ETH London Hard Fork: A Brief Introduction to Ethereum and EIP-1559

In late 2013, 19-year-old Vitalik Buterin proposed the concept of a Turing-complete virtual machine built on a distributed ledger. This virtual machine — called Ethereum — has two basic functions: to maintain a single source of truth (the state), and to update this state.

In essence, Ethereum is an open-source, decentralized, general-purpose blockchain that acts as a permissionless and trust-minimizing platform to run smart contracts.

Open source means that the source code of Ethereum — written in the coding language Solidity — is freely available for anyone to view, audit, replicate and redistribute.

Ethereum runs on a decentralized peer-to-peer (P2P) network, consisting of multiple nodes that update and maintain the state (the condition of the network at any given time). This means that no single entity has unrestricted power to control the network or shut it down. It is this decentralized nature of the Ethereum protocol that gives it the characteristics of being ‘permissionless’ and ‘trust-minimizing’.

Things start to get trickier when faced with the following question: how do you make a decision when no one is in charge? What is the mechanism by which consensus is achieved on a decentralized platform?

This was one of the daunting tasks that Satoshi Nakamoto solved in the original Bitcoin white paper. The answer was to implement a consensus protocol named Nakamoto Consensus — more commonly referred to as Proof-of-Work (PoW), whereby the valid chain is the one where the highest computational resources have gone into it. Ethereum uses this same consensus protocol.

One of the factors that differentiate Ethereum from Bitcoin, is the ability to process smart contracts — pieces of code that execute certain rules under specific conditions. An example of a smart contract could be something like this: Bob pays Alice $10 if Alice mows Bob's garden on a Tuesday. The rules laid out in a smart contract execute no matter what. This makes Ethereum resistant to censorship.

To understand why EIP-1559 was necessary, one needs a basic understanding of what Decentralized Applications (DApps) are. DApps are like the Applications on your phone, but instead of communicating with a centralized server like Amazon Web Services, they are built on a blockchain and use smart contracts to execute functions. Like the blockchain itself, DApps running on Ethereum are censorship-resistant.

To build DApps on Ethereum, as well as to perform P2P transactions, there is a network fee — gas — associated with it. This is paid exclusively using Ethereum’s native currency Ether, abbreviated as ETH. ETH has an uncapped supply schedule with a current inflation rate between 2–4%.

The Problem that led to EIP-1559

Ethereum was the first smart contract blockchain and is currently the most popular platform for developers building DApps. Currently, there are approximately 2,900 DApps on Ethereum, all of which require computational power to run. Before EIP-1559, when this high demand for network power was coupled with more than a million P2P ether transactions daily, the Ethereum network experienced high congestion. As a result, the gas prices required to complete that transaction also increased.

During this period, Ethereum implemented a simple auction method whereby users bid — with gas — for their transactions to be added to the blockchain. More specifically, these transactions are added to a block which is merely a list of records (transactions). Naturally, the wealthier an individual was (or the higher the urgency of a transaction to be conducted), the higher the gas fee that person was willing to pay. This inevitably bids up the minimum gas fee to disproportionately high levels making it economically unviable for most users.

This is precisely the problem that EIP-1559 solves.

What is EIP-1559?

Ethereum Improvement Proposal (EIP) 1559 is one of the five upgrades implemented as part of the London Hard Fork, changing the way users bid for their transactions to be included in the blockchain.

After the hard fork went live on August 5, the aforementioned auction method was replaced by an algorithmic process that sets an overall market rate for gas fees — termed the base fee. This base fee will be adjusted on a block-by-block basis resulting in the average block gas fee remaining around 10 million Gwei (= 0.01 ETH).

The improvement proposals also increase the block size to a maximum of 25 million gas, relative to 15 million gas in the past. What this means is that a single block can incorporate more transactions than it previously could.

In essence, instead of network congestion resulting in unpredictably high gas prices, now network congestion translates some of that gas price volatility into block size volatility.

What’s important to note is the fact that the base fee (paid in ETH) is burned instead of being paid out to the miners. This in effect reduces the circulating supply of ETH at any given moment and therefore decreases inflation. In the two weeks following the hard fork, $137 million worth of ETH was burned.

How does it impact the user?

Users no longer have to predict how high a gas price will achieve block inclusion while at the same time trying to avoid overpaying. Instead, the protocol quotes the base fee which the user can decide to pay or not pay.

One will also be required to set the following 2 values while performing transactions:

- Gas Premium: also called a tip that can be used to pay the miners. Since miners no longer receive any transaction fees, the tip is intended to introduce transaction priority relative to other transactions.

- Max Fee: maximum value the user is willing to pay inclusive of the tip.

Misconceptions surrounding EIP-1559

It is important to clear up the fact that 1559 will not reduce the amount of gas to be paid for transactions. Rather, it provides a more predictable gas rate for the user. The base fee will still have to be paid for transactions to be included in a block and this will adjust higher when there is increased network usage.

EIP-1559 is not a scalability solution and therefore does not address the issue of network bloat. This is what Ethereum 2.0 is intended for as it marks the transition of the protocol from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

What are the benefits of EIP-1559?

- Better UX: Previously, users could use tools to understand what other users were paying for transactions, therefore understanding what they’d need to bid for their transactions to be ‘competitive’. But these were by no means 100% accurate. There was still a degree of guesswork involved for the user to figure out the optimal gas to be paid. With 1559, this guesswork is completely out of the picture. Gas is now predictable as it will be the same on average.

- Block space efficiency: With block sizes adjusting the volatility in network usage, not only does gas remain stable and predictable but also block space is used more efficiently.

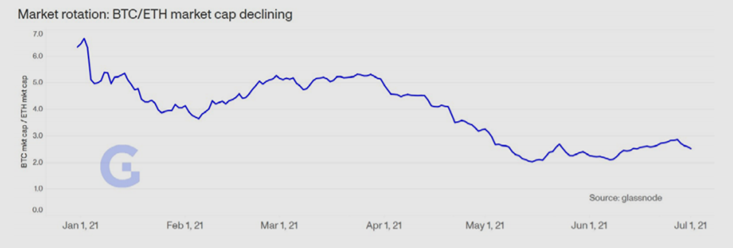

- Increased attractiveness for ETH as a store of value: while burning the base fee might not necessarily lead to ETH becoming a deflationary asset, it does reduce its inflation (for ETH to turn deflationary, it would require more ETH to be burned in base fee relative to the block rewards). This is precisely the reason why the demand for ETH as a store of wealth could pick up. As shown in the graph below, the market cap of BTC relative to ETH has been steadily declining. The utilization of ETH in smart contracts as well as its increasing store of wealth properties is a few factors that can be attributed to this demand increase.

Source: Glassnode

At Finoa, we are excited to see such improvement proposals being implemented successfully. We are thrilled that 1559 improves the overall experience of every single user and developer. Ethereum has demonstrated the ability to implement ongoing development efforts and is a sign of more things to come.