Crypto ETP investors waive a yearly $64.9M in staking rewards

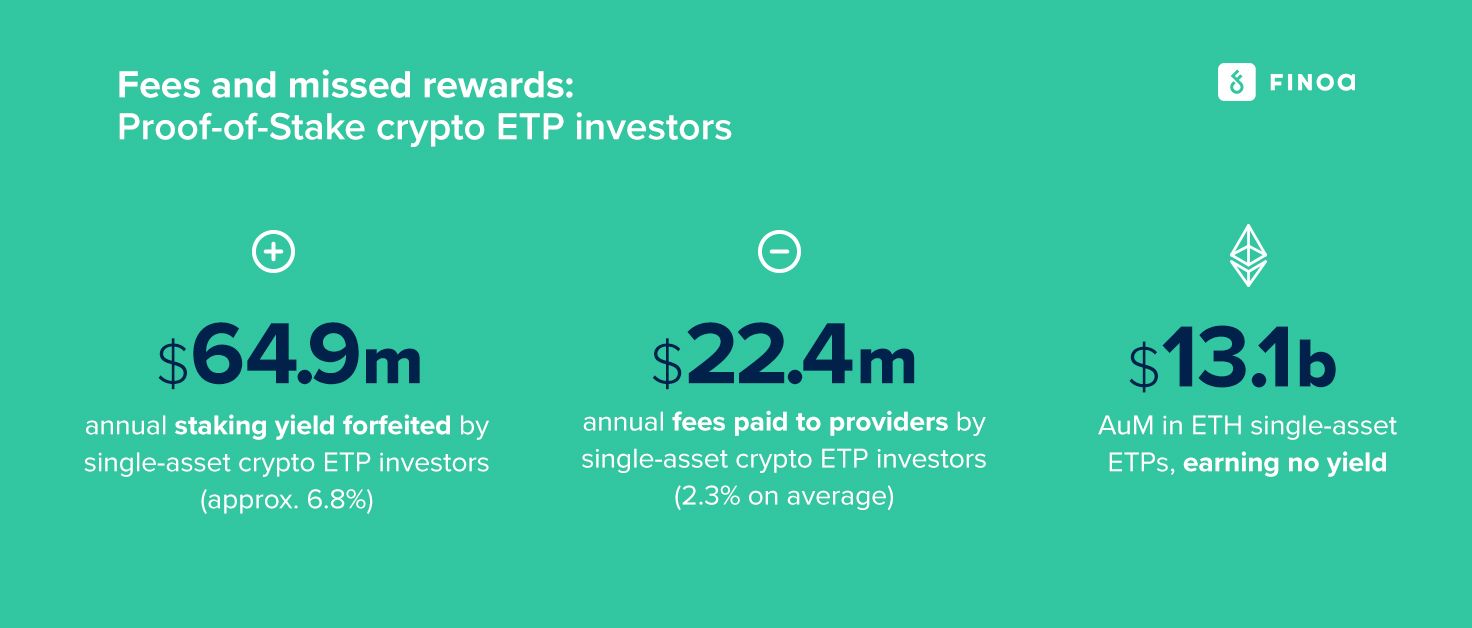

A recent Finoa study found that investors in single-asset crypto ETP (exchange-traded products) forfeit a yearly $64.9m worth of potential staking returns every year, corresponding to almost 6.8% of the total value of single-asset Proof-of-Stake token crypto ETP.

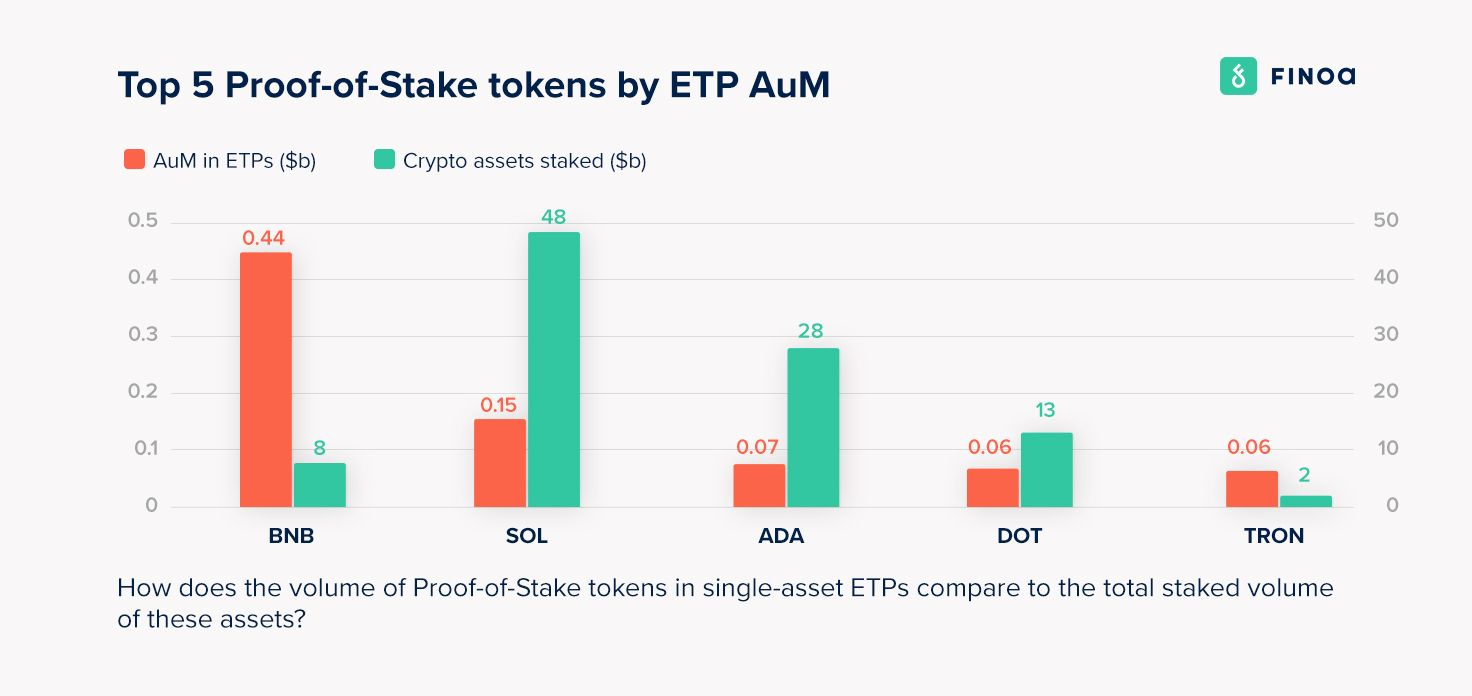

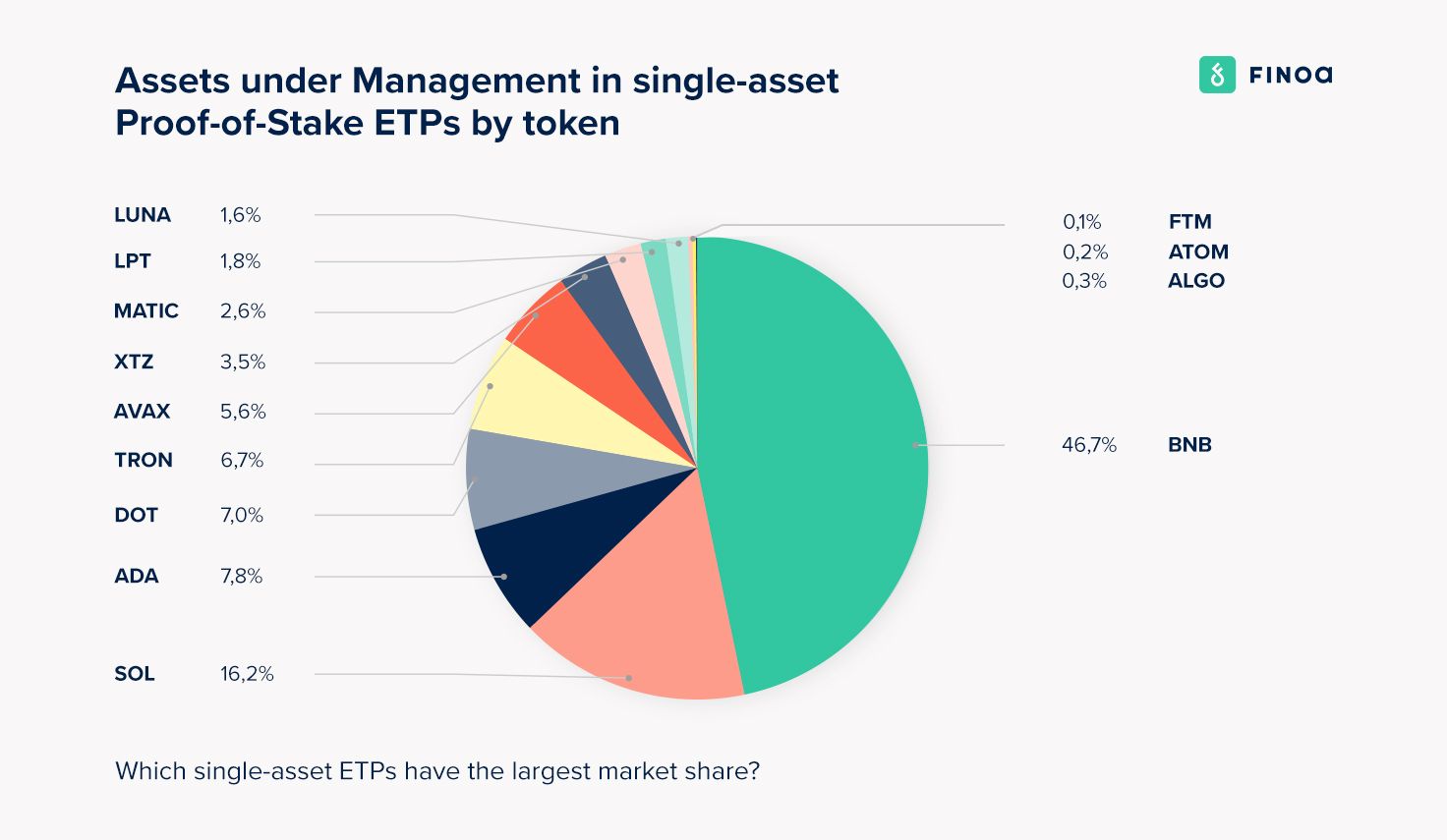

The Proof-of-Stake cryptocurrencies with the highest volume by assets under custody for the analyzed ETPs are Binance Coin (BNB) - 46.7%, Solana (SOL) - 16.2%, and Cardano (ADA) - 7.8%.

Only 20% of crypto ETPs offer staking rewards, with the vast majority of funds not enabling investors to earn on their Proof-of-Stake assets.

Proof-of-Stake coins offer a returns opportunity unique to decentralized financial markets

Over the years, digital asset investment opportunities have become more diverse, offering up entry points for all levels of expertise. Approaches range from the simple holding of an asset (via direct custody or ETPs) to generating returns from crypto-native strategies, such as staking, lending, or participating in decentralized finance.

The nature of crypto-assets brings novel yield strategies that ETP investors cannot benefit from. Specifically, direct owners of Proof-of-Stake currencies can earn rewards expressed as annual percentage yields (APYs) by delegating their stakes to blockchain validators, who use these stakes to run and maintain the network. Indirect owners of cryptocurrencies, on the other hand, are missing out on this opportunity when investing in crypto through ETPs.

In a study conducted by Finoa, it was found that investors in single-asset ETPs of Proof-of-Stake tokens are missing out on a potential $64.9M of staking rewards per year, or about 6.8% of the total AuM of these ETPs. The calculation takes into account a typical validator commission fee of 10% of rewards.

In addition, investors are paying $22.4m in fees per year to the providers of these ETPs, which corresponds to an average yearly fee of 2.3%.

When considering which Proof-of-Stake assets to acquire and stake, holders should consider the differences between the nominal and the real yields of these assets. The nominal yield represents the volume of rewards that a holder can get by staking these assets, calculated based on the number of tokens held. Unlike the “real yield”, the nominal yield doesn’t take into account the token dilution rate, sometimes also mislabeled as the “token inflation” rate, which represents the rate at which new tokens are issued to pay validators for their work.

Methodology

The data was mostly collected from publicly available sources, with the values for the staking rewards coming from stakingrewards.com, and the numbers on fund AuMs sourced from ByteTree, as well as from the individual websites of the respective trusts. These values are correct as of April 2022.

The staking rewards rates have been additionally adjusted to account for an average validator fee of 10%.

For the purpose of this study, we considered 5 major cryptocurrency funds: Grayscale, 21Shares, VanEck, Coinshares, and ETC group. Only single-asset ETPs from these funds were considered for the purpose of this study.

Ethereum ETPs and liquid staking

Another opportunity for earning staking rewards lies in Ether (ETH) investments. At the moment, ETH still operates as a Proof-of-Work asset, but it is projected that the ETH migration to a Proof-of-Stake asset will be completed sometime in 2022.

Currently, ETH holders that own less than the minimum staking amount (32 ETH) can participate in what is known as liquid staking by joining staking pools through platforms such as Lido. Liquid staking allows holders to earn rewards on staked assets without “locking” them - in other words, without losing access to their funds. This is done through the issuance of a tokenized version of the staked funds, which is a derivative that can be stored, transferred, spent, or traded like the original asset.

In this context, it’s interesting to think about the fact that there are $13.1b of AuM in ETH single-asset ETPs, earning no yield. At the current ETH staking APY of 4.81% (4.33% after a 10% fee), the ETH in these ETPs could be earning $567.4m in ETH rewards.

Although it is probably infeasible for ETP providers to make use of liquid staking solutions to stake ETH pre-merge, it’s likely that after the merge, a lot of ETH ETP investors will realize that they are missing out on easy returns.

Crypto investment products flourish amid market expansion

While still in its infancy, the crypto market is projected to continue growing beyond 2022. Institutional adoption is also trending upwards, with a recent Fidelity survey showing that nearly 8 in 10 investors agree that digital assets have a place in a portfolio.

A marker of this growth is the emergence of a variety of crypto ETPs, with a recent analysis by Bloomberg Intelligence estimating that crypto ETPs could surpass $120 billion in assets under management (AuM) by 2028.

For first-time investors looking to earn a long-term return through the passive holding of an asset, crypto ETPs can be a convenient option. However, as a non-crypto-native investment product, ETPs are not able to offer the same returns to holders compared to providers who allow the staking of assets under custody.

That being said, there are positive developments in the ETP space on the provider side, with issuers already exploring yield-generating products linked to PoS currencies. We’re at a point where crypto custody and staking infrastructure providers are sufficiently mature for such products to be offered at acceptable risk levels. We're excited about the future to come, and to see more investors participate in blockchains, whether through self-custody, with custodians, or via structured products such as ETPs.