How the decentralization in finance will be accelerated by the pandemic

An unprecedented financial market volatility

COVID-19 cases have been rapidly surpassing the 5 million cases mark globally. Even though we are still amid this pandemic, it has already dramatically reshaped societies, economies, and industries — with a rollercoaster effect on financial markets.

From the outbreak on a global basis, stock markets around the world have experienced one of the most tumultuous and volatile periods in recent history. Russia and Saudi Arabia began an oil price war after failing to reach an OPEC agreement, and the US unemployment rate reached an all-time high of 14.7% (equivalent to 23.1 million as of the time of writing). This unique type of crisis is aided by the lack of reliable empirical data to analyze its effects on the economy. The only thing that we know for sure is that the crisis and its impact will be profound.

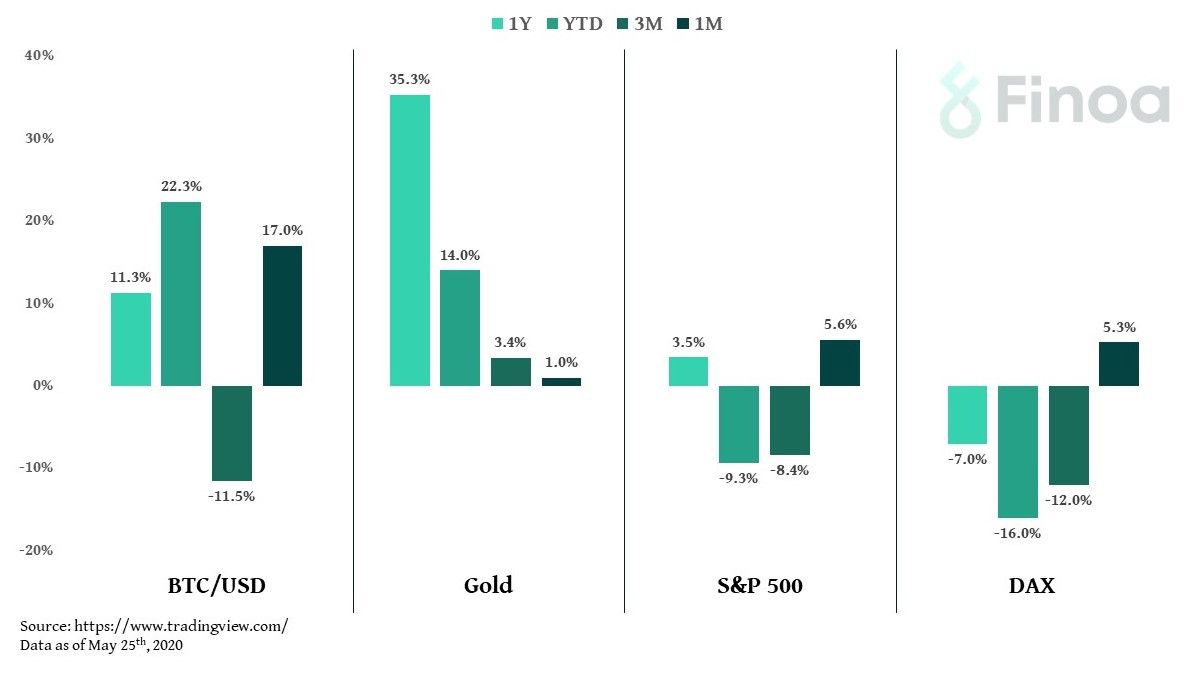

The negative impact of COVID-19 is felt across all industries and consequently has hit financial markets especially hard, with the S&P losing ~8.8% and the DAX losing ~18% YTD. Three days following March 9th (also referred to as Black Monday), on March 12th, both European and North American Stock-Markets fell by more than 9%. As a result, Wall Street experienced the most significant percentage drop in a single day since 1987. Stock markets surged with their best closing since 2008 on March 13th, immediately followed by a decline of more than 12% on March 16th, undermining the uncertainty and volatility that exists in the market.

Gold often considered a safe-haven asset, followed the negative trend of the stock markets, dropping by an average of 12% within two weeks after March 9th. Despite Gold returns remaining a haven across periods (see table below — 1Y / YTD / 3M /1M), the immediate market reaction it followed, indicates that its decline was probably due to its sale by investors trying to obtain liquidity and cover their portfolio positions. Whereas, compared to the previous global financial crises, a reverse effect was noticeable, with Gold in 2001 increasing by 4.5% and by 11% after the Lehman incident of 2008/2009.

Digital Assets have seen similar volatility with Bitcoin dropping by 50% in just one month (Mid-February to Mid-March 2020) but recovering 2x as fast as the stock market in the subsequent period time (Mid-March to Mid-April 2020). The instant price quoting and the 24/7 traceability hereby serve as a boon and bane at the same time.

The Digital Asset ecosystem, however, passed its stability test with excellence. On-chain data analyzed by CoinMetrics shows that especially short-term and relatively new holders most likely drove price volatility. Crypto evangelists and long-term orientated investors, including institutional investors, however, used the price decreases for significant top-ups driving the markets back to their pre-crisis valuations very quickly and thus, outperforming stock markets by significance.

The economic and human impact of an outbreak of an infectious disease

COVID-19 and social-distancing policies have already changed the way we work and live. The epidemic quickly generated a significant impact on businesses and the economy, forcing individuals to adapt their behaviors, governments to make substantial interventions, and companies to reorganize and rapidly operate in novel ways.

The Coronavirus pandemic has also generated several, additional opposing reactions:

Restrictions and social-distancing measures quickly drove a sharp fall in consumer and business spending, producing a recession with unexpected GDP slumps (up to double-digits) in several European countries. Furthermore, corporations have been forced to rethink operations, quickly implement new workforce policies, change client relationships, and adapt supply chains to meet an increasing online consumer buying behavior. All while trying to mitigate the effects of border closures, travel bans, and other slowdowns.

Looking at social reactions, new purchasing behaviors have already formed and are likely to remain once the crisis has passed. Digital adoption is increasing at an unparalleled rate; with stores closed, more consumers are shopping online, and contactless payments are booming, changing the perception that most people have of “money”.

With our lives becoming more and more digital, the coronavirus pandemic has shed some light on the fragile infrastructure of tedious processes that were still based on physical proximity and intermediation. Going to the notary, carrying out complex and highly intermediated buy/sells operations, running elections/voting for public topics, and even the distribution of urgently needed government subsidies via the traditional financial system is facing significant roadblocks. The examples here are endless. The lack of digital innovation over the past years has come to light showing the massive gap between people’s expectations and real digitalization levels.

A post-COVID-19 outlook

The world post-COVID-19 requires businesses and society as a whole to develop new hybrid organizations and models that leverage digitalization and as Marc Andreesen pointed out, “it’s time to build” now. Believing in the potential of blockchain to take a significant part in this new era, we are seeing two future scenarios with a view skewed to the financial markets potentially unfold.

1. A “new” financial system accelerated by the impact of the crisis

Governments are printing money as a response to the crisis, resulting in a tremendous amount of liquidity being injected into the markets — as compensation measures for the lack of real activity in the economy — is likely to result in an inflationary environment. Especially considering, the still extant money supply injected into the markets as a response to the last financial crisis in 2008.

The injected liquidity, in combination with the sharp market decline, leaves traditional wealth management portfolio models with huge losses, further decreasing society’s trust in traditional financial markets and institutions and significantly increasing the interest in alternative and autarchic concepts, decentralization being one of them.

As data suggests, wallet creations are at an all-time high. Additionally, March saw the most significant inflow into stablecoins and a massive spike in the volume of Bitcoin trading against stablecoins (crypto-cash equivalents). Ethereum-issued Tether market cap increased by about $300M from March 10th through March 15th and by $1.5bn from March 10th through April 15th. The increase in liquidity and the maturation of the blockchain ecosystem is hereby another crucial checkmark to attract institutional investors into the market.

On top of this, we are seeing a variety of new decentralized applications creating a new high-yield ecosystem and serving as an answer to the zero- or negative-interest-rate ecosystem in the traditional financial world. Applications range from new decentralized governance models such as Staker DAO, and decentralized lending protocols such as Compound to innovative and new portfolio managers and liquidity providers such as Balancer Labs — to only name a few here.

Yes, stock markets can still bring significant profits to investors, mainly triggered by QE, but the environment and the groundwork are ready to see severe growth of Digital Assets and an overly decentralized financial system. Money, as a result, is becoming more and more digital with the help of blockchain technology and innovative development projects such as the Chinese CBDC or Facebook’s Libra highlighting this trend.

2. Accelerate Innovation with blockchain as a driving force

Organizations and governments are forced to rethink their short and medium-term priorities: leading out of adversity can be achieved only through a massive acceleration and shift towards digital platforms, channels, and, above all, digital money. With consumers ready to go 100% paperless and to welcome an entirely digital currency, that would bring benefits not only to “consumers” but also enhance efficiencies to the entire systems behind.

Blockchain is one of the few technologies that can create such a system in an efficient and trusted way. We are seeing excellent pilot projects going precisely in this direction. Noteworthy flagship projects like the Chinese CBDC have already had a positive impact on the blockchain ecosystem, forcing other central banks to move to an “implementation” or “pilot” phase and follow suit.

At the same time, traditional enterprises have the urge to interiorize this shift. Governments should acknowledge the current scenario as an opportunity to innovate sub-efficient markets and infrastructures. Leveraging blockchain technology via tokenization and the use of smart contracts, for example, can help digitalize overly complicated, expensive, and inefficient processes such as notarization.

Blockchain can significantly affect and solve problems currently posed by movement restrictions, such as with Annual General Meetings (AGMs). Current limits are preventing shareholders from both traveling to and attending meetings forcing companies to go for “Virtual” AGMs or to cancel them altogether. If generally having an AGM is an expensive (e.g., hire a venue, arrange for catering, and possibly make travel arrangements for board members) necessity to guarantee Shareholders’ democracy, the integrity of voting must be ensured with the help of technological accessibility, accountability, and be trusted by every shareholder. Blockchain is the perfect missing piece of the puzzle.

While it is still too early to accurately predict the real impact that the pandemic will have on the global economy, all doubts over the benefits of blockchain and its decentralized concept have already been cleared with COVID-19 having helped cast them aside. The “transparency, traceability, and interoperability” of blockchain platform/applications and the need to strengthen, better connect, and improve value chains will be critical to getting the economic recovery underway. The above-mentioned positive traits will ultimately result in the general wide-scale adoption of blockchain technology and decentralized applications — not only in the financial industry but across society.

Whether you are a corporation looking into innovation, or an institutional/private investor looking to diversify your portfolio to gain higher returns, now is the perfect time to get acquainted with blockchain-based Digital Assets and their underlying concepts.