Crypto adoption among retail and institutional investors in 2022

With another boom and bust cycle behind us, it's time to assess crypto’s progress along the adoption curve. Has crypto taken two steps forward and one step back, or was visible progress made over the last bull market?

This article will review crypto adoption among both retail and institutional investors, and show that more investors than ever are holding crypto, including traditionally conservative groups like family offices, publicly traded companies, and financial advisors.

The crypto adoption curve: where are we now?

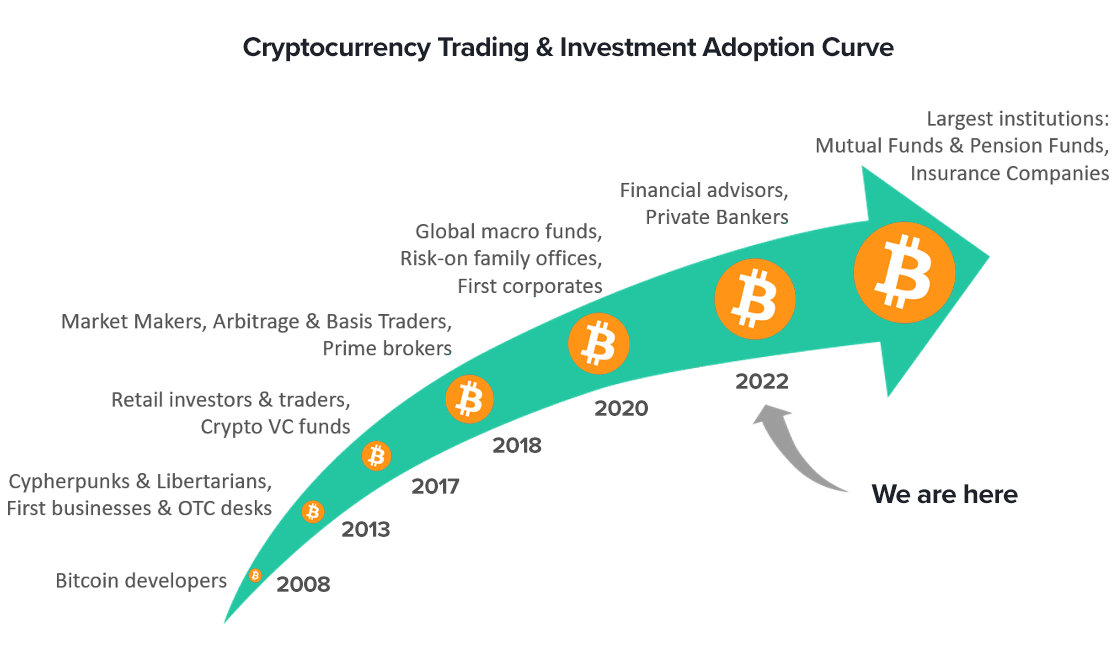

A good indicator of the progress of crypto toward mainstream adoption is the so-called “crypto adoption curve.” The curve shows the different user segments, ranging from early adopters (Bitcoin developers) to the laggards, represented by large, established institutions, such as Mutual and Pension funds.

Retail investors and crypto

Global crypto adoption rate: ownership in 2021 vs 2022

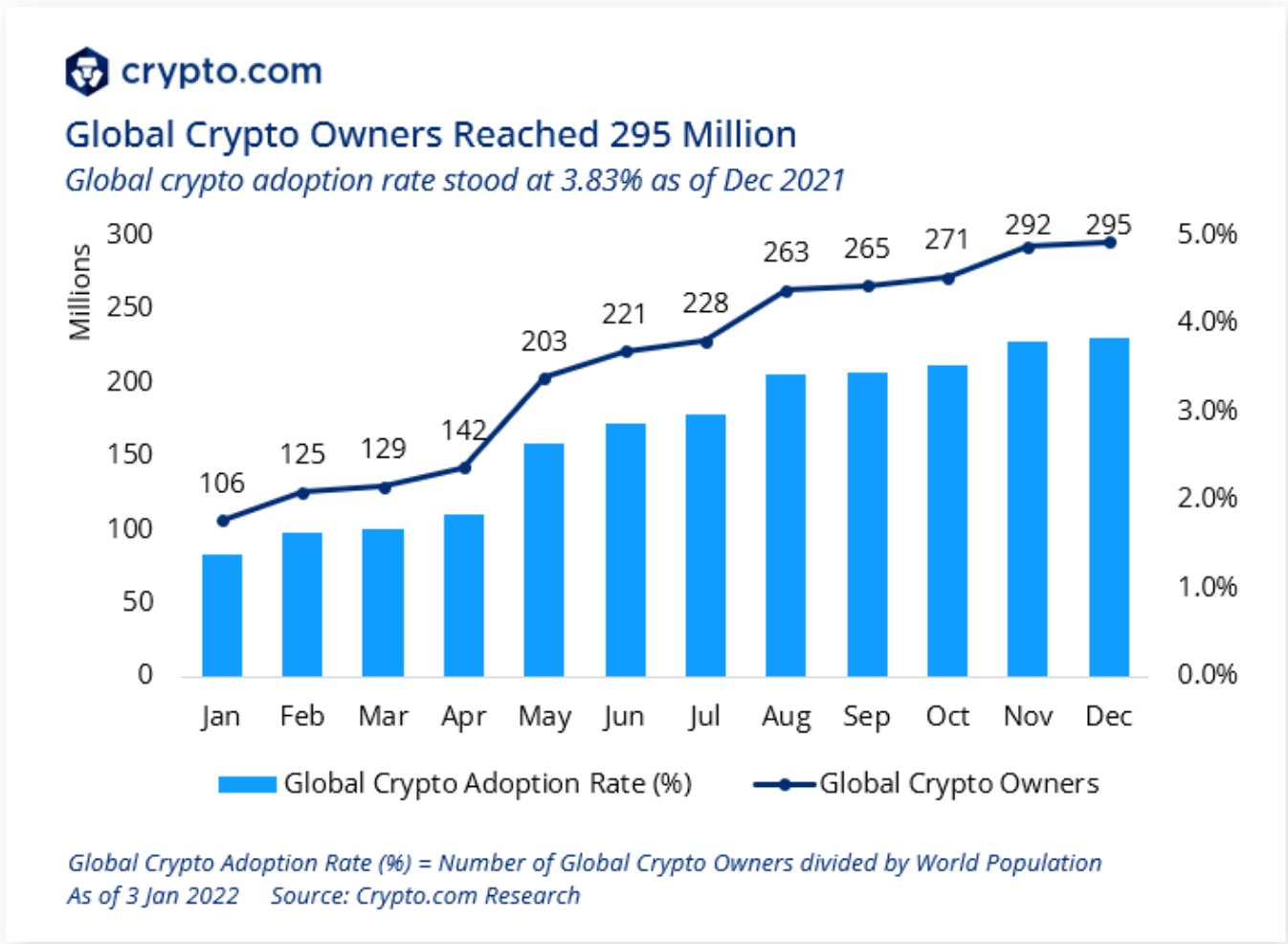

Over 10% of global Internet users likely own some form of cryptocurrency - 500m people if we assume 5 billion internet users. Crypto.com estimates closer to 300m crypto owners worldwide, a 275% increase from their January figure.

Source: Crypto.com

What is the crypto adoption index?

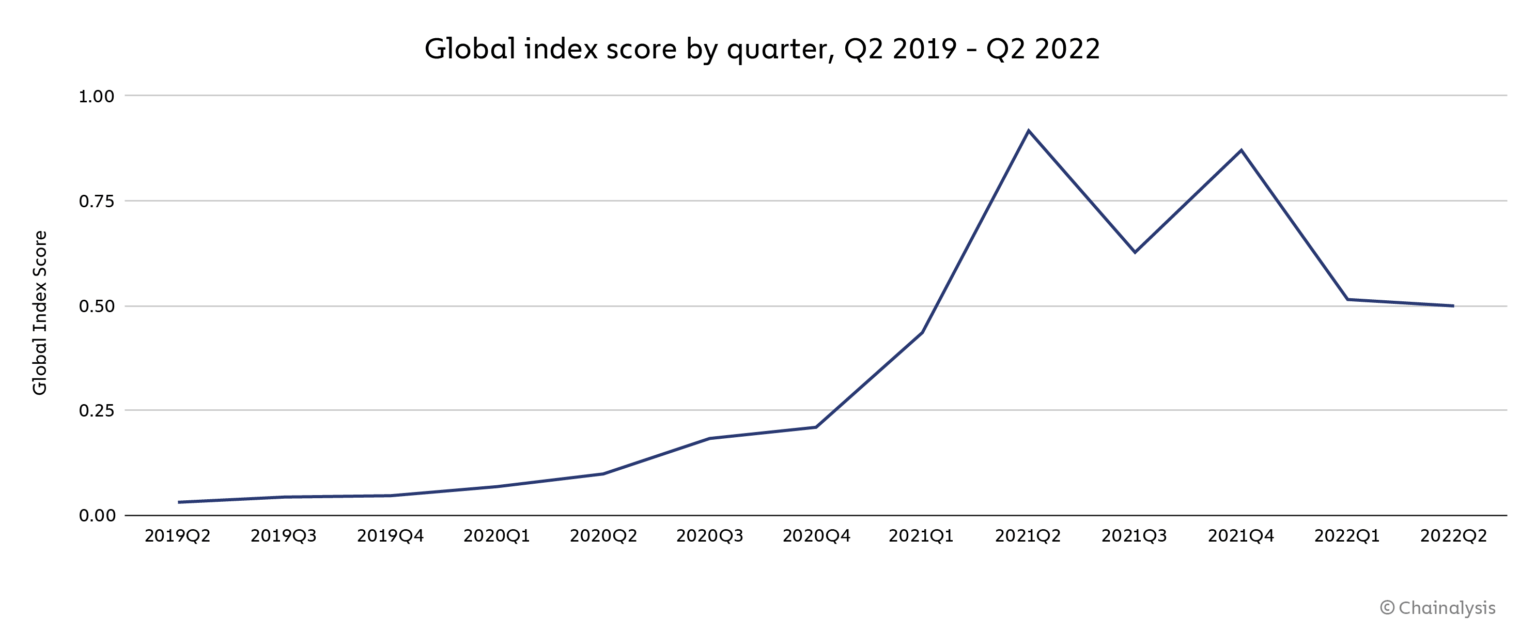

The Global Crypto Adoption Index is a metric put forward by Chainalysis and is made up of five criteria, which are based on the countries’ usage of cryptocurrencies. 146 countries were surveyed and ranked from 1 to 5 on these five sub-indexes. The lower the score, the higher the rank.

The data suggest that crypto adoption eased off after growing constantly since 2019. However, the ones affected by the rising prices in 2020 and 2021 stayed around and continued to invest capital. Emerging markets dominated the index and, even though the growth remained conservative, adoption levels are still higher than the 2020 bull market.

Source: Chainalysis

The countries with the highest Global Crypto Adoption Index are Vietnam, the Philippines, Ukraine, India, and the US.

Crypto ownership by country: 2022 trends

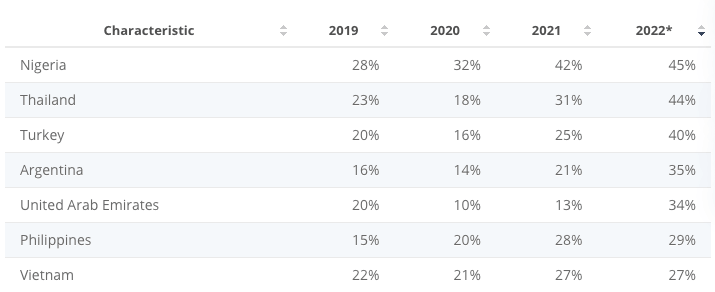

Crypto ownership and use are only legally restricted in 3% of countries worldwide and fully illegal in another 3%. According to Finbold, the countries with the highest prevalence of crypto ownership among internet users are Thailand, Nigeria, the Philippines, South Africa, and Turkey, each with between 18% and 20% of their internet users owning cryptocurrency. Other crypto ownership estimates, such as the one by Statista (shown in the table below) demonstrate steady growth in the four years from 2019 to 2022.

Source: Statista

Crypto interest among retail investors continues to grow long-term

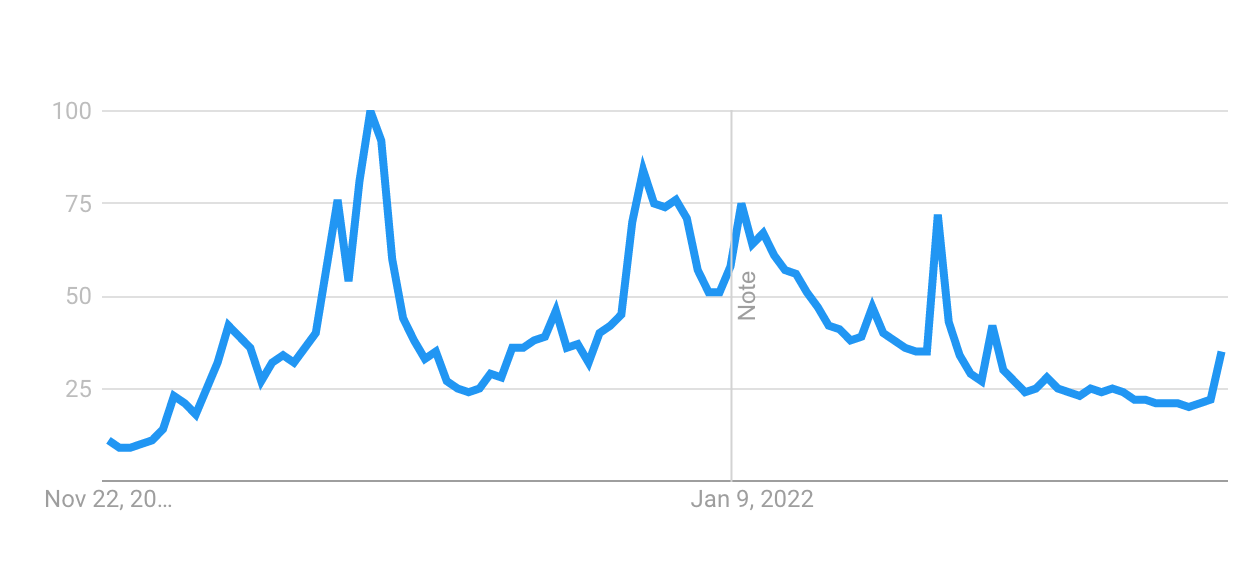

As we showed in our 2022 guide to institutional crypto, search volume has historically correlated heavily with price, and can be used as a proxy for retail investor interest. The number of Google searches for the word “crypto” increased dramatically over 2021. Although search volume did fall from its 2021 peak, in 2022 it remained elevated above 2020 levels.

Looking at blockchain data also indicates increased adoption: the number of active addresses on the Bitcoin and Ethereum blockchains increased substantially throughout 2020, now remaining slightly below their 2021 peaks. However, the fact that there are still less than 1 million active addresses reinforces that crypto is still at the beginning of its long road to mass adoption.

Institutional investors and crypto

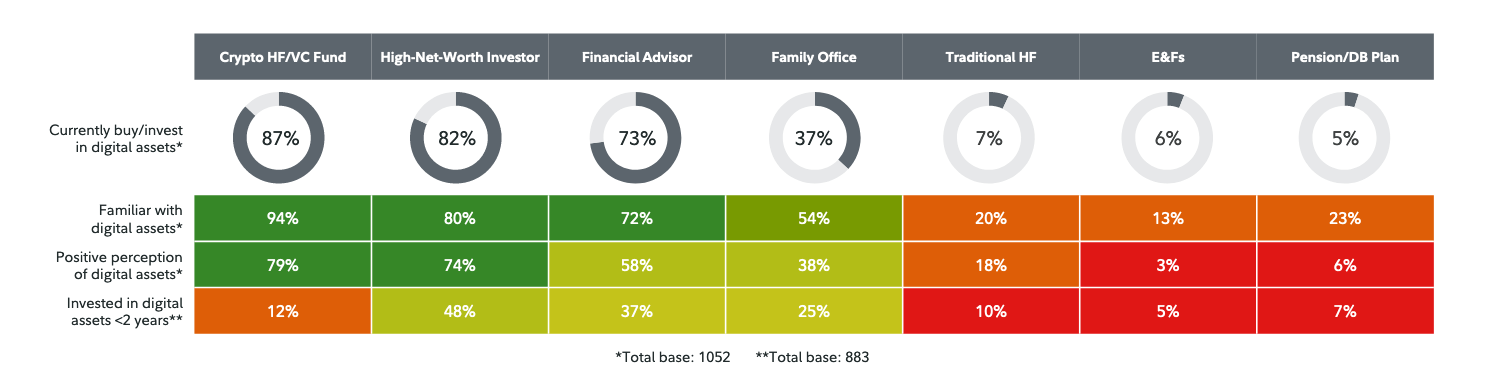

According to the 2022 crypto adoption report by Fidelity, nearly six in ten institutional investors (58%) invested in digital assets globally. Let’s examine each category individually.

HNWI: Based on the same survey, 82% of high-net-worth individuals were already invested in crypto in 2022. The graphic shows the adoption of crypto and the positive perception of digital assets among various investment classes.

Source: Fidelity

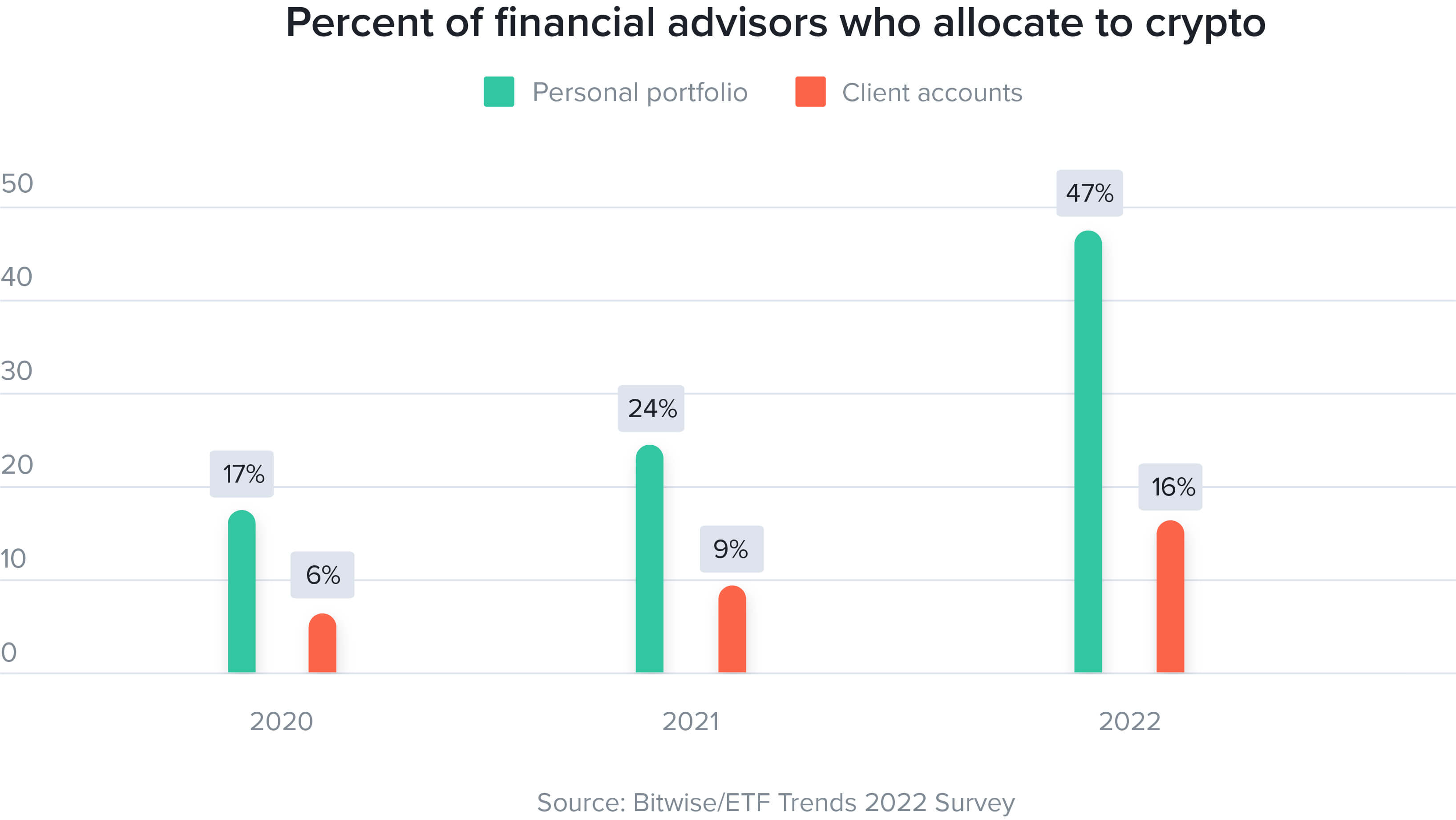

Advisors: Crypto assets are also becoming popular with financial advisors. According to Bitwise, more than 9 in 10 financial advisors received questions from clients about crypto in 2021 and 16% of advisors had allocated their clients to crypto. In their personal portfolios, almost half of financial advisors own crypto assets. The strong growth year over year is shown in the graph below.

Hedge funds: There is also increasing adoption among traditional hedge funds, with one in three hedge funds invested in digital assets, compared with one in five last year. Over a quarter of hedge fund managers not yet invested are looking to invest or already planning to invest. Allocations remain small though: the average allocation to digital assets by these funds measures 4%, with more than half of the funds having a position of less than 1% of their AuM.

Institutions: Institutions remain largely uninvested in crypto, with 88% of polled institutional funds in Europe saying their firms were not invested in crypto. A 2021 poll of US asset managers similarly found that only 5% were invested in, or planned to take crypto positions soon.

Public companies: According to Bitcointreasuries.net, 39 publicly traded companies own Bitcoin on their balance sheet, for a total of about 1% of the Bitcoin supply (just over 200,000 Bitcoins, or $4b worth at $20k per BTC). At the top of the list is Microstrategy, with 0.62% of the Bitcoin supply and thus 62% of the Bitcoin owned by publicly traded companies. Tesla sold 75% of its Bitcoin in July 2022, but, with 9720 Bitcoin remaining, still holds the third most Bitcoin of any public company behind Microstrategy.

Who owns the most bitcoins?

Who are the top bitcoin holders? Bitcoin’s creator Satoshi Nakamoto holds over 1 million Bitcoin or 5% of the supply. Satoshi and his wallet address haven’t been active since the early days - it’s likely that Satoshi has disappeared permanently, effectively taking his coins out of circulation. (It’s speculated that Satoshi is computer scientist Hal Finney, who died of complications from ALS in 2014.)

A look at the largest Bitcoin addresses reveals that crypto exchange Binance holds at least 1.3% of Bitcoin in its cold wallets, although a portion of this likely belongs to Binance’s customers.

Roger Verr was arguably the first-ever bitcoin investor and was rumored to have bought over 400,000 Bitcoin at under $1 each, or almost 2% of Bitcoin’s supply. A few years later, the Winklevoss brothers used the proceeds from their settlement with Mark Zuckerberg to buy $11 million in Bitcoin for as little as $10 per coin in April of 2013, giving them 1% of all the Bitcoin in circulation.

In 2020, Microstrategy became the largest institutional investor, eventually securing 0.61% of the Bitcoin supply.

What’s holding investors back?

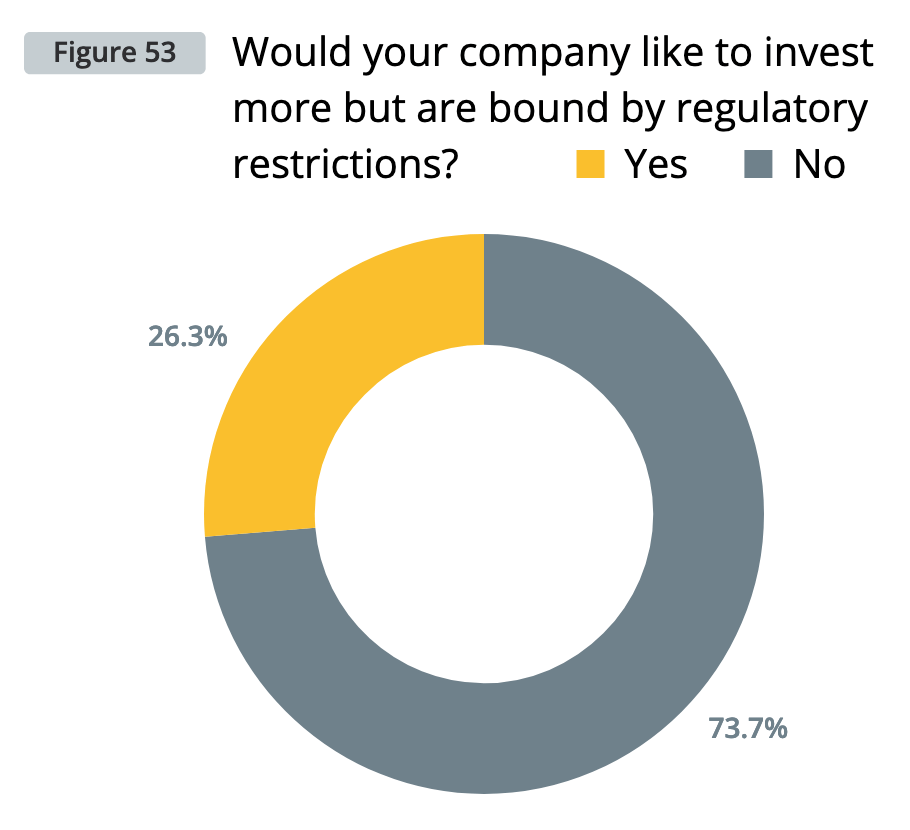

While crypto ownership has increased in popularity amongst investors, many hurdles remain to boost investor confidence. A recent Cointelegraph survey sponsored by Finoa showed that 51% of respondents consider liquidity risk an important factor stopping them from investing in crypto. 37.1% of the respondents also stated that the uncertain regulatory environment is holding them back.

In another analysis by Bitwise dating from January 2022, 60% of respondents cited regulatory concerns as preventing them from investing in crypto assets, and almost a third of respondents cited custody concerns. This explains why 82% of crypto hedge funds make use of an independent crypto custodian.

Source: Cointelegraph Research

As brokerages, exchanges, and custodians work to expand token coverage, improve their product offerings, and market to wider audiences, regulators around the world are clarifying their governments’ stances toward crypto. A European country leading regulatory progress is Germany, which was the first EU member state to regulate digital assets under the banking act: in March of 2020, Germany’s financial regulatory agency (the BaFin) and several other entities classified digital assets as financial instruments, thereby laying down a broad definition for further regulation.

Founded in 2018, Finoa is a regulated custodian in Germany and offers institutional crypto custody for venture capital firms, crypto hedge funds, corporates, and high-net-worth individuals. Institutional investors can access a range of services including custody and staking – all via an intuitive platform that enables users to securely store and manage their crypto assets, regardless of their level of familiarity with crypto.

Interested in learning more? Contact us for more information about how professional crypto custody can help you advance your strategy.