How traditional and crypto-native hedge funds invest in digital assets

Disclaimer: Finoa is a custody service provider platform and any data or information presented should not be considered investment advice, financial advice, trading advice, or any other sort of advice.

Introduction to traditional hedge funds and crypto hedge funds

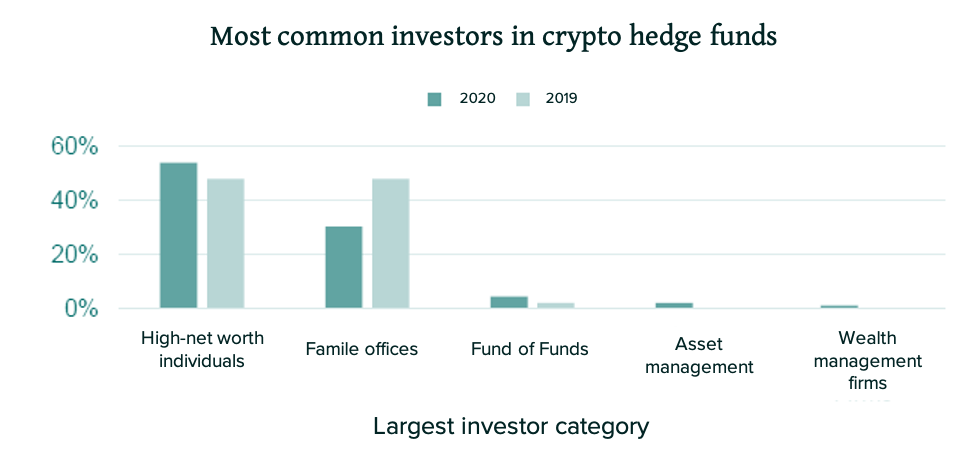

Whether it be traditional hedge funds making an entrance into digital assets or crypto-native funds at the forefront of the market, there’s no shortage of funds and crypto investing strategies. As described in our institutional adoption report, different institutions enter crypto for different reasons, and this is true for hedge funds as well. Funds employ diverse strategies to achieve their objectives: some invest in bitcoin and other assets for fundamental reasons while others trade opportunistically in the markets to earn market-neutral returns. Investors have found that digital assets present truly unique opportunities and challenges, and the inflow of capital is accelerating from both traditional hedge funds and crypto-native hedge funds.

Here at Finoa, we see a range of investors with a variety of strategies, and we’re happy to share our insights as to the leading European custodian for institutional investors. We work with some of the leading crypto funds and have extensive expertise in helping our clients leverage our solutions to execute their strategies in a compliant and secure way. We strive to continue meeting the needs of fund managers and investors by executing crypto investing strategies while staying compliant and keeping their funds secure. This report will outline some of the most recent developments shaping this space.

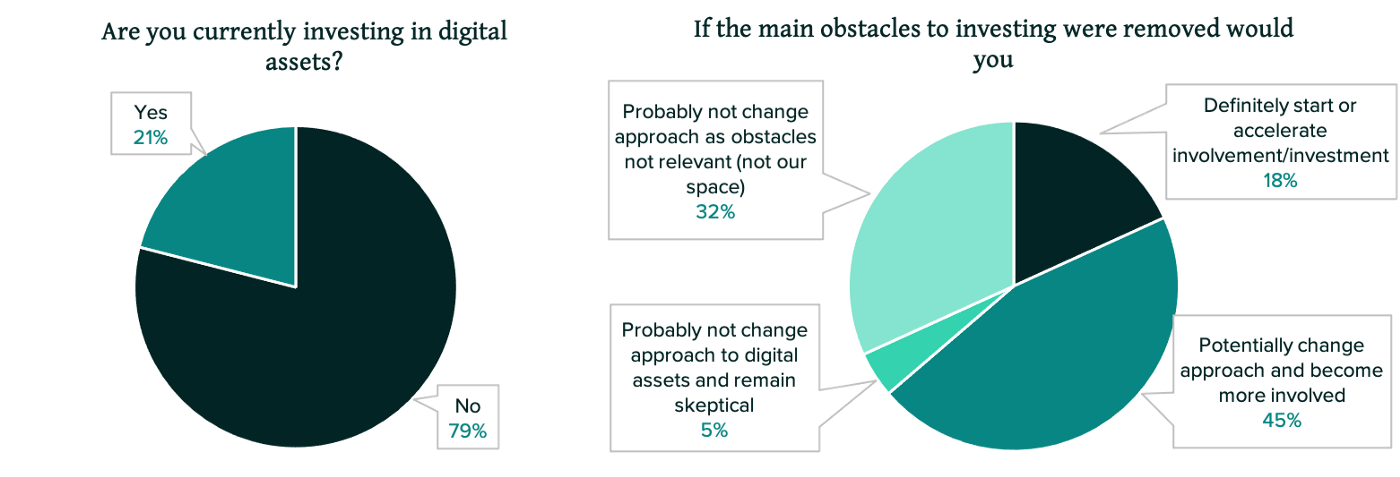

Traditional hedge funds are slow to enter the crypto space

For decades, traditional hedge funds have allocated capital using unique investing theses, experimented with new trading strategies, and ventured into diverse asset classes. The investable universe of assets has consisted of equity in companies or other funds, physical assets and commodities, various forms of securitized debt, currencies, and derivatives. You would expect the experimental and adventurous nature of hedge funds to make them prime candidates for investing in digital assets like cryptocurrencies, but a 2020 survey from PwC showed that only 21% of hedge funds had invested in digital assets.

Source: PwC, 2020 Crypto Hedge Fund Report

The non-invested funds cited multiple obstacles to investing, including regulatory uncertainty, client reaction and reputation risk, and the availability of service providers. Interestingly, only 35% of respondents stated that they did not believe that digital assets had value, raising questions about how the other 65% would invest if hurdles were removed.

Source: PwC, 2020 Crypto Hedge Fund Report

Fortunately, this was asked in the PwC report, with 18% of respondents saying they would “definitely” start investing if the main obstacles were removed, and 45% saying they would “probably” invest. It seems that although hedge funds have some interest in the value proposition of digital assets, they are overwhelmed by obstacles to investing and this has hampered their progress. Only those 21% with the strongest interest or facing the least obstacles have leaped.

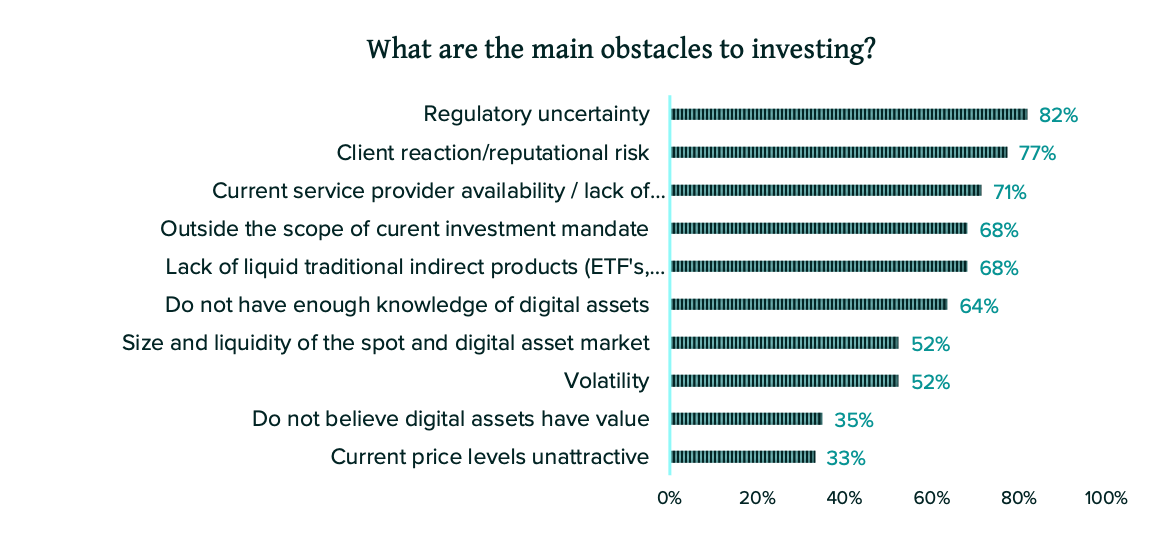

Of the 21% that had made the digital asset leap by the time of the 2020 PwC survey, 86% of them reported having invested less than 2% of their fund’s capital. This falls in line with the indicated purpose of the investment — general diversification over half of the funds, an inflation hedge for 14% of them, and a way to get exposure to a new value-creation ecosystem for 29% of those surveyed. This reflects the understanding that digital assets can serve different roles for different investors and are already doing so for a minority of hedge funds.

Source: PwC, 2020 Crypto Hedge Fund Report

As of 2020, the hedge fund industry had yet to enter the digital asset space with confidence, no doubt learning more about the space and waiting for further developments and regulation. Once digital assets reach a critical level of perceived safety and acceptance, we may see hedge funds begin to pile into the space. Until then, a new class of hedge funds has been born to fill the trailblazer role in the digital asset market: crypto-native hedge funds solely focused on the digital asset space.

Crypto Hedge Funds

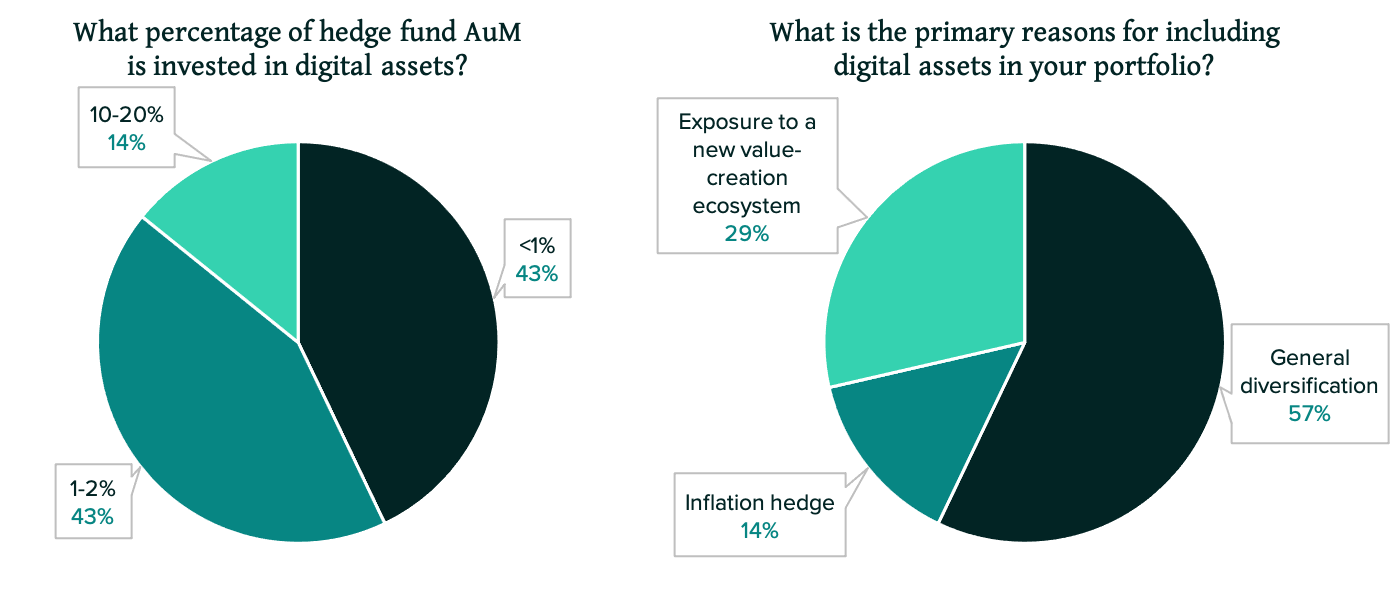

The crypto hedge fund industry is small but growing. PwC estimated in 2020 that crypto hedge funds globally had about $3.8 billion in assets under management, still small relative to the traditional hedge fund industry but nearly double the 2019 estimate.

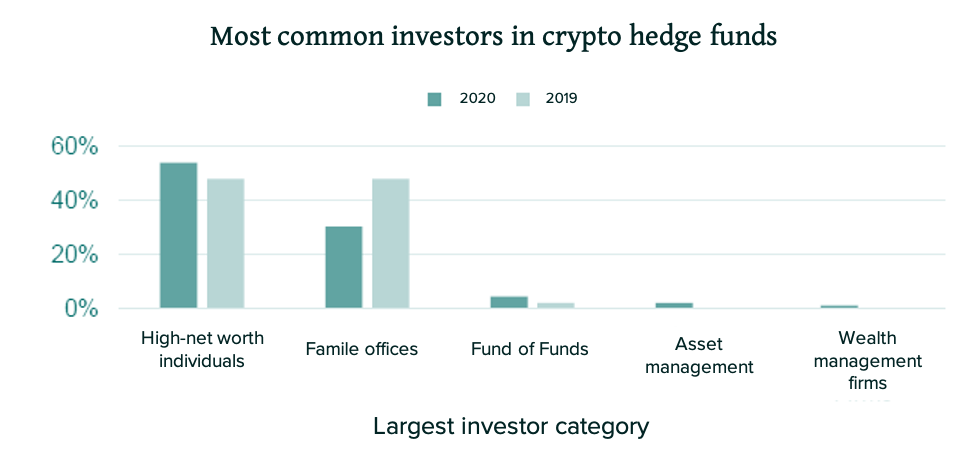

If we think of crypto hedge funds as trailblazing in the crypto universe, it makes sense that their investors would be risk-on and adventurous as well. The crypto hedge funds which were the focus of the 2020 PwC report had high-net-worth individuals and family offices as investors, with very little capital from funds of funds or wealth management firms. Just as retail investors preceded institutional investors in the broader crypto space, it seems that individual investors and their family offices are preceding more traditional firms when investing in crypto hedge funds.

Source: PwC, 2020 Crypto Hedge Fund Report

Crypto investing and trading strategies — directional vs market neutral

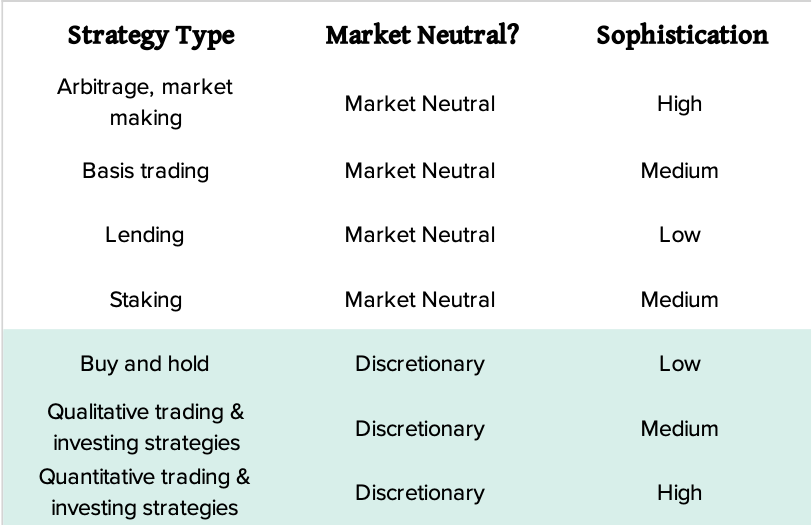

Traditionally, the definition of a hedged fund was a fund with not only long positions but also some short positions to hedge the portfolio against market downturns. Some modern hedge funds seek to build a portfolio where the total size of the short positions balances out the long positions, resulting in a portfolio that does not react to the direction of the overall market, and thus can be termed “market neutral.” Indeed, we can broadly classify funds according to whether their strategies are market neutral or directional.

Directional strategies

A fund not trying to build a market-neutral portfolio is free to take bets in the direction of one or more assets. This usually involves an investing thesis centered around the long-term growth of digital assets, which translates into a strategy of buying a basket of cryptocurrencies. Crypto hedge funds can limit themselves to the most liquid, well-established tokens, or seek to purchase tokens of projects in the early stages of development, as a venture capital firm might do. Whatever the strategy, it is at the discretion of the asset manager how and when to enter and exit positions, and whether to inform those decisions by a qualitative feel for the market, or by quantitative models and indicators.

Market neutral strategies

Market-neutral strategies are more sophisticated than directional bets, relying on quantitative analysis and involving two sides of a trade that, when taken together, cancel out the correlation to the broader market’s movement. These market-neutral strategies include arbitrage and market making, basis trading, lending via centralized or decentralized (DeFi) platforms, and earning returns from staking (if hedged against the underlying assets). Trading these strategies usually requires a degree of automation and speed, meaning that trades are executed algorithmically based on a set of conditions.

Different strategies — different risks, different returns

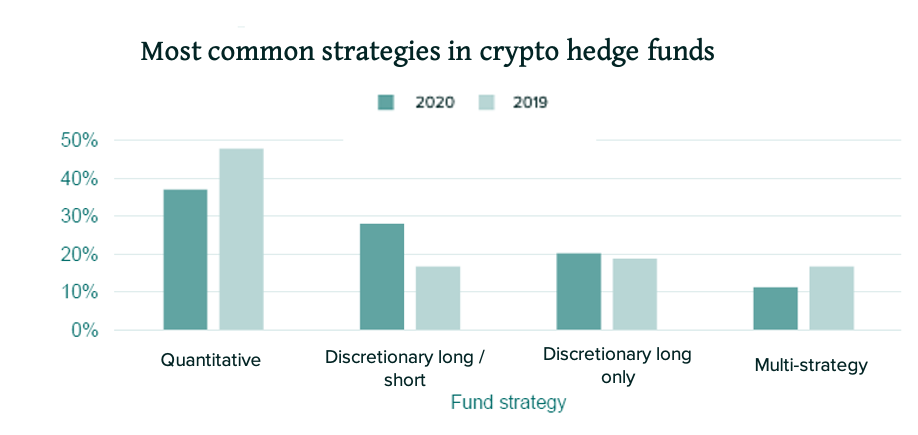

Ask a room full of fund managers how to invest in crypto, and they may each give you a different answer. There exist many strategies, each seeking to achieve an objective by taking a certain level of risk. What all good strategies have in common is a degree of control over how much risk is being taken, and an understanding of what kind of returns (or losses) can be expected. The 2020 PwC survey found that quantitative strategies were the most common among crypto hedge-funds, although their popularity declined since the previous year. In 2nd place were discretionary (directional) strategies going both long and short on digital assets. Long-only strategies were the third-most common, and a minority of funds engaged in some combination of multiple strategies.

Source: PwC, 2020 Crypto Hedge Fund Report

At Finoa we see investors approaching digital assets in different ways — we support some of the largest crypto funds as they execute their strategies, all while adhering to the highest standards of security and compliance. Let’s examine some of the most common market-neutral strategies in more detail, starting with the quantitative ones.

Arbitrage and market making

Because the crypto market started from scratch, the early days saw very limited and fragmented liquidity across unreliable and often untrustworthy exchanges. (While not necessarily a problem for retail traders, this presented a major obstacle for hedge fund investment and crypto investing from other large players.) Eventually, exchanges began to improve and a growing market brought larger trading volumes. During the frenzy of the 2017 bubble, large inter-exchange price discrepancies created ample opportunities for arbitrage, while erratic bid-ask spreads on exchange order books created opportunities for market making. This incentivized the creation of a new wave of sophisticated market-neutral trading firms such as Alameda Research, Volkvang, Wintermute, Amber Group, and others.

While the activities of these firms have greatly improved market efficiency and boosted liquidity, they have also removed the low-hanging fruit of arbitrage and market-making profits. Today, hedge funds are more likely to be customers of these firms than directly engage in arbitrage and market-making activities themselves.

Basis trading

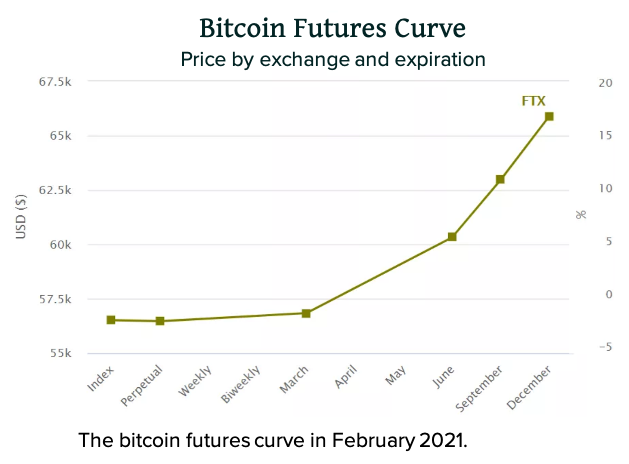

The basis trade also referred to as a ‘cash and carry trade’, is perhaps the largest remaining market-neutral crypto investing strategy. In the bullish regime of the past months and years, futures contracts for bitcoin have traded at a significant premium over the price of the spot market. In February 2021 for example, someone could buy one bitcoin in the spot market (for immediate settlement) for around $57,000 and sell one September-settling futures contract for $63,000, representing a premium of over 10%.

The Bitcoin futures curve in Feb 2021 showed a very steep contango curve. Source: Bitcoin Futures Info

The resulting position is market-neutral since any move in bitcoin’s price affects both the long spot position and the short futures position. Once the futures contract reaches expiry, it can be settled with the spot bitcoin (if physically settled) or the position can be closed at the current price of the spot market (if cash settled). So regardless of the price bitcoin ends up trading at, the trader earns a profit equal to the premium that originally existed.

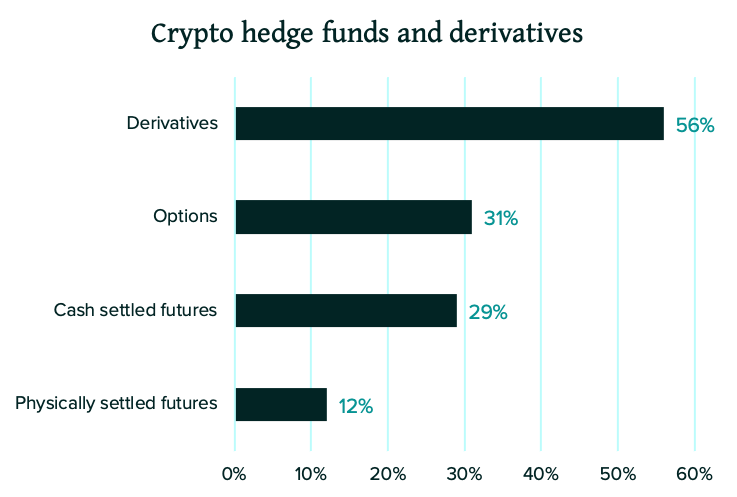

Only 29% of crypto hedge funds use cash-settled futures and would thus be able to conduct the basis trade. Source: PwC, 2020 Crypto Hedge Fund Report

This type of guaranteed market-neutral return is one that many funds would be happy to lock in. Indeed many funds have done so, as noted by Genesis in their 2021Q1 report, “the persistence in basis premium has led many more institutions to eye crypto yield opportunities.” Most crypto funds are not able to participate in this trade, however, either because they are not permitted to or not comfortable with holding derivatives and keeping margins on exchanges. Luckily, the demand for cash piling into this trade has spilled over into the crypto interest rate market.

Lending

Interest rates on Celsius as of June 9th, 2021 (not all tokens shown)

For investors and traders wondering how to invest in crypto in a market-neutral fashion, but unwilling or unable to participate in the futures market, an opportunity with slightly lower yields is presented by the lending market. The PwC report found that around a third of crypto hedge funds were involved in lending, and almost a quarter were borrowers, no doubt to improve the efficiency of arbitrage or market-making operations or to boost capital allocation to the cash and carry trade.

Crypto investors can use centralized or decentralized lending platforms to lend out crypto assets or stablecoins, usually collecting an interest rate of between 2–10% per annum. This rate changes depending on the asset, the current state of the interest rate market, and the platform that is being used.

A key differentiator here is whether lending is being carried out by a centralized platform or a decentralized protocol. A centralized lending platform like BlockFi or Celsius Network will vet each institutional borrower and manage their loan book, while a decentralized protocol consists of a smart contract that is configured to automatically handle lending, borrowing, and liquidations. Note that all lending platforms currently engage in collateralized borrowing only, whereby the borrower must put up more collateral than is being taken out in the loan. This means there is no credit risk, and as long as the borrower’s collateral is liquidated in the event of his collateral ratio dropping significantly, there should be no risk to the lender.

Centralized lending platforms easily enable hedge fund investment, but their use still requires turning over custody of digital assets to the lending platform, which must also be trusted to liquidate clients in a timely and orderly fashion should the market change drastically. For investors who do not want to relinquish custody of their assets, staking remains an option.

Staking

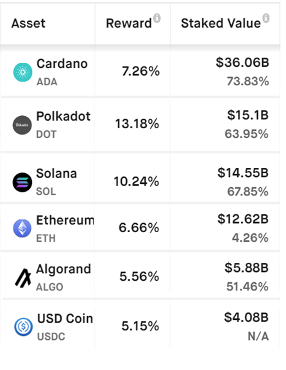

Staking rewards as of June 9th, 2021 on Staking Rewards

The PwC report found that over 40% of crypto hedge funds are involved in staking. Staking is a possibility unique to crypto, by which an asset is used to verify transactions on its underlying blockchain, earning rewards in the process.

As described in a previous Finoa blog article, staking is an attractive way to support blockchain infrastructure, earning a return from assets while keeping them in secure custody. The remaining risk is that of ‘slashing’ due to a mismanagement of the staking infrastructure, which is why Finoa has partnered with leading institutional-grade staking providers such as Chorus One, Figment, and Blockdaemon.

This not only provides clients access to the highest quality infrastructure but also improves decentralization by avoiding the possibility of a large portion of blockchain tokens being staked with the same validator. Because Finoa works on-demand to integrate with emerging blockchains that clients care for and invest in, we have a tailored solution and work closely with VC funds and crypto hedge funds to ensure their staking needs are covered.

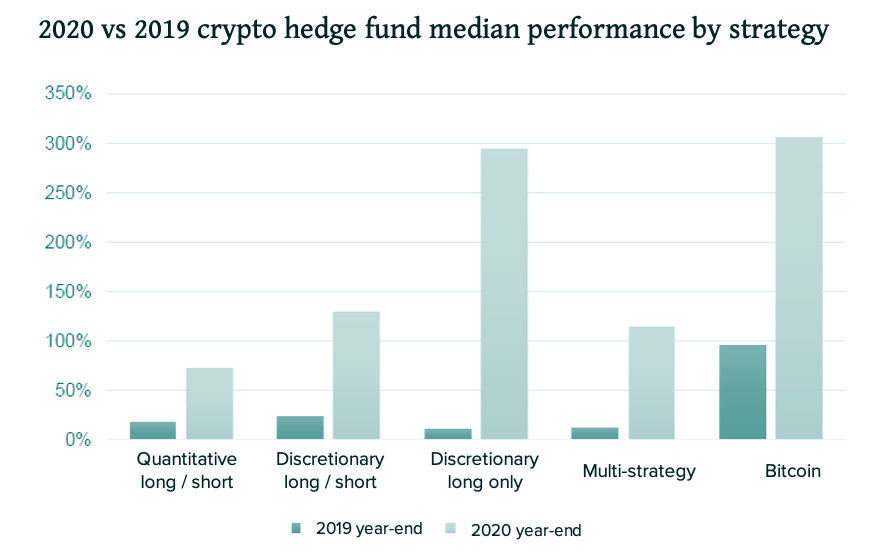

Discretionary trading and investing

In years where the crypto market grows substantially, it is not the market-neutral strategies that have yielded the highest returns, but instead the discretionary long-only strategies, as shown in the chart. Unlike the previously described strategies, discretionary investing in crypto requires industry knowledge and insight, and ample conviction, as profits are not a guarantee. The dominating source of returns in these strategies is the growth of the market itself, and those who profit the most tend to be those that got in early with strong convictions.

In years where the market grows substantially, the crypto investing strategies with the highest returns have been holding bitcoin and discretionary long-only. Source: PwC, 2020 Crypto Hedge Fund Report

Ironically, the median performance of the discretionary long-only funds that PwC surveyed was still lETPsower than the return that could be had from simply buying and holding bitcoin. Indeed, it seems the simplest and often most profitable investment to be made in the digital asset space is a simple “buy and hold” bitcoin investment.

While perhaps too simple for a hedge fund investment, this has been the strategy followed by major corporate investors like Square, MicroStrategy, and Tesla, as well as hedge fund managers like Stanley Druckenmiller and Bill Miller. The digital asset market cap surpassing $1T in January 2021, the entrance of institutional investors, and the continued support of regulators worldwide have signaled a global acceptance of digital assets as a store of value and a source of innovation and wealth creation.

Bitcoin’s value proposition as a store of value was hammered home in the economic aftermath of the 2020 coronavirus lockdowns, with investors regarding it as ‘digital gold.’ At just one-tenth of gold’s market capitalization, though, bitcoin and crypto still have a long way to go before filling the purpose they are so often talked about.

Bitcoin’s positive performance and non-correlation with other asset classes meant that even a small allocation to Bitcoin would have significantly increased the Sharpe ratio of a traditional portfolio. Analysis from the ETP provider Iconic Holdings found that:

“In the example of the traditional 80/20 stock bond portfolio, it can be observed that the Sharpe ratio increases from 6.66 with no cryptocurrencies included to approx. 8.17 with 1% crypto, 9.53 with 3% crypto, and 9.79 with 5% crypto allocated.”

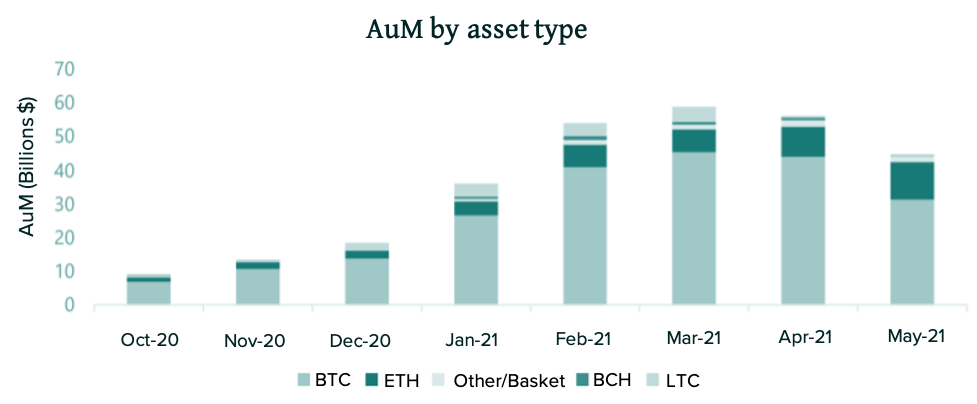

The purpose of a crypto investment does not have to be limited to that of digital gold, though. Institutional investors are catching onto the fact that most of the innovation in the crypto space is centered around DeFi and built on Ethereum’s blockchain. The AuM of crypto ETPs indicates the beginning of a trend toward greater ETH exposure for institutional investors.

The AuM of exchange-traded products has grown significantly and is predominantly made up of bitcoin, although Ethereum is gaining market share. Source: CryptoCompare

ETPs are still very limited in the tokens that are offered — investors looking to reach the bleeding edge of innovation will have to turn to a digital asset custodian with broad asset coverage like Finoa. Finoa’s support for over 200 digital asset tokens has made it popular with some of the largest VC funds and crypto funds, as investments in emerging blockchain protocols can be made, without compromising on the security or accessibility of assets.

Opportunity sensed by some but not all

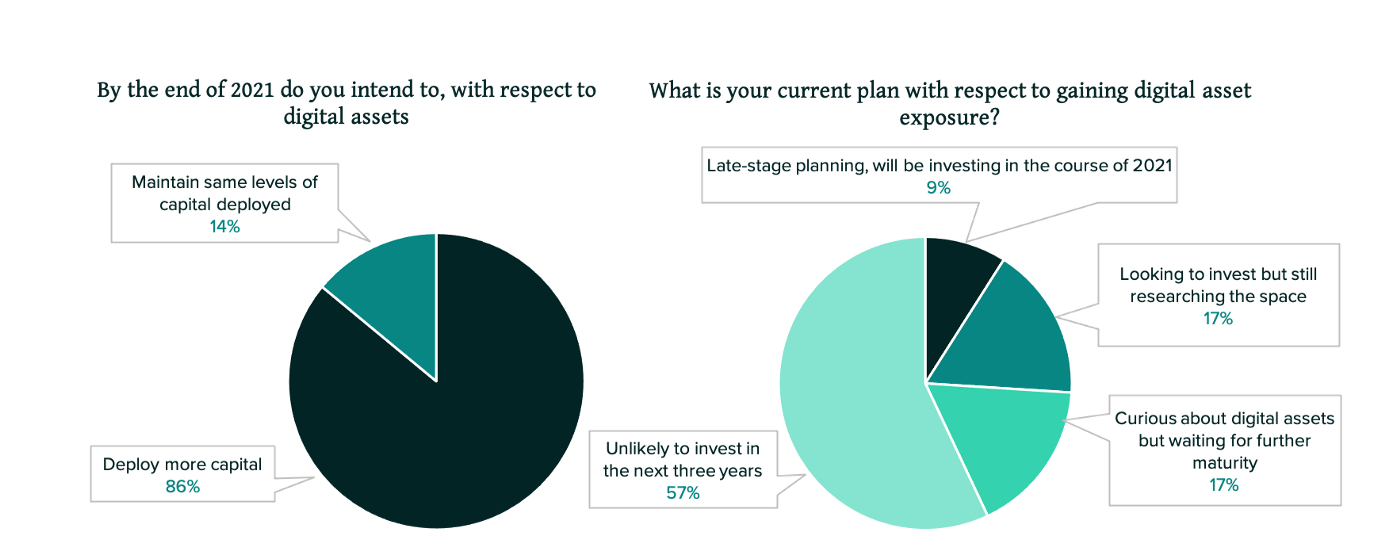

There currently exists a rift between the traditional hedge fund industry and crypto hedge funds. While crypto hedge funds thrive and diversify, most traditional hedge funds are still determining why and how to invest in crypto. Interestingly, hedge funds that made the leap and invested in digital assets seem to have ‘caught the bug’, with 86% of those surveyed intending to deploy more capital in 2021. For the traditional hedge funds still uninvested though, there does not seem to be any hurry, with only 9% stating an intention to enter the digital asset space in 2021, and over 57% saying they were unlikely to invest in the next three years. It seems the rift will continue.

Source: PwC, 2020 Crypto Hedge Fund Report

Professional service offerings significantly reduce risks unique to crypto

There now exist several institutional-grade crypto custodians, trading desks, and prime brokerage offerings giving large investors secure multi-governance custody solutions and multi-venue smart order routing. Some of these service providers grew out of market-making icons and arbitrage firms, while others built themselves up to serve the increasing number of institutional investors in the space. In Europe, Finoa has emerged as the leading platform for institutional access to crypto, providing a custody solution with multi-governance capabilities, staking with institutional-grade infrastructure providers, and access to markets via a German-regulated OTC trading partner. Our clients enjoy the safety and security of a regulated custody offering while having access to industry-leading asset coverage. We’ve been able to significantly reduce the technical barrier to entry and simplify the digital asset management experience, empowering many VC funds, crypto funds, high-net-worth individuals, and corporates to enter the digital assets ecosystem for the first time.

Remaining challenges — regulation

As we saw in a previous section, regulatory uncertainty was a leading obstacle to investing in digital assets, with 82% of traditional hedge funds citing it as a barrier. This section could easily be another report entirely, but since a 2019 report stated that more than half of all crypto funds were domiciled in the US, we’ll briefly cover the regulations surrounding crypto hedge funds in the US and Finoa’s home country of Germany.

Crypto hedge funds in the United States

The level of complexity of setting up a crypto hedge fund in the United States depends on whether the fund simply seeks to purchase digital assets or go further and trade derivatives or become involved in initial coin offerings (ICOs).

Part of the confusion for US asset managers is the fact that cryptocurrencies are designated differently by different regulatory bodies: cryptocurrencies are designated as property by the IRS, commodities by the CFTC, and currencies by FinCEN. The SEC has yet to nail down definitive advice on whether cryptocurrencies are securities, for now only regarding ICO tokens as securities. Unless the SEC designates all cryptocurrencies as securities, hedge funds won’t need to register as an RIA with the SEC, but many do so as a preemptive precaution. In any case, the fund itself is a security and must satisfy an exemption from the Securities Act of 1933.

Regardless of the fund’s activities, it will have to follow the fraud provisions of the CFTC and the SEC. Crypto and non-crypto funds have to be structured under one of two exemptions from registration under the Investment Company Act, either by limiting their fund to less than 100 investors and structuring with Section 3(c)(1) or by only accepting investors with very high net worth requirement and structuring under section Section 3(c)(7). If using derivatives or leverage, a hedge fund will need to register as a CTA and CPO with the CFTC and register with the NFA.

Crypto regulation in Germany

Germany’s regulatory regime is more uniform than that in the US, which already regulates digital assets under the banking act. since March of 2020, Germany’s Federal Financial Supervisory Authority (BaFin) and several other entities have officially classified digital assets as financial instruments, making Germany the first EU member state to do so and laying down a broad definition for further regulation. Further regulatory developments arrived in the summer of 2021, which enabled “special funds” to allocate 20% of their balance to digital assets, greatly contributing to the wider legitimization of crypto as an asset class.

It seems Germany is not unnerved by the emergence of crypto assets — the German Federal Ministry of Finance published in their First National Risk Assessment that the crypto-related money laundering threat for Germany is medium-low, citing that is it often easier to launder funds with cash, and that Germany has the wherewithal to secure incriminated crypto assets.

The future of regulation lies in unified EU-wide policies, though: a new piece of regulation called Markets in Crypto-assets (MiCA) should come into play by 2024, ending EU member states’ national crypto policies and allowing EU crypto-asset service providers to operate across all EU markets, albeit under stricter rules.

Crypto hedge funds can be launched in Germany as limited partnerships and can seek custody services from companies with BaFin-regulated crypto custody licenses like Finoa. Finoa has extensive experience consulting and working with some of the largest established crypto funds as well as emerging funds looking to set up operations in a compliant and efficient manner.

Conclusion

With traditional hedge funds still mostly on the sidelines, crypto funds have filled the gap and provided an avenue for actively managed capital to flow into the digital asset ecosystem. Many hedge funds use market-neutral strategies to earn low-risk returns, but in times of market growth, it is the long-only discretionary strategies that yield the highest returns for investors. Indeed, crypto funds are hard-pressed to outperform a simple ‘buy and hold bitcoin’ strategy, and institutional investment still centers around bitcoin.

Regardless of the strategy or asset type, crypto’s unique barriers to entry make finding the right partner increasingly important. Finoa’s offering is shaped by our experience partnering with and supporting a diversity of funds, allowing them to effectively execute their strategies while meeting strict requirements set by fund managers and investors. We offer industry-leading token support, staking with institutional-grade validators, and enable trading through a German-regulated OTC trading partner. Please don’t hesitate to get in touch if you’d like to discuss how we can support your digital asset investing strategy.