 applications with the SEC for a Bitcoin ETF.) Grayscale has also stated its desire to convert its products from trusts into ETFs, which would then become redeemable for the underlying assets and trade at a fairer price. Institutional investors wishing to purchase crypto via exchange-traded products will have to wait for a US ETF and make do with existing ETPs.

Crypto investment use cases — Finoa’s perspective

In crypto, investors are as diverse as the methods used to achieve an allocation. Not every institutional investor is the same or enters crypto for the same reason, and Finoa serves a variety of clients who can be broadly categorized as follows:

The rise of exchange-traded products

A list of crypto ETPs as of May 5th, 2021 — Bloomberg

1. Venture capital is investing in crypto-projects

Whether investing in a blockchain project, participating in governance, or receiving staking rewards, Finoa sees a variety of VC firms following a variety of crypto investing strategies. Traditionally, VCs invest in startup companies at the initial stages of their growth, taking big risks but purchasing significant portions of equity. In crypto, while some founders build companies and raise money by selling equity, innovation also happens in another way: teams of developers work to design and implement new blockchain protocols. Developer teams raise money by allocating a number of tokens on their new blockchain to be sold to investors. VC investors make an agreement with the development team to receive these tokens once the blockchain starts running, after which point more tokens can be distributed to the wider public via a public token sale. Finoa aspires to be the bridge allowing institutional investments to flow into crypto, including the protocol layer, the infrastructure layer, and the application layer, and to this end serves both VCs as well as industry leaders like CoinList.

GOVERNANCE: On some blockchains, the tokens represent the ability to participate in the governance mechanisms of the blockchain protocol and are used to vote on decisions about how the protocol should run in the future, or where the development team should focus their efforts. This model more closely resembles ownership of voting shares of traditional companies, and venture capital firms are willing to pay for the ability to influence the direction that their investment takes. This is a unique use case that Finoa is following with great interest as here too, custodians have a potential role to play.

STAKING: For blockchains using the Proof of Stake consensus mechanism, investors can enjoy the ability to stake their tokens on the network and earn passive rewards.

Finoa allows Proof-of-Stake token holders to choose from several institutional-grade validators to delegate their stake, ensuring that the underlying blockchains remain decentralized.

2. Crypto-native startups with their own token treasury

As blockchain developers design new and innovative blockchain protocols, they implement unique methods to fund their efforts and organizations. Typically, a developer team will allocate themselves an initial number of tokens, which can be used to sell to venture capital (VC) firms to raise funds. These developer teams require custodians like Finoa in order to safely have custody of their remaining treasury assets in a regulated manner.

3. Traditional companies invest some of their treasury and provide infrastructure

The current low-interest-rate environment has led many companies to seek yield for their treasury and hedge their exposure to inflation. German corporates are no exception, and we work with many corporate clients who are looking for digital asset exposure. These types of clients generally seek to purchase Bitcoin and Ethereum and show limited interest in tokens of other protocols. While corporates have generally not led the surge in institutional investments, Genesis Trading reports that the ratios are shifting:

“Before Q1 2021, hedge funds and passive funds were some of our largest clients by OTC volume. As corporate clients began buying Bitcoin for their treasuries in Q1, our ratios shifted. When viewing our top 100 largest clients by OTC volume traded, Genesis saw volume from “Corporates” increase from under 1% to over 25% of our total activity.” (Genesis Q1 2021 Report)

However, not all corporates are getting involved in crypto solely for their treasury assets. T-Systems, one of Finoa’s corporate clients, saw an opportunity to provide staking and node infrastructure but required a custodian to safely manage the proceeds from their staking and node activities. Read more about our cooperation here.

4. HNWIs seek first-time exposure or move from self-custody to professional solutions

High-net-worth individuals are also becoming interested in crypto but often have no way to invest via their existing brokerage solutions, and do not want to manage custody of their own digital assets. Finoa offers intuitive access to the ecosystem, bringing down the technical barrier to entry and offering the opportunity to custody with a regulated crypto custodian. In this class of clients, we see some risk-on investors exploring purchases of tokens other than Bitcoin or Ethereum.

This category also includes early investors or miners of Bitcoin and other cryptocurrencies who have custodied their own stockpiles for years, but recently watched the value of their assets grow to such a degree that they seek professional custody services.

5. Hedge funds and crypto-only funds pursue diverse strategies

Many hedge funds limit their trading and investing strategies to certain asset classes, and this applies to crypto as well. We see a number of funds with the sole purpose of putting money into the crypto space, either in tokens, equity in startups, or both. Because these funds are crypto-only, investors typically allocate a small portion of their assets. A typical NYDIG Bitcoin investor, for example, has between 1–5% of their portfolio invested in cryptocurrency, with a few exceeding 5% (Forbes).

At Finoa we are happy to serve some of the world’s largest crypto funds, custodying their digital assets and allowing them to earn staking rewards on their Proof-of-Stake tokens.

There is also a place in the crypto markets for traders seeking returns without betting on the directional movement of the crypto market. The most notable of these “market neutral” crypto investing strategies is the “basis trade”: cash is used to buy Bitcoin on the spot market, which is used as collateral for a short position in the futures market where bitcoin trades at a premium. Since these contracts expire at the same price as the spot market, all that is required to capture a profit equal to this premium is to wait until the expiry of the futures contract and then sell the spot Bitcoin position back to cash. Genesis Trading reports that “the persistence in basis premium has led many more institutions to eye crypto yield opportunities.” This trade incentivizes the flow of cash into the crypto market, as well as higher interest rates in the crypto lending markets, as traders seek to get “longer” bitcoin in order to increase the size of their basis trade.

6. Family offices and asset managers

Family offices manage familial and generational wealth and focus on managing risk by constructing a portfolio of diverse assets. Such a portfolio should have a high “Sharpe ratio” — diversified enough to perform well in many economic environments while never experiencing significant volatility. Many family offices and asset managers continue to monitor crypto but do not engage on their clients’ behalf, but some have realized that even a small allocation to Bitcoin can significantly increase the Sharpe ratio of any traditional portfolio. This is due to crypto’s non-correlation with other asset classes and the positive performance of Bitcoin over recent years. Analysis from the ETP provider Iconic Holdings found that:

“In the example of the traditional 80/20 stock bond portfolio, it can be observed that the Sharpe ratio increases from 6.66 with no cryptocurrencies included to approx. 8.17 with 1% crypto, 9.53 with 3% crypto, and 9.79 with 5% crypto allocated.”

Finoa is receiving a growing number of inquiries, signaling that adoption has started among family offices and investment advisors.

Investing passively vs putting assets to work

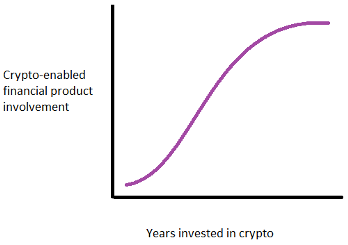

Crypto investors generally become more sophisticated over time and learn how to use their assets with the ecosystem.

We’ve explored the types of crypto investors and their reasons for investing, but we can also classify investors based on their level of involvement with the crypto assets they own:

- Passive holders: interested in the long-term price appreciation of their assets, perhaps first-time buyers.

- Yield seekers: put crypto-assets to work — earn interest via centralized lending platforms and rewards from staking.

- DeFi users: use assets to participate in decentralized finance (DeFi) via lending protocols, yield farming, blockchain governance, or interactions with other decentralized applications (Dapps).

There is a shift happening on the institutional side, where the focus is broadening from simple crypto investing strategies to more complex engagement with the crypto ecosystem.

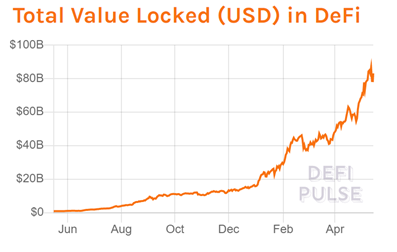

The value of digital assets locked in DeFi has exploded over the past 12 months (see graph below), but regulations still lag behind and prevent many institutions from entering in full force. Centralized lending (CeFi) companies have successfully opened up a lending market for crypto and work with many large institutions, but the world of DeFi still remains largely retail-dominated due to regulatory and technical complexity and risk.

The evolution of digital assets

Cryptocurrencies

The recent entrance of major corporations and institutions into the crypto ecosystem signified an advancement along the adoption curve. Crypto has clearly grown beyond the retail investors who pushed bitcoin to its 2017 heights — now accredited and institutional investors are learning how to invest in crypto. US banks have been given the regulatory go-ahead to offer custody of crypto assets, and core banking software is being upgraded to facilitate crypto investing by private and investment bankers. However, the low adoption from family offices and pension providers shows that we still have a long way to go before cryptocurrencies and other digital assets reach the level of acceptance associated with equities, bonds, or real estate. The largest of institutions will not be able to enter the crypto market in a meaningful way until there is more comprehensive regulatory and tax guidance, less volatility and more liquidity in the markets, and the ability to cheaply insure large portfolios of assets.

Central bank digital currencies (CBDCs)

A development that ran parallel to the cryptocurrency space in 2020 was the testing of China’s digital Yuan and the beginning of serious discussion around Central Bank Digital Currencies in Europe and the US. While it seems unlikely that countries will begin to move to a “Bitcoin standard” of money or use their sovereign wealth funds to enter crypto in the near future, Governments are now paying attention to cryptocurrencies and thinking about their role in the future of digital money.

Tokenization of existing financial assets

Perhaps the largest development yet to take shape in the digital asset landscape is “tokenization”, whereby existing financial assets are put onto the blockchain in the form of “security tokens”. Tokenization is set to create massive change in the way we account for and trade assets, both digital and physical, as ownership of digital assets can be more easily transferred, fractionalized into smaller shares, and traded with more liquidity. Tokenization of real estate assets, for example, would do away with listing agents, real estate attorneys, title companies, and notary signing agents, as smart contracts and blockchain ledgers would create immutable records of ownership and transactions. Research from the World Economic Forum (WEF), Deloitte, and McKinsey project that up to 10% of the global Gross Domestic Product (GDP) will be stored and transacted with the help of blockchain technology by 2025–27. A 2018 study from Finoa estimated a tokenized asset market of ~$24trn by 2027.

In 2020, Finoa custodied an asset-linked token representing a German DAX share, which was created by Bankhaus Scheich and Cashlink Technologies. We’ve already taken the first step in what we predict will soon be a massive trend towards tokenization.

Conclusion

Whether through a crypto ETP, a prime brokerage trading desk, or an agreement with a developer team, institutional investors of all kinds are entering the blossoming crypto-asset space. An asset class once seen as risky and confusing has become an area of opportunity, and institutions are keen to find their place in this growing industry.

At Finoa, we serve a wide variety of institutions that choose to get involved in crypto for a variety of reasons. Our goal is to create the gateway for traditional financial market participants to safely engage with digital assets, supporting the ecosystem and growing with our clients. We instill trust by keeping safety and security our highest priority while developing our product to meet the needs of an increasingly sophisticated client base. We see industry trends clearly reflected in our client base, and we’re more excited than ever to serve as the leading European custodian in the rapidly evolving world of cryptocurrencies and digital assets.