The role of MEV in DEX arbitrage

With a total of $713m extracted from the ETH economy, MEV is a significant source of revenue for those with the skills to take it. But what is MEV, and is there a difference between good and bad MEV?

In this article, we explain how MEV works, what are MEV attacks, and how they differ from the legitimate practice of MEV arbitrage.

First of all, what does MEV stand for? While Ethereum was still a Proof-of-Work chain, MEV stood for “miner extracted value,” but now that miners have been replaced by validators, MEV stands for “maximum extractable value.” For all practical purposes, MEV is the maximum reward that a validator can extract for contributing to a Proof-of-Stake network.

What is MEV and how is it made possible?

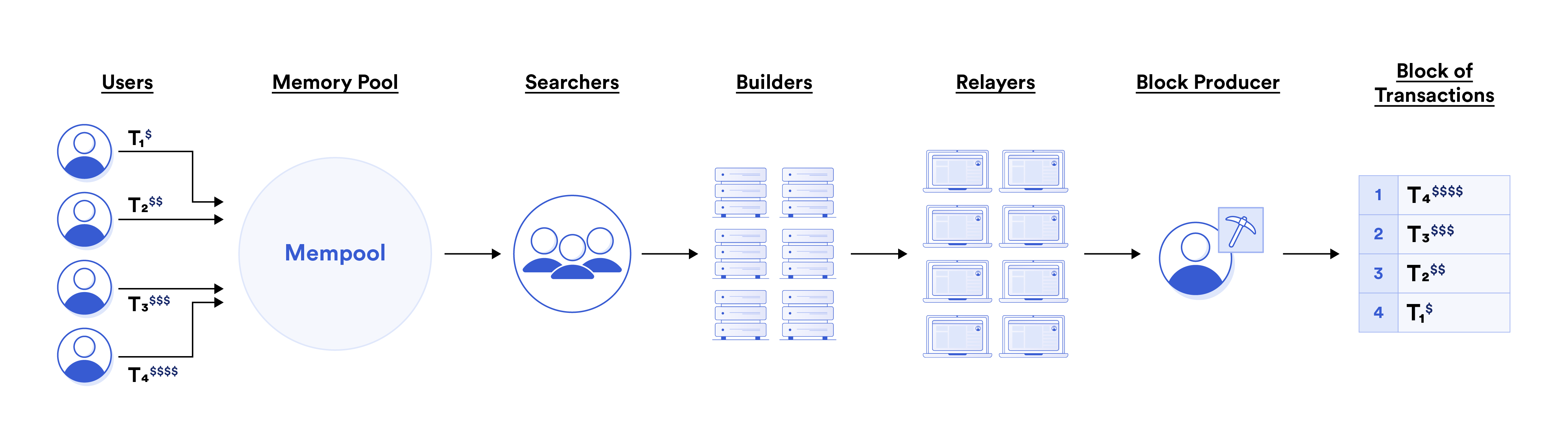

On the Ethereum blockchain, all new transactions must first wait in the public memory pool, or "mempool," before they are put into a block and added to the blockchain. In the past, it was miners/validators who decided which transactions to put into a block, and in which order. They simply chose the transactions with the highest transaction fees and paid little attention to their ordering.

Eventually, MEV searchers started to realize that there was profit to be made by reordering transactions, censoring transactions, or creating new transactions based on the transactions viewable in the mempool.

MEV arbitrage vs MEV attacks

The first thing to understand is that the transactions in question are not simply sending tokens from one address to another, but rather initiating trades or loans in the Decentralized Finance (DeFi) markets. Let’s focus on decentralized exchanges (DEXes), where the large majority of MEV is extracted.

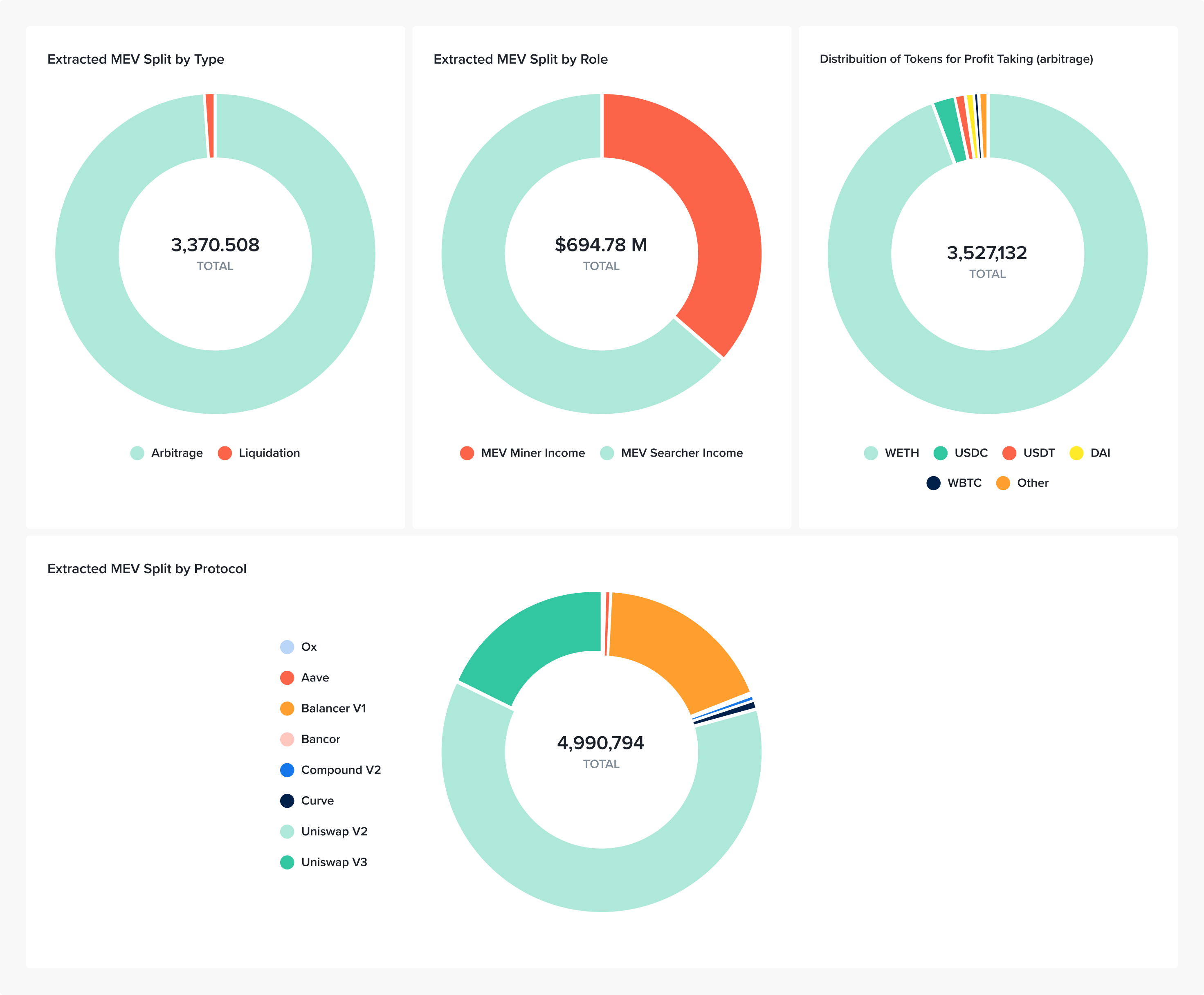

Extracted MEV, snapshot as of March 13th, 2023. Data via Flashbots.

Most dexes use the Automated Market Maker (AMM) pricing mechanism, where the absence of an order book means that orders do not carry a guarantee of a price at which they will fill. An order – and the price being paid – is only final once it has been added to the blockchain. While that order waits in the mempool, it’s possible for MEV participants to carry out their own transactions.

The ability to see incoming orders allows MEV participants to carry out simple frontrunning, or more complex sandwich attacks, whereby a legitimate buy order is sandwiched between two new orders which buy the token in question and sell it at a higher price. Frontrunning and sandwich attacks result in a worse price for the legitimate DEX trader, but not all MEV activities are adversarial to the trader: MEV is also used to carry out arbitrage, which helps traders to have a better price.

How MEV works. Diagram source.

Generally, MEV transactions that extract value directly from users via frontrunning and sandwich attacks are referred to as “MEV attacks”, or “bad” MEV, while arbitrage is referred to as “good” MEV since it helps to stabilize prices across DEXes and does not extract value directly from an individual user. As we will see, arbitrage now makes up the large majority of MEV revenue.

Just like in traditional markets, extracting arbitrage in DeFi markets requires arbitrage bots that identify inefficient orders and rapidly execute trades to capitalize on and reduce those inefficiencies across markets. Unlike in traditional markets, however, DeFi arbitrage can be de-risked by carrying out multiple transactions “atomically,” meaning that one transaction only happens if the other transaction does.

MEV arbitrage, a significant part of Ethereum’s economy

Although MEV trading has dark origins, the MEV-Boost software from Flashbots removed conflicts of interest by separating the role of block-builder (who decides the order of transactions within a block) from the role of block-proposer (which adds the block to the chain). Running on the premise that “if you can’t beat them, join them”, Flashbots created a way for MEV revenue to be collected efficiently and distributed fairly to all the validators and stakers who run MEV-Boost.

As a result, 85% of Ethereum’s blocks are now proposed using MEV-boost, and 99% of MEV currently comes from arbitrage.

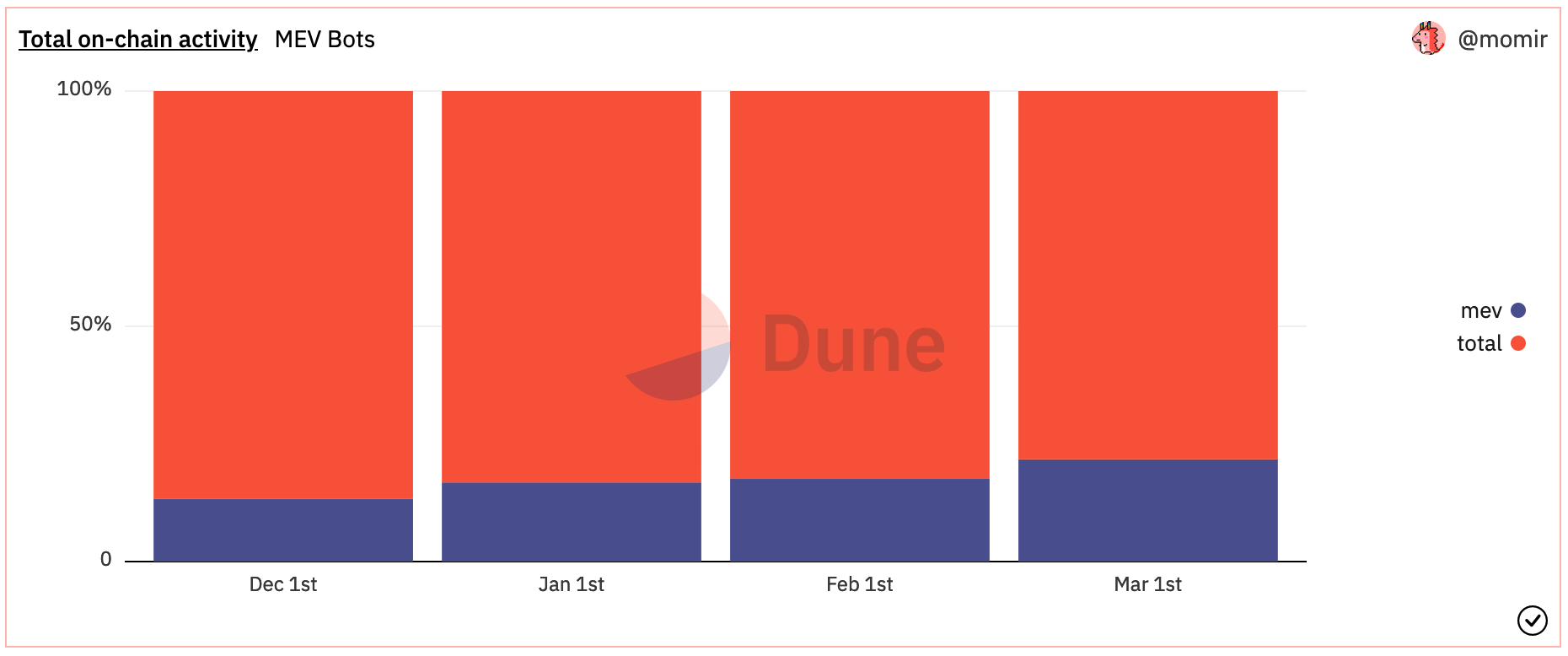

MEV bot activity has been rising steadily. Data via Dune Analytics.

Related article: What's next for Ethereum: the Shanghai upgrade and beyond

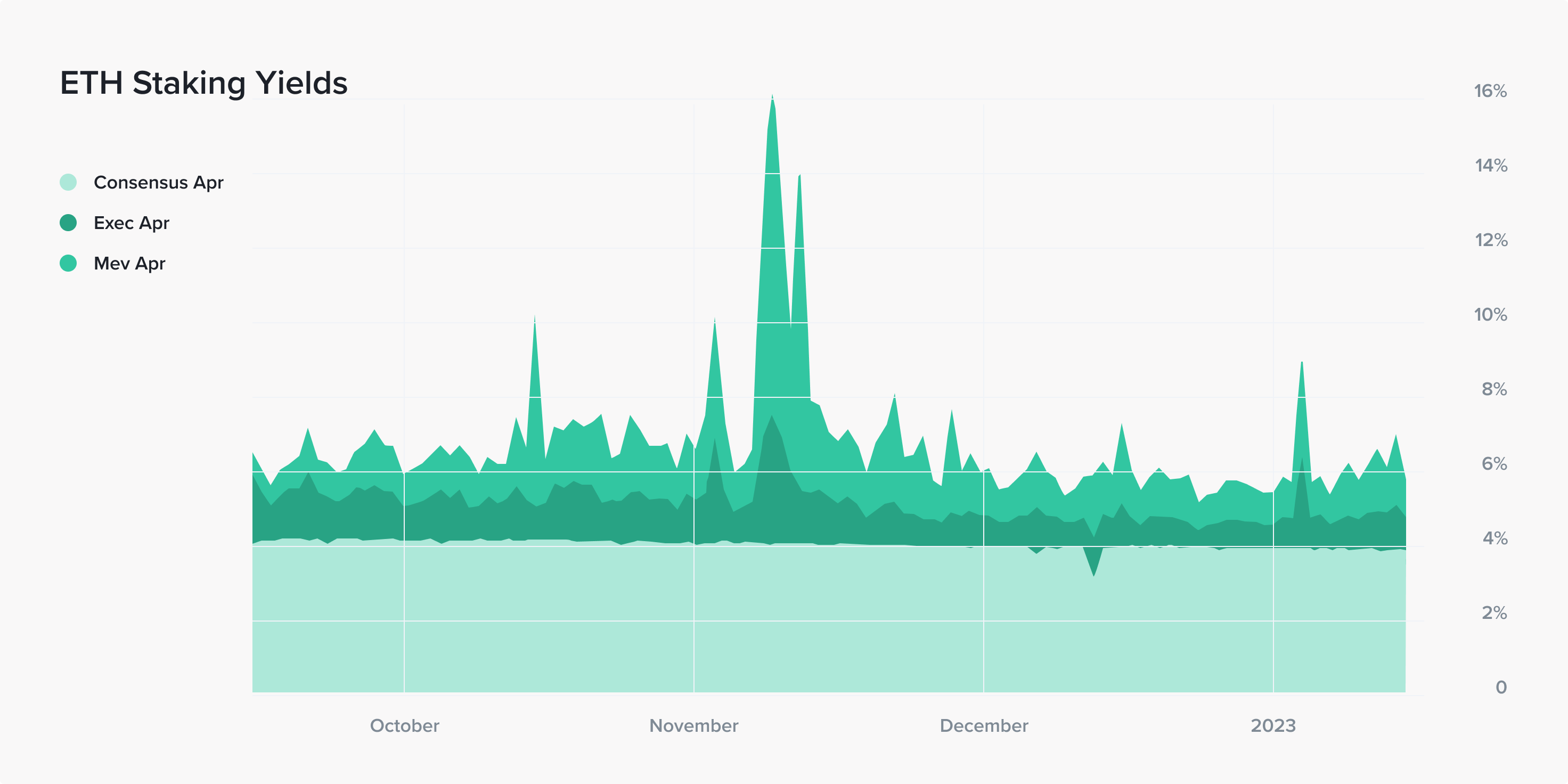

The practice of optimizing trades with MEV, otherwise known as “MEV trading” currently comprises over 20% of on-chain activity on Ethereum (shown above), and has become a significant part of the Ethereum economy. Validators are incentivized to run MEV-Boost since it maximizes their staking reward by selling block space to an open market of builders. In this case, MEV revenues generate another 1-2% APY for stakers, or about one-third of the total staking reward, as shown in the chart below from Parsec.

Evolution of staking rewards generated by MEV. Data via Parsec.finance

MEV remains contentious due to censorship issues

But MEV isn’t totally “solved” – it remains contentious due to the censorship debate resulting from the sanctioning of the Tornado Cash protocol. In August of 2022, Tornado Cash was blacklisted by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), making it illegal for United States citizens, residents, and companies to receive or send money through the protocol.

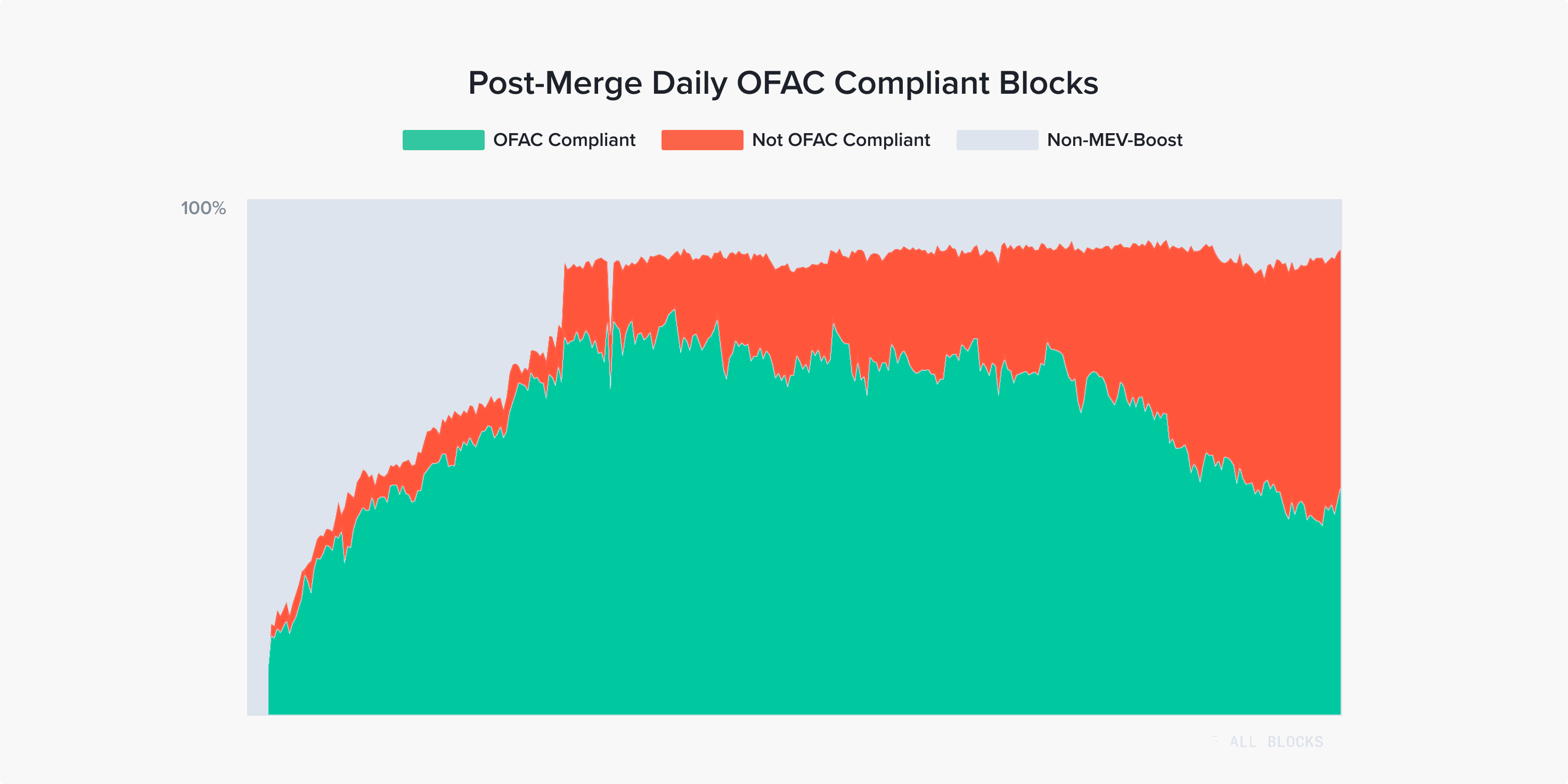

The number of blocks not enforcing OFAC censorship is increasing. Snapshot as of March 13th, 2023. Data source.

Since then, validators have had to put careful thought into the MEV relayers that they use to source MEV revenue. (Relayers are the mediators between block builders and block proposers, allowing validators to offer their block space to block builders.) Some relayers include transactions containing ETH which has passed through the Tornado Cash protocol at some point in the past, and some relayers exclude, or ‘censor’ these transactions.

Relayers that exclude such non-compliant transactions are deemed as “OFAC compliant.” Given the high number of Ethereum nodes in the US, it is likely that many US-based validators want to be on the safe side of regulatory scrutiny, and not risk non-compliance.

Flashbots’ own relayer was the first-ever MEV-Boost relayer and chose to censor non-compliant transactions, which explains the initial dominance of OFAC-compliant block products on Ethereum, as shown in the chart. As more relayers have become available, including non-censoring relayers, this trend has reversed, and now less than half of the blocks are OFAC compliant.

Conclusion

Miner-extracted value, or MEV, began as an opaque value-extracting activity that was detrimental to users and potentially destabilizing for Ethereum. But ever since the widespread adoption of MEV Boost by validators, MEV trading has largely been made “fair,” with 99% of MEV revenue now being generated from DeFi arbitrage – an activity that is stabilizing for markets and generally regarded as a good type of MEV.

MEV remains important for Ethereum’s economy, making up 15% of all Ethereum transactions, and boosting the reward rate by 25% for stakers and validators. Issues remain though, as validators must decide whether to censor “non-compliant” transactions, or whether they will potentially include any transaction in their blocks.