An innovative approach to staking Mina

We are happy to share that Finoa has developed a new and safer solution for staking Mina. In this article, we go through the characteristics of the Mina staking process and explain how Finoa now offers a compliant and secure setup for Mina validators that guarantees clients their share of staking rewards.

How staking works

Delegators can generally decide freely which validator to delegate their crypto assets to. Validators and delegators are rewarded by the network with newly minted tokens and transaction fees for their participation in the network. These rewards are distributed proportionally to the number of tokens staked. In most cases, this process is automated, and the network allocates the right amount of tokens to the correct beneficiary.

How Mina staking works

Contrary to the staking process of most networks, the Mina blockchain does not automatically transfer the staking rewards to the corresponding validators and delegators. Instead, the validator chooses the receiving address to which all staking rewards shall be transferred. What typically happens is that the validator chooses its own address and then distributes the staking rewards to delegators manually.

This implies that the validator is not bound to transfer the rewards to the delegator entitled to them, as the validator has full control over the staking rewards. This mechanism exposes delegators to potential bad behavior by validators who can misuse their power and transfer the reward to an address of their choice. In other words: the delegator is dependent on trusting the validator in order to receive the rewards for their delegated tokens.

This also entails that validators act as custodians for the delegators by having full power over their funds. This adds a new dimension of counterparty risk and can add complexity in certain jurisdictions as node operators could then be considered as carrying out financial services. In Germany for example, only BaFin-licensed crypto custodians are eligible to provide this service, so it is important to carefully select who to partner with when selecting a validator. Read more about Finoa’s custody solution here.

The unique FCS solution

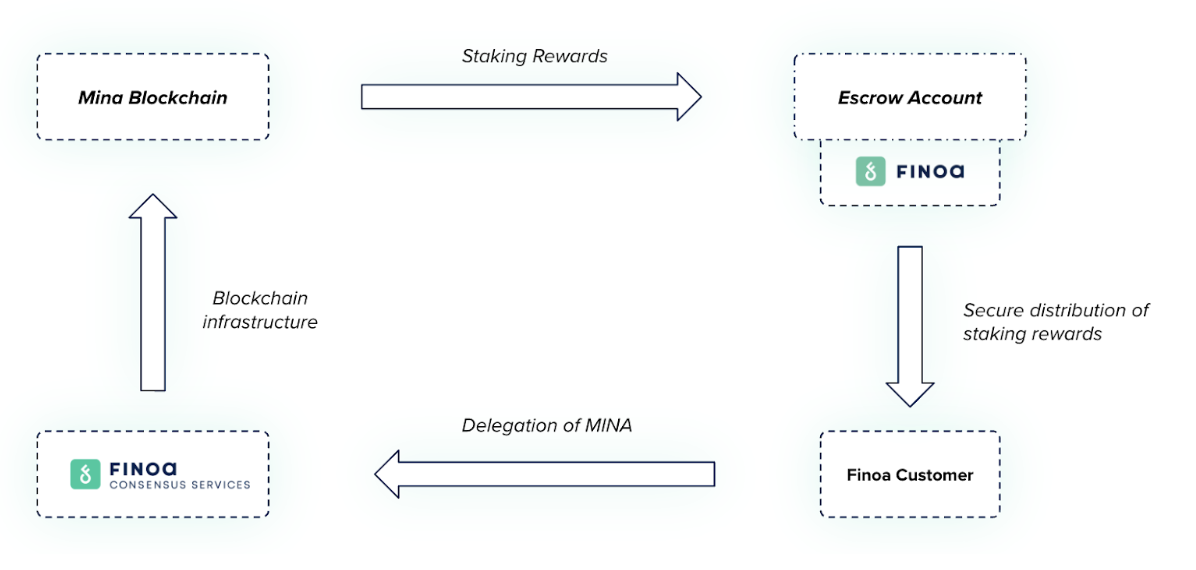

Given the limitations mentioned above, Finoa has developed a new way of offering Mina staking to its clients via its FCS subsidiary. With this new solution, rewards are first deposited in a regulated Finoa wallet, and then transferred to the delegators’ address and thus overcome the potential risks outlined above. Our approach is unique in the ecosystem and leverages the advantages of an escrow account.

With the new setup, custodial responsibility is transferred to Finoa. Staking rewards - including the validation fee - are sent directly to an escrow account held on trust by Finoa for the delegators - Finoa clients as well as the validator, FCS. Finoa then transfers the respective amount of rewards directly to the address of the eligible delegator. By using the escrow account, FCS as the validator is not in control of customers’ staking rewards nor does it act as a custodian of the delegated assets. Finoa, on the other hand, as a BaFin-licensed crypto custodian can safely take temporary custody of the reward before transferring them to delegators and validators.

A new setup limited to Finoa customers

This service is only available to Finoa clients who go through a thorough and compliant onboarding process. This allows FCS to quickly identify the relevant delegators, which are required to operate an escrow account and distribute rewards accordingly. This identification is made possible thanks to the thorough onboarding process Finoa clients go through. This service is not available for unknown Delegators who do not go through the onboarding and verification process of Finoa.

To learn more about how to leverage Finoa’s unique setup to safely stake your MINA tokens, get in touch with our team.