Mapping business opportunities in the era of tokenization — a $24trn game

In our first publication — The Era of Tokenization — market outlook on a $24trn business opportunity, we outlined our granular market sizing of tokenized assets and the potential of a $24trn digital asset marketplace by 2027.

As shown, in the short-term tokenization will especially affect standardized issuing products such as Equity or Bonds, benefitting from significantly lower issuance and transaction costs (e.g. substitution of smaller IPOs with STOs). Subsequently, we expect the accelerating tokenization of smaller and more illiquid and non-fungible assets (e.g. SME shares or Real Estate), attributed to the benefit of easy ownership transfer leveraged by blockchain technology.

While the benefits of asset tokenization seem obvious, mainstream adoption and the capturing of full market potential will not only require the current crypto ecosystem to professionalize but will also require existing business models in the traditional financial industry to adapt. The often-seen reluctance of incumbents to enter the space provides FinTechs and other startups with a multi-billion dollar market opportunity.

Business Opportunities

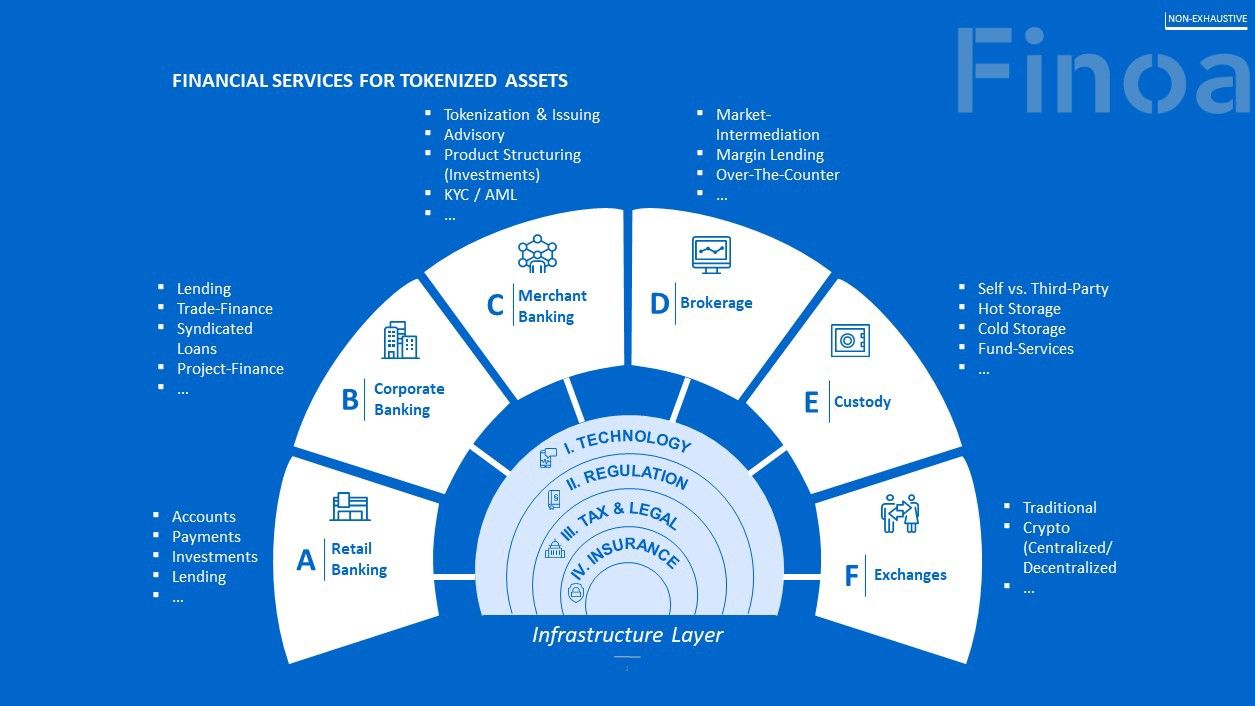

At a very high level, the financial services landscape for tokenized assets can be consolidated under the following framework:

Within this article, we will focus on the opportunities of the financial services, while just briefly touching on the infrastructure layers.

A. Retail Banking (Opportunity for new entrants: low to middle)

In our framework, we allocate standard banking products such as savings/checking accounts, loans, debit/credit card payments, mortgages (and many more) to Retail Banking. To allow mainstream adoption of tokenized assets in the private sector, especially of cryptocurrencies, innovative Retail Banking accounts will evolve, or incumbents will adapt existing accounts to crypto-methodology.

We observe this field being divided into three main groups of market participants:

- FinTech players with a hybrid model (FIAT & Crypto) combining traditional finance with digital assets — e.g. Revolut (United Kingdom)

- FinTech players with a crypto focus — e.g. Bitwala (Germany), TenX (Singapore)

- Traditional Banks launching crypto-offering — e.g. Bank Frick (Liechtenstein)

Within the first category, Revolut has been the first mover, offering their strong “traditional” retail customer base the option to buy/sell a range of cryptocurrencies. While their biggest European competitor N26 has yet not entered the battlefield, we expect them to do so shortly within the second category, we can list several projects that are struggling to succeed (i.e. TenX, WaveCrest, Amon) due to regulatory risks or because of collapsing business models, as traditional banks refuse to partner/process, for example, credit card payments.

Traditional banks in the third group are yet the most reluctant to enter the space, mainly because of regulatory uncertainty that results in the risk of jeopardizing their traditional revenue streams. Overall, the hybrid model of FinTech players seems to be the most likely to capture the market potential at this point in time.

B. Corporate Banking (Opportunity for new entrants: low to middle)

Traditional Corporate Banking products include loans, syndicated loans, trade, and project finance, among others. Over the last months, we have especially seen more development of trade finance use cases for blockchain technology. Incumbents are trying to defend against disruption through the formation of industry consortia (e.g. R3/Corda), leveraging blockchain technology to digitize letters of credit and bills of ladings, track payment guarantees, and expedite receivables discounting. Startups like Flexport and Tradeshift (both USA) already show significant traction in the space, while a win against strong industry consortia won’t come easy.

C. Merchant Banking (Opportunity for new entrants: high)

As in the traditional financial landscape, buy-and-sell side services (Merchant Banking Services) complement financial services for digital assets. Service providers (sell-side) for issuers will be required to develop, register, and sell securities to finance their operations. Those service providers will need to cover compliant KYC/AML processes, technological capabilities of structuring tokenized assets, as well as distribution channels towards the investor side (buy-side). We currently see several new entrants trying to establish market standards for security tokens with their own protocols/token structures, such as Polymath (Canada), Securitize (USA), Neufund (Germany), and Harbor (USA). It has to be determined whether this will be a race to the bottom or if several protocols across different jurisdictions will survive.

To properly develop buy-and-sell side services, close cooperation with technology standards/protocols, law firms, and market makers will be required, consolidated under the roof of “full-service providers” (e2e tokenization services).

D. Brokerage (Opportunity for new entrants: middle)

Facilitators in the buying and selling of assets are needed for tokenized assets just as much as they are for traditional financial assets since they are the key to triggering sufficient market volumes/liquidity and provide efficiency through investment advice and market information/transparency. The current crypto ecosystem suffers from low-volume order books across a fragmented landscape of exchanges. For a “big money” inflow from the institutional side, brokerage infrastructure has to evolve to allow liquidity for high-volume transactions while avoiding significant market movements/manipulations. Several new players are working on OTC solutions, reducing overall transaction costs and ensuring best-price execution, such as Circle and XTRD (both USA) as well as Huobi (United Kingdom) in Europe. Some of these new players are even backed by traditional institutions as in the case of Circle, with Goldman Sachs.

E. Custody (Opportunity for new entrants: high)

The lack of institutional custody solutions is one of the key roadblocks to accelerated growth in the current tokenized assets ecosystem. In the majority of jurisdictions, qualified custodians (licensed) are required by regulators — for example, once a fund size grows beyond a certain threshold (e.g. >$100mn). However, these players are currently non-existent or are offering unsophisticated product offerings. Even without the regulatory requirement of qualified custodians, asset managers are craving custody solutions that help them to store the private keys to their tokenized assets, as the safeguarding of assets is not among their core capabilities. Furthermore, investors of the asset manager’s fund demand sophisticated security mechanisms, only to be provided by custodians. As of today, the combination of regulatory requirements and lack of trusted institutional custody solutions keeps a vast majority of traditional asset managers from taking positions in tokenized assets.

To ensure sophisticated blockchain functionalities such as staking (as in proof-of-stake) or dividing/voting rights (as in tokenized common shares), online/hot-storage custodians are required.

F. Exchanges (Opportunity for new entrants: middle to high)

Over the last few years, a large number of crypto exchanges have evolved, providing liquidity to the secondary market of cryptocurrencies and utility tokens. The vast majority of those are not yet regulated by their local regulating bodies and, hence, not qualified to offer security tokens representing, for example, equity — which is expected to trigger the next wave in the ecosystem. This subsequent lack of liquidity and market depth is a significant roadblock to accelerated growth and can only be conquered with the rapid evolution of licensed exchanges or traditional exchanges entering the digital asset space. Promising new entrants are OpenFinance as well as Overstock’s tZERO (both USA), which are among the first US-based regulated security token platforms. Rumors continue to swirl that traditional stock exchange Nasdaq (USA) may be close to entering the battlefield, which remains unconfirmed by the organization. In Europe, Gibraltar Stock Exchange (GSX), Malta Stock Exchange (MSX), as well as Swiss Exchange (SIX) are known to launch digital asset operations in the first half of 2019. Overall, traditional exchanges seem to have better cards to win this business opportunity, as security regulation (e.g., German BörsG) foresees that exchange market participants need to be “qualified” — leading to the tiered system that banks participate in exchanges (and not end clients) in the traditional world. This would likely also happen to crypto exchanges, leaving them with an advantage due to their strong B2C (end client) focus.

Infrastructure Layer

The infrastructure layer is the necessary basis for the foundation of a solid landscape of financial services for tokenized assets:

I. Technology: Ongoing technological innovation and maturity of blockchain technology

II. Regulation: Consistent and clear regulatory guides across jurisdictions with regional/global standards. (The current situation shows jurisdictions moving independently — e.g. Malta VFA license).

III. Tax & Legal: Transparent taxation methodology and legislative guidance

IV. Insurance: Increasing insurance and reinsurance offerings for tokenized assets for risk-diversification

To unlock the ~$24trn business opportunity, significant development across the financial landscape of tokenized assets is required. The infrastructure layer is the basis for a solid foundation of the ecosystem, but core-value will be captured across the key financial pillars. In the foreseeable future, Custody, as well as Merchant Banking services, are expected to contain the most significant business opportunities for new entrants, as they are crucial for the professionalization of the landscape.