Finoa launches ETH native staking as the first regulated crypto custodian in Europe

Finoa, in an effort to advance institutional engagement in the cryptocurrency sphere, has unveiled its regulated in-custody staking services for Ethereum (ETH).

Ethereum has solidified its position as a prominent blockchain since its establishment. Within a span of just seven years, it has facilitated a digital asset ecosystem that is both efficient and inclusive. Furthermore, it has expanded the possibilities of cross-border value transmission and furnished a foundation for blockchain developers to create pioneering business models that bring communities together through collective ownership.

Finoa has developed a unique approach that empowers institutional investors to stake their ETH holdings directly from the secure custodial environment of their segregated on-chain wallets. Staking rewards, as determined by the Ethereum protocol, will be automatically deposited into the investors' wallets, thereby boosting both operational ease and security.

Growth in ETH Staking following the Ethereum 2.0 Upgrades

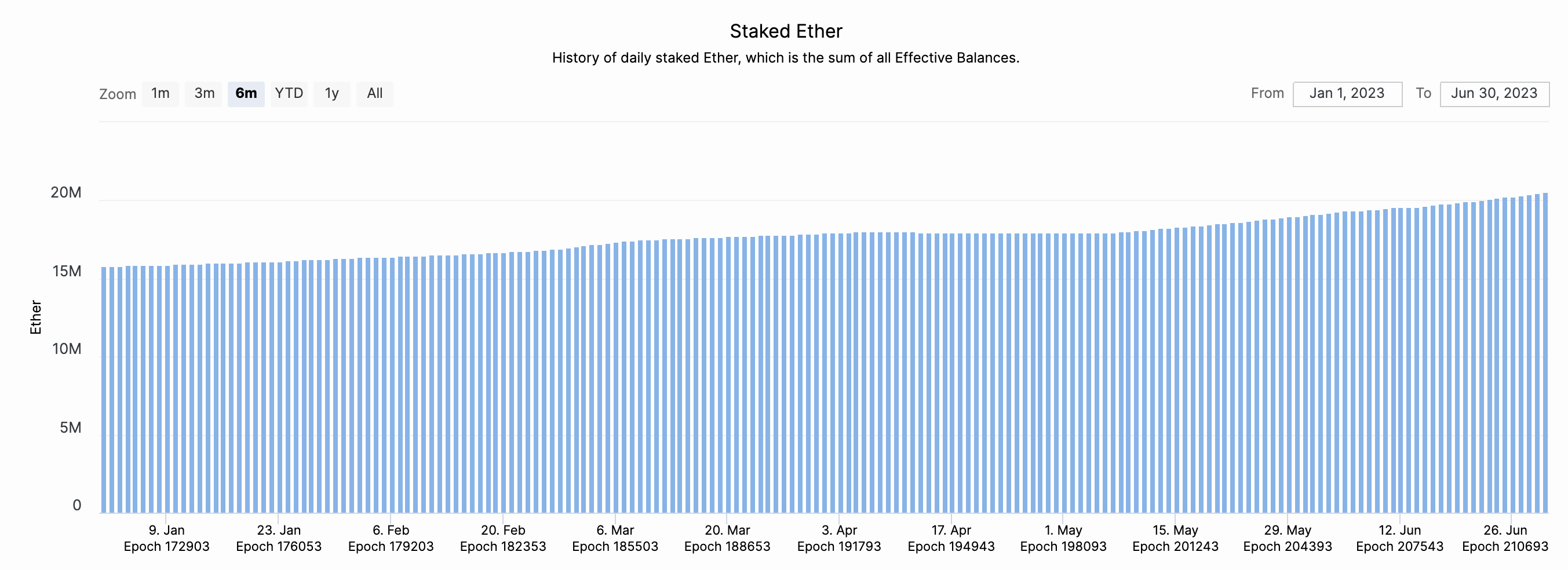

The recent findings from "beaconcha.in" reveal that as of the end of June 2023, the amount of ETH staked has seen a substantial 30% increase from 15.7 million to 20.4 million ETH since the start of the year. This represents a total value of $39 billion staked ETH, which is roughly 17% of the total $231 billion market cap.

The Benefits of Staking ETH

Earning Rewards: The Ethereum network currently offers staking yields in the region of 4.3-5.7% APR. However, these rates are likely to fluctuate with the addition of more ETH being staked and the entrance of new validators, potentially reducing individual returns.

Enhancing Network Stability and Security: Staking ETH strengthens the stability and security of the Ethereum network. Validators who stake ETH have an incentive to act responsibly and in the network's best interests. Any form of misbehavior or failure to meet the network's standards could lead to the forfeiture of their staked ETH. This mechanism ensures the stability and security of the Ethereum network, safeguarding the investment of every ETH token holder.

Promoting Sustainability: Ethereum's transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism resulted in a remarkable >99% reduction in energy consumption, making it a more sustainable alternative. This transition aligns with the Ethereum community's commitment to energy efficiency, addressing societal concerns about the environmental footprint of cryptocurrencies and blockchain technologies.

Finoa and Finoa Consensus Service - a unique combination

Through its German incorporated subsidiary, Finoa Consensus Services, Finoa can offer institutional investors with a great degree of flexibility and security in setting up their ETH staking operations.

Investors can confidently delegate their ETH holdings via Finoa, knowing that their assets are protected, while simultaneously leveraging the staking services offered by Finoa Consensus to maximize their returns. This integration of custodial and staking services creates a unique and convenient solution, empowering institutional investors to actively engage in the Ethereum ecosystem with confidence and ease, whilst at the same time offering a unique opportunity for them to customize their setups to fit operational and regulatory needs.

Finoa clients will be able to tailor settings such as MEV preferences, geographical setups, and cloud/bare metal infrastructure preferences.

Exclusive Staking Services for Finoa Clients

Finoa's native ETH staking from secure custody services are currently exclusively available to Finoa clients. For more information on becoming a Finoa client, please contact us.