What can institutional investors gain from custody diversification?

Today’s institutional investors are wise to custody their digital assets with a trusted third party — but can they reduce risk even further by spreading their investment across multiple custodians?

The value of custody diversification

Institutional investors entering the digital asset space today understand the importance of keeping their digital assets in the custody of a trusted third party (see previous blog article). Management of the assets’ private keys gets delegated to the custodian, requiring trust in the custodian and their underlying infrastructure. In this article, however, we will explore whether it is possible and practical to further reduce risk by spreading digital assets across multiple custodians.

Gold storage is similar to digital asset custody

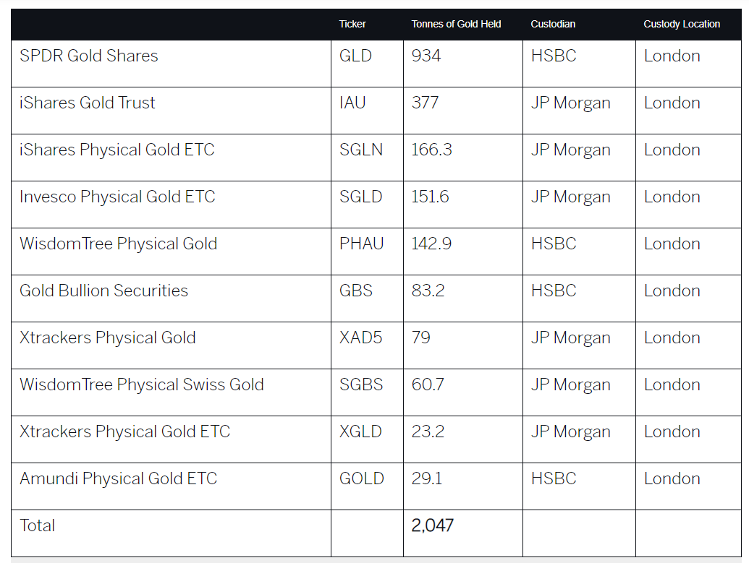

Digital assets resemble gold since both can be owned directly or indirectly. Some gold investors physically own and store their gold others keep it in a bank. Few investors go down the non-physical route and purchase exchange-traded funds (ETFs) backed by physical gold. The cost of storage associated with these gold ETFs is low since they benefit from economies of scale. However, most of the world’s gold ETF is consolidated in the same vaults, as shown in the table below.

Examining the physical location of gold stored by leading ETF providers shows that owning several gold ETFs does not achieve custody diversification. (HanETF)

Every major gold ETF stores its underlying assets with one of two banks, both in the city of London. This seems counterintuitive considering that the role of gold for many investors is an asset that holds its value across time and through major disruptive events. Buying gold through ETF requires confidence that London’s infrastructure will operate normally during a disruptive event or if investors wish to redeem their ETF shares for physical gold.

Is the crypto ETP industry trending toward the use of multiple custodians?

Thankfully, crypto custodians are not all consolidated in the same city: digital asset investors can choose from institutional-grade custodians from around the world. It is still worth considering, however, whether or not the digital assets should remain with a single custodian or spread out across several. No clear trend has yet emerged in the industry, and Finoa is also seeing a mix of investor attitudes on this issue. We can look to emerging crypto-backed exchange-traded products (ETPs) for more insight. With over $6b in assets under management in May 2021, these ETPs are the preferred method for many institutional investors to achieve exposure to the crypto market.

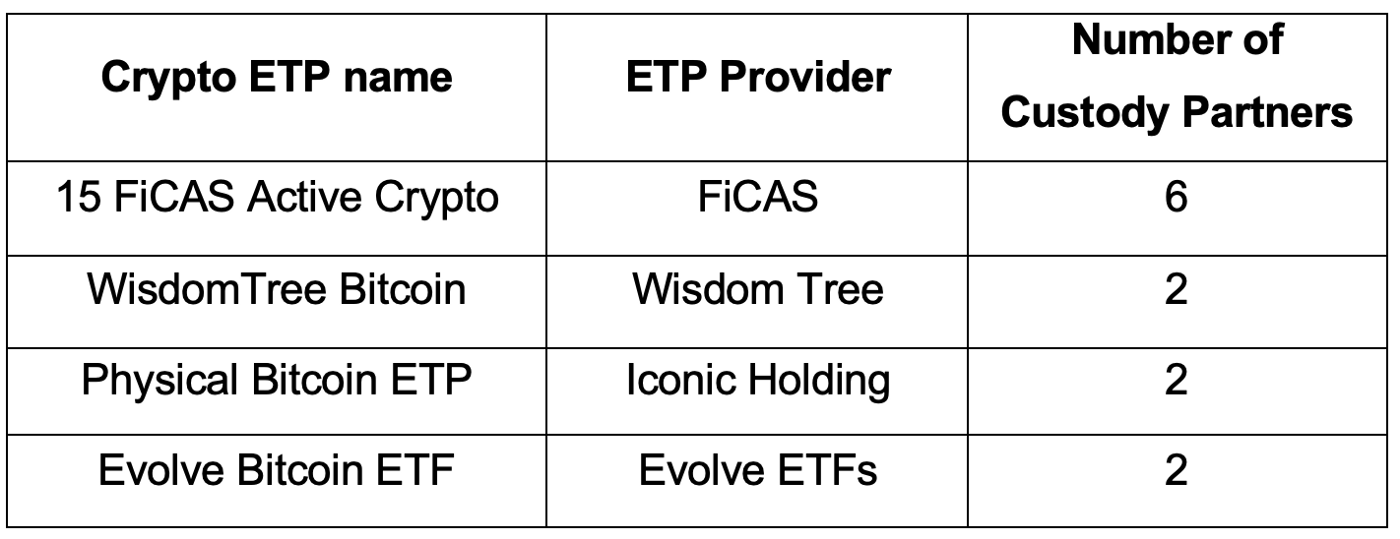

The providers of the crypto ETPs partner with existing institutional-grade custodians to safeguard shareholders’ underlying assets. The ETP buyer, therefore, achieves exposure to crypto without having to manage a private key or decide on a custodian. Many ETP providers partner with a single custodian, but a few enlist more than one custodian to store the assets. As shown in the table, Wisdom Tree, Iconic Holding, and Evolve ETFs have each chosen two providers, with little overlap between their choices. Interestingly, the provider of the actively managed FiCAS ETP chose six custodians for risk management reasons.

Are there benefits of spreading digital assets across multiple custodians? Are there risks to consider when using a single, well-regulated, institutional-grade custodian (see our previous article on cybercrime)? While risk is low, it is still worth considering reasons to seek custody diversification.

Regulatory and tax diversification

Asset managers looking for a digital asset custodian are still met with fragmented regulatory regimes across the globe and a general lack of regulatory guidance. In the US, the federal Securities and Exchange Commission (SEC) and the individual states are discussing what constitutes a “qualified custodian” of digital assets. In the EU, we see positive regulatory developments, especially in Germany. With progressive regulation such as issuing preliminary crypto custody licenses to companies like Finoa, Germany is paving the way for the rest of Europe.

Laws and regulations surrounding digital asset banking are still evolving, with individual countries laying out regulatory guidelines for crypto service providers and businesses. In Europe, the lack of a common EU framework creates risk for both digital asset service providers and their customers, a situation the EC hopes to remedy with a new regulation called Markets in Crypto-assets (MiCA). The MiCA regulation should come into play by 2024, ending EU member states’ national crypto policies and allowing EU crypto-asset service providers to operate across all EU markets, albeit under stricter rules. The EC’s proposal is a positive development but highlights that service providers currently cannot enjoy the benefits of Europe’s internal market. There remains a lack of legal certainty about the regulatory treatment of crypto-assets and an absence of a legislative framework at the EU level.

For asset managers, it may be advantageous to achieve relative independence from any single regulatory jurisdiction for the time being by choosing to custody their digital assets with custodians domiciled in various countries. This may also be beneficial from a tax point of view — a common reason for institutions to seek footholds in diverse countries. In context to crypto, income from staking is an example of a unique tax situation that countries have yet to solidify regulatory attitudes toward.

Fortunately, Finoa’s home country Germany was one of the first countries in the world to define digital asset custody as a financial service by incorporating custodians into the German Banking Act. It is evident that the German Supervisory Authority takes crypto seriously and is working to build a regulatory framework of a high standard and set strict requirements for companies offering financial services in the country.

Getting exposure to digital assets in a compliant and regulated way is increasingly top of mind for institutional investors and corporations exploring custody options. As legal and regulatory requirements are taking shape, caution is required when assessing unlicensed or unaudited providers in this space — institutional investors should only select partners who are strongly committed to compliance and security. At Finoa, we acknowledge that custody is an evolving and iterative service — if you are interested in learning more about our viewpoint and how it may benefit you, feel free to reach out to our team here.

Infrastructure Risk

Infrastructure risk is the type of risk that custodians can control — the primary mission of every custody provider should be to design their digital asset infrastructure to eliminate financial loss risk. Today, industry-leading custodians manage the private keys using either hardware security modules (HSMs), multi-party computation (MPC), or cold storage vaults. Not all of these solutions, however, are flexible enough to meet the unique needs of institutional investors with large positions and varying levels of activity. Standards for underlying infrastructure are still forming. Thus, the operational framework and infrastructure should be considered while accessing custody providers.

See our FAQ page for more information, and request a demo if you are interested in learning how our HSM infrastructure can complement your digital asset strategy.

Unpredictable and human-made failures

Even beyond the choice of infrastructure type, there may be additional value in seeking geographic diversification of the custodian’s data centers. Although unlikely, one can never rule out the possibility of extreme weather events, political and social unrest, or armed conflicts resulting in a failure of electricity or telecommunications networks, which would disrupt a custodian’s service.

Perhaps the most unpredictable errors are those resulting from human beings. Whether it be the Japanese stock trader who intended to sell a single share for 610,000 Yen but sold 610,000 shares for 1 Yen each or the BlockFi giveaway winners who won several hundred dollars but received several hundred bitcoin instead, these errors can't be foreseen. Even if a piece of crypto infrastructure is secure, users can create irreversible mistakes.

Overcoming this drawback, Finoa requires multiple user authentication of transactions, preventing the withdrawal of funds by a bad actor or a well-intentioned person making an honest mistake.

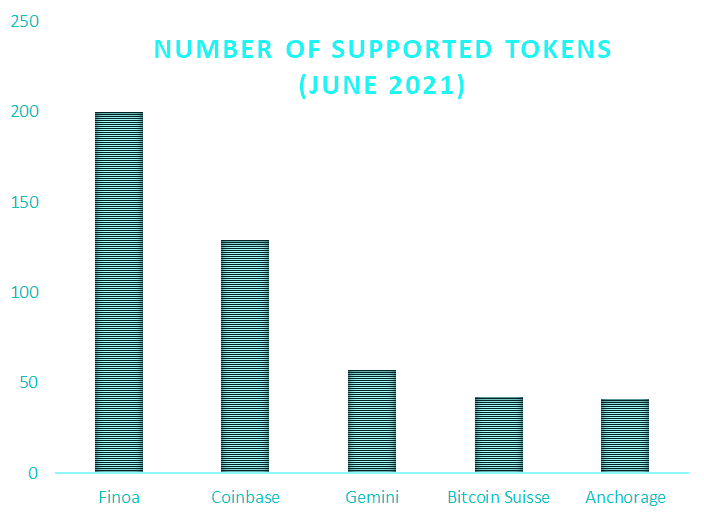

Achieving broad asset coverage

Perhaps the most common reason to diversify custody is to find support for a broader range of crypto assets. Especially for venture capital firms, crypto native funds, and hedge funds, it is critical to find a regulated custodian that supports every protocol of interest. Unfortunately, many leading custodians lack the required agility to integrate new blockchains. Finoa has filled this niche in the market, offering support for many new tokens from day one, including MINA, NEAR, FLOW, SKALE, ROSE, and AUDIO. We pride ourselves on providing support for assets that our clients care for, having demonstrated industry-leading integration times for emerging layer-2 projects built on already-supported infrastructure.

At Finoa, we regularly hear from asset managers who picked a custodian offering competitive prices to invest in Ethereum or Bitcoin but later shifted to newer digital assets not supported by the chosen custodian. We are proud to offer industry-leading token coverage, enabling institutional investors to support the development of emerging blockchain protocols without having to compromise on the security or usability of their assets.

The balance of cost and risk

The relationship between cost and risk depends not only on the number of custodians but also on whether staking, lending, or other (decentralized) financial activities are undertaken.

Everything comes at a price, and secure crypto custody is no exception. Custodians’ pricing models may discourage asset managers from opening accounts with many custodians and splitting their assets across them. Although, the possible income from offerings such as staking or lending may offset this price and influence the custody setup selection process.

Custodians’ pricing models usually include a setup fee plus a percentage fee on assets held in custody, which decreases with higher amounts. Custodians, therefore, incentivize asset managers to put their entire portfolio with that one custodian, paying one setup fee and benefiting from the lowest possible percentage fee on the assets. This may be why we see crypto ETP providers diversifying their custody beyond a single custodian but not spreading their investment across more than two.

However, the cost and risk relationship is not as straightforward as shown in the graphic above. How much cost can be offset by participating in staking and lending and how risky those activities are should also be regarded. While it’s possible to stake assets in custody, lending involves removing assets from the account and increasing the risk. Asset managers will have to consider the balance of risk and cost and decide how they wish to manage their digital assets.

At Finoa, we aim to offer competitive pricing for our digital asset custody service. Our goal is to build long-lasting relationships with our clients and grow with them. We provide investors with early access to innovative decentralized projects and continuous interaction with the protocols they care for, all within our highly secure and regulated environment.

Conclusion

When seeking a digital asset custodian, today’s investors are faced with a varied and inconsistent regulatory landscape, diverse custody solutions, and limitations on asset coverage. Asset managers must decide on their priorities regarding a custodian’s infrastructure type, the accessibility of assets, the ability to stake or lend, options for multi-governance accounts, and asset coverage. Many investors enlist the services of multiple custodians — sometimes a necessity to gain access to a range of desired tokens. Understanding this challenge, Finoa strives to offer digital asset services that meet the needs of every institutional investor — we offer industry-leading token support within the context of Germany’s strict crypto regulations.