Non-fungible tokens: boom or bust? A glance at opportunities for institutional investors

The concept of non-fungible tokens has existed since 2012 (known as colored coins at that time), but it was not until March 2021 that a work of art called Everydays: The First 5000 days made the public ecstatic. The buyer of the artwork paid the astonishing US $69 million for a digital collage created by Beeple — an artist who until October 2020 had never sold a print for more than the US $100. Many people were puzzled by how a digital picture could be worth millions even though anyone could take a screenshot of it.

And yet there is an appealing rationale for the future of NFTs. Industries that struggled to monetize their work are now realizing the potential of the technology. For example, integrated royalty mechanisms allow creators (such as artists or musicians) to receive a percentage of revenue every time the NFT changes hands on secondary markets. Additionally, the financialization of NFTs is gaining high traction these days, attracting institutional investors as well.

We at Finoa have consolidated our market insights in an attempt to shed light on the subjects relevant to institutional investors, in particular:

- What does it mean for a token to be non-fungible?

- How did NFTs develop?

- If there is value in NFTs, how does it materialize?

- How will decentralized finance (DeFi) protocols benefit NFTs?

- How do we expect NFTs to develop in the future?

As the first step, we need to understand that non-fungibility is an aspect familiar to us since our childhood days of cherishing prized objects like the latest Barbie doll or Superman action figure. The ownership of those unique items stored as tokens on a digital, decentralized, public ledger called blockchain is what we are not familiar with.

What does it mean for a token to be non-fungible?

Non-fungibility becomes very clear if we contrast it with fungibility. Fungibility refers to the ability of a good or asset to be readily interchanged for another of like kind. Imagine your best friend lends you a one-dollar bill. Would he expect you to give him back that exact dollar bill? Probably not as all US dollars are identical. Therefore, currencies are fungible.

But how would we value the iconic 1939 Volkswagen Type 1, more commonly known as the Bug or Beetle? (For those unfamiliar with classic car collecting — this iconic car designed by Ferdinand Porsche was affordable and became the zeitgeist of the 1960s, symbolizing the small is beautiful ethos.) In contrast to an exchange of dollar bills, it would be an uneconomic decision to exchange your 1939 Beetle for another more modern Beetle because they are both Beetles. The value of your car depends on variables such as condition, uniqueness, and popularity.

How is it related to NFTs? NFTs are revolutionary because they establish proof of ownership for digital assets. Like a one-of-a-kind Beetle, each NFT is unique and not interchangeable. A record of transactions on the blockchain confirms the time of the creation of the original NFT, including every time it changed ownership.

If you are new to the digital asset space, you might wonder which use cases emerge from NFTs. Currently, the great majority of NFTs held for sale are digital artworks, rare videos and sports highlights, assets in games, collectibles, and virtual properties. However, the tokenization of tangible assets such as cars, real estate, and wills is highly anticipated in the future.

Attaching digital content to the blockchain as a non-fungible token is neither complex nor technical. Anyone can mint an NFT. All you need to do is upload the high-quality representation of your digital item on the NFT marketplace of your choice — OpenSea being the largest, with 98.6% market share as of January 2022 — without writing a line of code. The NFT creation process allows you to choose how many copies of a specific version you want to mint, making some tokens more exclusive than others.

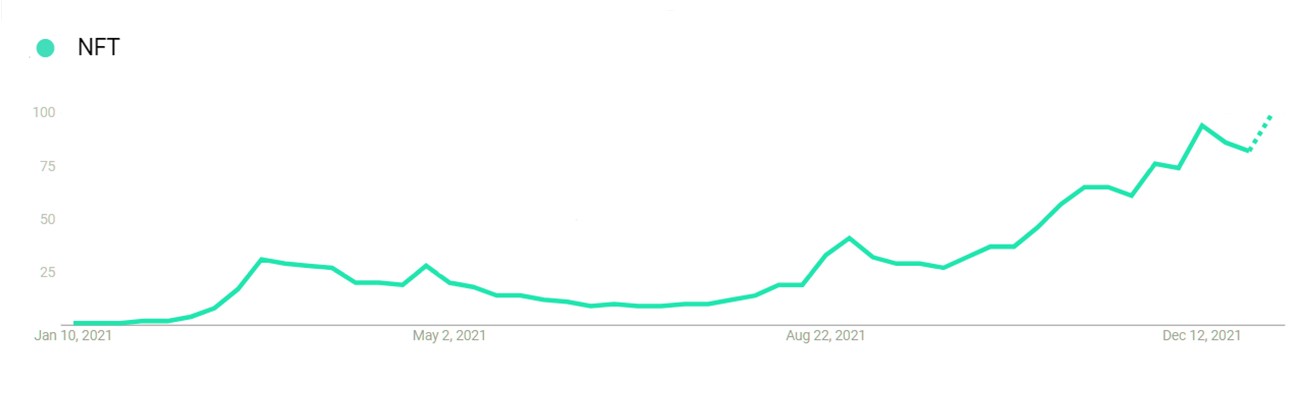

As you might have noticed, global interest in NFTs has heavily increased in the past year. Worldwide Google search volume for the keyword NFT is currently making new highs, surpassing search volume for the word crypto for the first time.

The worldwide popularity of the search query “NFT” as of 10/01/2022. (Source: Google Trends)

However, it is primarily in the marketing channels of Discord and Twitter that lively exchanges and information distribution take place. A step back in time is required to retrace the birth of NFTs.

How did NFTs develop?

If we look at NFTs from a high-level perspective, it makes sense to divide the history into three stages.

Stage 1: Bitcoin-based NFTs

Timeframe: ~ 2012–2016

When tracing NFTs back to the original idea, we must acknowledge the Colored Coins whitepaper by Yoni Assia (co-founder of eToro) and Vitalik Buterin (creator of Ethereum). In 2012, this whitepaper introduced Colored Coins as the earliest NFT predecessor. These were small denominations of Bitcoin “colored” with specific attributes coded into metadata using Bitcoin’s scripting language. Although colored coins created a solid basis for NFTs, Bitcoin’s scripting capabilities were limited. Since colored coins only represented small denominations of Bitcoin, the commissions for processing transactions were low compared to other more profitable cryptocurrencies, discouraging miners from participating.

Such factors left the door open for a programmable blockchain — namely Ethereum — to create a better implementation. In June 2018, the ERC-721 token standard was accepted, creating a revolutionary opportunity for anyone to create and transfer NFT tokens on the Ethereum blockchain.

Stage 2: Ethereum-based NFTs

Timeframe: ~ 2017 — today

In October 2017, the first example of NFTs called CryptoKitties — a collection of artistic images representing virtual cats — appeared on the Ethereum network, using the still experimental ERC-721 standard. The virtual cats carried different rare visual attributes and were breedable, allowing users to create new cats with unique features. The crazy amount(s) of money spent in the game presumably appeared outlandish to the general public but did not bring the trend to a halt. One market participant even paid 600 ETH (US$ 170,000 at the time) for the most expensive CryptoKitty ever.

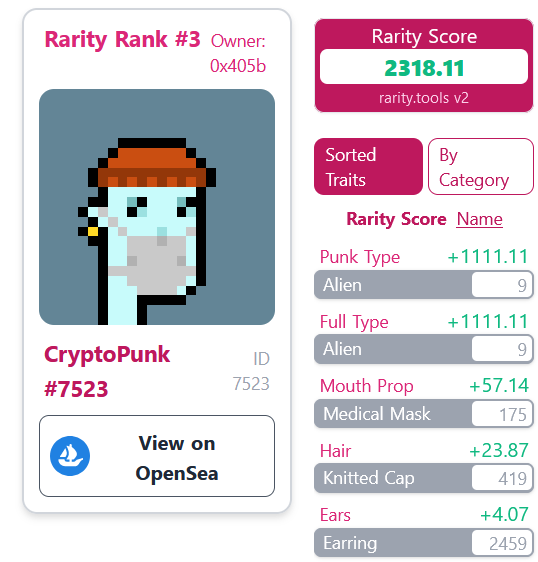

Another NFT heavyweight with its origins in 2017: CryptoPunks, a collection of 10,000 algorithmically-generated characters with unique features, could be claimed for free at launch by any user with an Ethereum wallet. Fast forward to today, and the value of CryptoPunks has skyrocketed. The most expensive Punk ever, the only alien CryptoPunk with a medical face mask, was sold for a nail-biting US$ 11.75 million.

The Ethereum ERC-721 token standard was not only an enabler of NFT adoption but also brought the Ethereum blockchain to its limits with roaring transaction fees.

Stage 3: “Alternative blockchain” based NFTs

Timeframe: 2020 — today

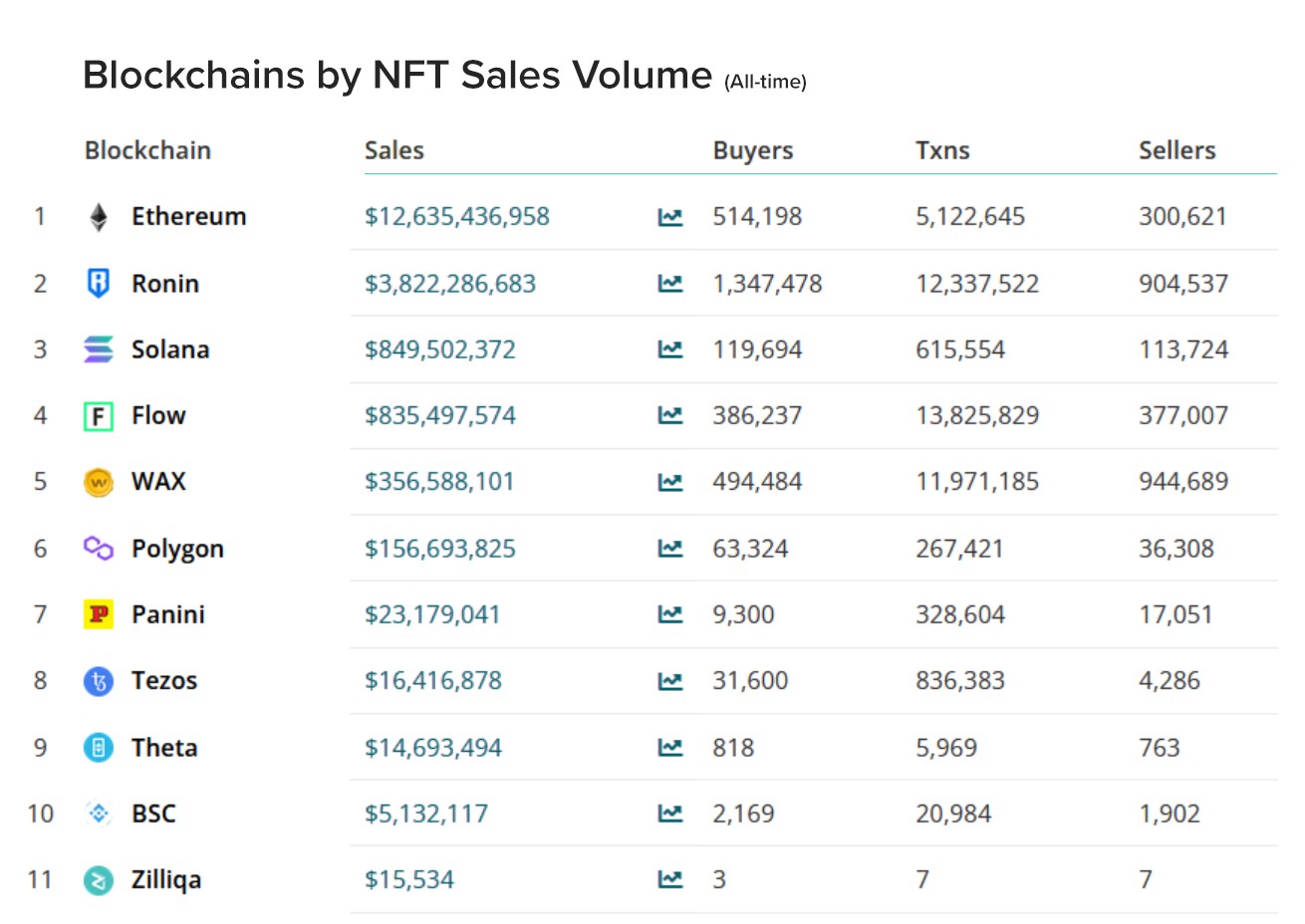

Currently, other Layer 1 protocols, as shown in the table below, are developing capacities to solve the perceived shortcomings of Ethereum. These newer blockchains include Solana, Ronin, and Flow, to name a few.

Blockchains by all-time NFT Sales Volume on 04/01/2022. Protocols created specifically for NFT transactions (e.g. Ronin, Flow, and WAX) are gaining ground on Ethereum. Simultaneously, other “multiple use-case” blockchains (such as Solana) are increasingly used for NFT transactions. (Source: CryptoSlam.io)

For example, the iconic CryptoKitties announced its transition from Ethereum to the Flow blockchain which could get the ball rolling for other projects. While Ethereum can handle 13–15 transactions per second, Flow protocol achieves a throughput of 1,000 transactions per second intending to reach 10,000 TPS capability. Flow achieves this by using a Proof of Stake consensus mechanism designed for extensive scaling without complex sharding techniques.

Aside from Flow, many blockchains are promoting scalable, low-fee infrastructure designed explicitly for NFTs. As shown in the table above, with over $12.6b in sales volume, Ethereum remains the most widely used blockchain for NFTs. The success of Axie Infinity has pushed Ronin to the number two spot, with Solana and Flow taking third and fourth place.

Where do NFTs derive their value, since they are just a record on a blockchain?

Here is proposed a framework of 5 variables that influence the value of an NFT.

Value of NFT = Rarity + Utility + Ownership History + Liquidity + Community

CryptoPunk #7523 aka the third rarest punk according to Rarity.tools (Source: Rarity. tools)

1. Rarity

Purchasing a rare NFT maximizes the likelihood of having a high-value NFT in your wallet. The importance of uniqueness becomes apparent when we look at collectibles, which have a limited quantity or varying scarcity of their attributes. For a given NFT in a collection, each trait can be assigned a rarity score based on the percentage of NFTs with that trait. The more unique these characteristics, the higher the expected value. For example, CryptoPunks with a low circulation of traits is valued way higher than those with a mixture of common traits. For this reason, it should not be surprising that CryptoPunk #7523 — the third-rarest punk in the space — was traded for US$ 11.75 million.

Redeemable Bitcoin pillow in exchange for an NFT (Source: Rarible)

2. Utility

Is the NFT attached to a game, metaverse, or does owning it give a unique benefit? The present and expected future utility of an NFT is crucial when understanding a value composition.

Redeemability understood as the unique opportunity for an NFT holder to trade the NFT for physical goods unavailable to the public, adds utility to NFTs. For example, Redeemablenfts.com is a marketplace for crypto merchandise, such as “Hodl” pillows.

Another way to create utility value is to offer interoperability for users. Future innovations may lead to a world (or so-called metaverse) where users can transfer all of their non-fungible belongings from one game to another.

Moreover, holding a scarce NFT can grant you a lifetime membership to closed communities, the best example being the “Bored Ape Yacht Club” — a troop of 10,000 cartoonish primates. Beyond showing off a prestigious ape as an avatar on Twitter, the club enables exclusive NFT ownership rights before anyone else. For instance, each proud owner of a bored ape could mint a free Mutant Ape NFT, which currently trades for several hundred Ether on Opensea.

Finally, an interesting yield-bearing utility can be generated when NFT meets Decentralized Finance (DeFi). Especially from an institutional investor perspective, the DeFi use case is worth a closer look which follows later in this piece.

3. Ownership history

Value is heavily affected by the creator or previous owners of the NFT, which can be globally recognized artists, celebrities, or brands. Any object tied to a prominent figure or brand on the market affects the value perception of their work.

In the documentary Trader, the legendary hedge fund manager Paul Tudor Jones puts on his lucky sneakers, claiming that he bought them at a charity auction because they used to be Bruce Willis’ and the man’s a stud. It underscores how ownership history can heavily influence an item’s appreciation potential. How can that be related to NFTs? In June 2021, the famous rapper Jay Z changed his Twitter profile picture to CryptoPunk NFT #6095, which he had purchased on OpenSea. According to DappRadar, a global app store for decentralized applications, Jay Z would generate a nice profit of 90% on #6095 if he sells it today.

4. Liquidity

In general terms, the liquidity of NFTs is low compared to fungible tokens. Because there is a risk of being stuck with an NFT, those NFTs with high trading volumes command a premium. High trading volumes also prevent market manipulation and volatile pricing. Thus, investors may place a high value on NFTs deployed on the Ethereum blockchain, as there is a high probability that they can be traded on secondary markets.

CryptoPunk evolving into a digital identity worth more than US$ 9.5 million. (Source: one37pm)

5. Community

How strongly is the community engaged with the project? Since NFTs exist in a supply and demand-driven economy, if the community is not enthusiastic about the project, chances are high that it will not be worth much for long.

First, a strong community is one with a long-term view of the respective project. For example, in Telegram or Discord channels, the members discuss potential use cases and further engagement with the project rather than disclosing primarily profit-driven motivations.

Second, a strong community is emotionally attached to their NFTs. For instance, the owner of CryptoPunk #6046 turned down a US $9.5 million offer because he perceives the NFT as a crucial part of his identity. Or to phrase it in his words: “I am my jpeg, my jpeg is me.”

How will DeFi protocols benefit NFTs?

NFTs constitute one of the hottest topics in the space, with internationally recognized newspapers such as The Economist and Financial Times lending their opinions. However, for many institutional investors, exposure to an unregulated, highly volatile asset class appears relatively speculative. As for most NFT projects, historical time series of prices only go back as far as early 2021, making it fairly unsuitable for long-term or quantitative analyses.

What the future holds is anyone’s guess, and it doesn’t help when Coinbase founder Fred Ehrsam states that 90% of NFTs produced today will have little to no value in three to five years. And yet, Mike Novogratz, an ex-hedge fund manager and founder of Galaxy Investment Partners, recently referred to NFTs as the most important thing that happened this year.

Visa’s purchase of a CryptoPunk demonstrates a bullish attitude. Chances are that other players will follow suit. To give you another example, Kevin Rose announced on behalf of True Ventures, a venture capital firm that invests in early-stage technology start-ups, that the firm is pursuing to hold blue-chip NFTs on its books.

Although we find ourselves in the early NFT stages, we wonder what would make it worthwhile for an institutional investor in the non-fungible world. NFTs do not earn any yield, unlike fungible tokens, which can be lent out, staked, or otherwise put to work.

In a previous blog post, we discussed DeFi and its promising nature for institutional investors to participate in decentralized lending, borrowing, and trading using fungible tokens. As we have already pointed out in the utility section of this article, what we expect to see in the future is an attractive fusion of both worlds — DeFi and NFT.

Let us draw up the current DeFi market offering for NFTs:

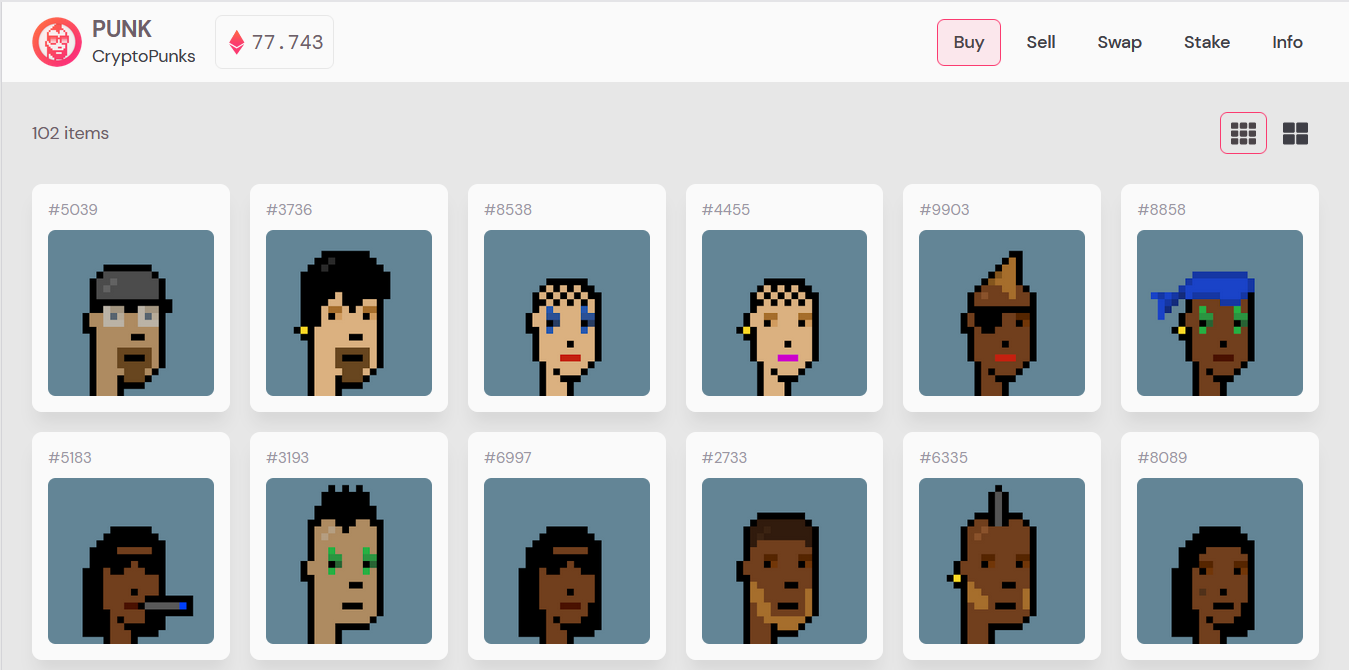

1. Liquidity Pools & Fractionalization

Within the NFT market, NFTX and NFT20 have emerged as the leading platforms to solve the lack of liquidity. Holders of NFTs that do not trade frequently can place their NFTs into a so-called “vault” or “pool” which functions as a repository for holding many NFTs of the same value. The majority of the vaults are “floor” vaults, meaning they contain the lowest valued NFTs from a collection. When NFT is deposited in the vault, the user receives a token representing a claim on any single NFT in the vault. The token can be used throughout the DeFi space including to generate yield.

CryptoPunk Vault on NFTX with floor-priced NFTs. (Source: NFTX)

The classic way to generate yield on DeFi tokens is to provide liquidity on a decentralized exchange such as Uniswap, which enables trading activities on that exchange and earns transaction fees. Decentralized exchanges — like Sushiswap and Uniswap, which hold the largest market share — allow for on-chain trading without requiring a traditional order book. Instead, these pools motivate liquidity providers to lock their assets in exchange for an incentive proportional to their share of the total liquidity available in that trading pool.

The innovation of NFTX and NFT20 is the beginning of transforming a non-fungible item into something fungible that can be easily traded or used to generate passive yield on decentralized exchanges.

As an alternative to liquidity pools, fractionalization protocols such as Fractional and Unicly are gaining ground. Using these protocols to split an ERC-721 token into multiple ERC-20 tokens has become increasingly popular as it allows the broader public to acquire small parts of the most coveted, otherwise too expensive NFTs. Especially in the light of a highly volatile and illiquid NFT market, fractionalization also enables the investor to minimize risk by obtaining portfolio diversification instead of relying on a small number of expensive NFTs. Similar to NFTX and NFT20, Unicly and Fractional decompose non-fungible ERC-721 tokens into fungible and liquid ERC-20 tokens allowing the use of tokens for DeFi applications like trading and lending. DeFi functionality will likely be enabled for other blockchains as well.

2. Lending

Since DeFi applications do not require any central authority as an intermediary in the lending process, investors have the opportunity to borrow other cryptocurrencies against their NFTs as collateral. Especially for investors who do not want to part with their NFT but require cash, lending can be the perfect solution. In case the value of the collateral becomes less than the value of the loan, the collateral can be liquidated to pay back the loan.

On the leading NFT lending platform, NFTfi, lenders grant borrowers up to 50% of their NFT value as the loan principal. The interest rates, however, vary depending on the lender and the desirability of the NFT. But as discussed previously, we have to consider the NFT market as highly illiquid, which makes it difficult to establish the real-time value of an NFT. As a proxy for the fair value of the collateral, lenders can pay attention to the recent sales history or the floor price of similar assets.

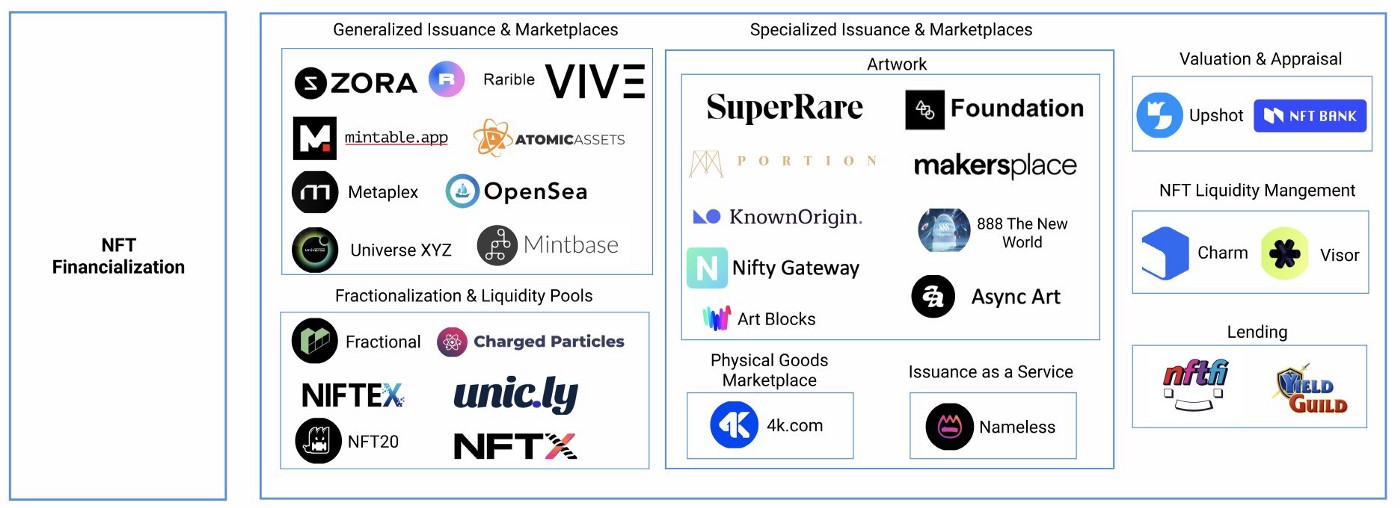

It is exciting to see the ball rolling for lending platforms being created explicitly for institutional investors and high-net-worth retail investors. Arcade (formerly Pawn.fi) raised a US$ 15 million Series A fund in late December 2021 to facilitate loans against NFTs for institutional investors. With the marriage of DeFi and NFTs, we are entering an exciting new chapter in the crypto world. The existing landscape of DeFi/NFT projects (shown in image 6) continues to build and capture peoples’ interest and imagination.

Mapping the NFT landscape within decentralized finance (Source: Messari)

How do we expect NFTs to develop in the future?

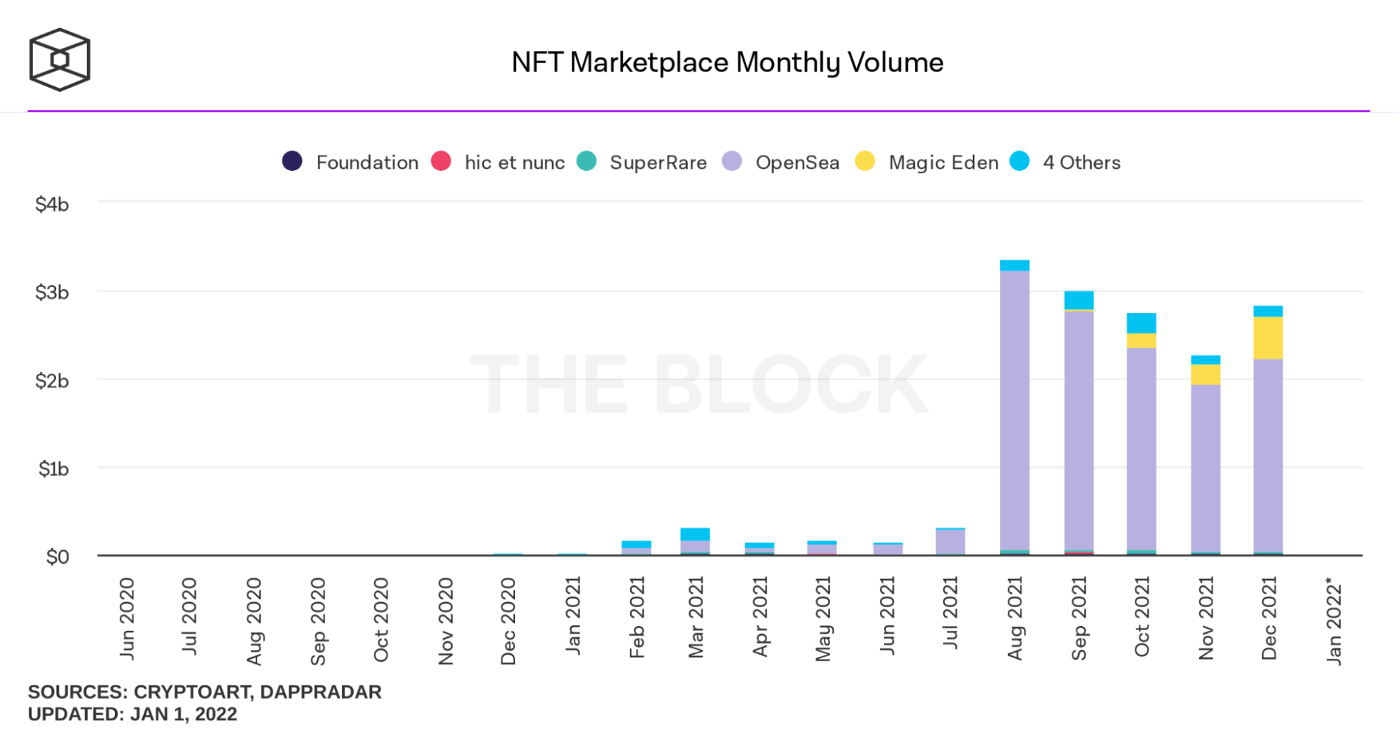

NFT trading volume exploded in 2021, increasing 38,060% year-over-year in Q3 of 2021, as shown in the graph below. That trend has continued to pick up momentum as daily trading volume surpassed US$ 231 million two days into 2022, the highest level since the initial explosion in August of 2021.

NFT trading volume experienced strong growth in 2021 (Source: The Block)

This trend does not disclose the rate at which non-fungible tokens are adopted across different population groups. According to research conducted by Finder.com, we have not yet reached the “early majority” stage of the adoption bell curve. As of November 2021, we find primarily early adopters invested in NFTs: Just 2.8% of American internet users currently own an NFT with an additional 3.9% planning to buy NFTs shortly. NFT adoption rate here in Germany paints a similar picture: While 4% of Germans hold NFTs in their wallets, an additional 3.4% plan to do so in the future.

NFT adoption curve in late 2021 in Germany

We are still in the early days of NFTs, which might explain the lack of regulation and continuing volatility.

But let us look into the future: How will the investment perspective of institutional investors adapt once an early or even late majority of the population has some of their savings tied up in NFTs? And especially: What role should a digital asset custodian play in the NFT ecosystem?

Fred Ehrsam’s notion that 90% of NFTs produced today “will have little to no value in three to five years” is speculative. However, it draws our attention to the fact that only a handful of NFTs will produce steady value retention or appreciation in the long run. Today’s “blue chip” projects like CryptoPunks, Bored Ape Yacht Club, and NBA TopShots, are being sought after by institutional NFT investors striving to minimize their risk.

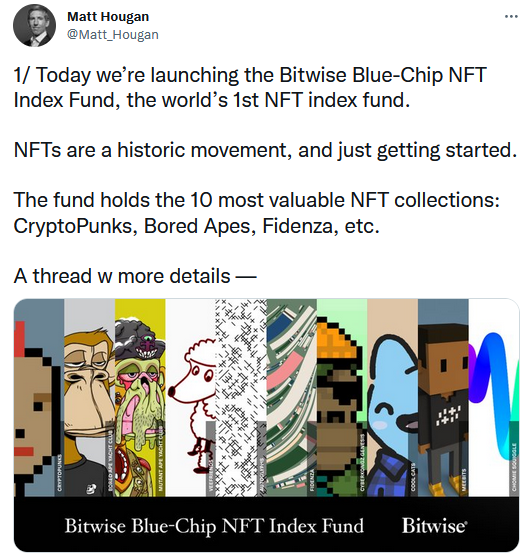

Shortly before the New Year of 2022, Bitwise Asset Management, a leading index fund manager with more than US$ 1.7 billion assets under management (AUM), announced the Bitwise Blue-Chip NFT Index Fund — the “world’s 1st NFT index fund”.

Bitwise’s chief information officer Matt Hougan announced the NFT index fund launch (Source: Twitter)

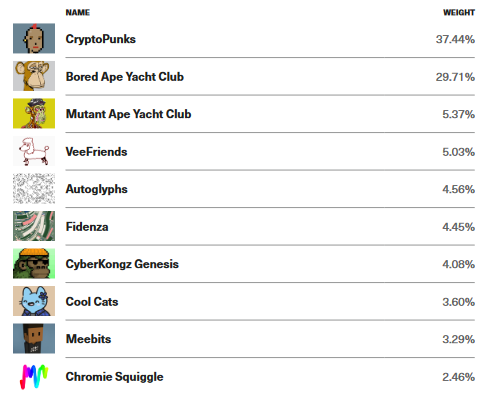

The index fund is designed to make it easier for accredited investors to gain market-cap-weighted exposure to the top 10 most valuable and established NFT collections. Like equity index funds, the NFT index fund rebalances quarterly and is composed of the holdings shown in the image below.

Index constituents of the Bitwise Blue-Chip NFT Index Fund as of 14/12/2021 (Source: Bitwise)

Although the fund removes the complexities around the purchase and custody of NFTs, the investor gives up the unique opportunity to generate additional returns via DeFi products instead of paying a 3% management fee to Bitwise for administering the fund. A direct NFT investment is currently the only way for an institutional investor to access DeFi and prevent an otherwise static state. Brandon Buchanan, CEO of a Miami-based Web3-focused investment management firm called Meta4 Capital, said:

“NFTs that would otherwise be in a mostly static state are put to work. We can financially engineer returns over the interest rate for our investors either by buying additional NFTs or earning yield through DeFi protocols.”

Like conventional crypto-currencies, institutional investors are likely to rely on trustworthy custody solutions for their NFTs. At Finoa, we are curiously exploring NFT custody across multiple chains. We offer support for Ethereum ERC20 tokens and the native tokens of the Flow blockchain, giving investors a way to make an indirect bet on NFTs. (As shown in the table, the Ethereum and Flow blockchains have enabled 72% of the historical trading of NFTs.)

The exciting integration of NFTs and DeFi only began within the last year and is still in its infancy. However, in the future, digital asset custodians could enable institutional investors to achieve both the highest levels of security and the opportunity to generate stable returns on their NFT investments.

Conclusion

In summary, this piece presented the concept of proving ownership of a non-fungible item on a blockchain. While Ethereum is the underlying blockchain behind most NFTs, several other blockchains are gaining significance in the quest for a low transaction cost, scalable infrastructure.

While assessing five key value drivers for NFTs, we also established that the NFT market is still highly volatile and illiquid, with investors often struggling to determine the value of an NFT. We also looked at vault solutions that increase the fungibility of floor NFTs, improving their liquidity and also providing an opportunity to earn yield via DeFi applications. Conversely, fractionalization mechanisms break a single NFT into multiple tokens.

The industry is still in the early stages of NFT-based DeFi products. We are looking forward to seeing more protocols in that innovative field. When it comes down to selecting a custodian for NFTs, there will potentially be a rising demand for security and the potential to earn a return on the assets over the long term.